Everyone Should Pay a “Solar Tax”

Monthly connection fees are good for the climate.

Regular readers of this blog are well aware that the California Public Utilities Commission (CPUC) published a proposed decision on reforming net energy metering (NEM) for residential rooftop solar last December. One of the most contentious elements of the proposed decision is a requirement that households that install solar power in the future pay a monthly fixed connection fee to help cover the various fixed costs associated with distributing electricity in California. This has been derided as a “Solar tax” since, under the proposal, only solar homes would pay the connection fee .

Over the last few months there have been several head-scratching and, I would argue, misguided arguments put forward in favor of preserving the NEM status quo. The most curious one is the widely circulated argument that NEM reform would constitute a step backwards in California’s climate leadership. In fact, the opposite is true. For many years, NEM has been a growing impediment to the centerpiece of California’s current climate plan – electrification of households and transportation.

How could NEM be impeding climate progress? It’s really not that complicated.

- Under the current NEM, homes with rooftop solar do not contribute much to the cost of electricity infrastructure, wildfire mitigation and compensation, investments in new clean technologies, and many other programs utilities are required to pay for.

- Those costs are still recovered through the price of electricity, so the more homes that go solar, the higher the cost of electricity for everyone else. This is the real solar tax – one that is paid by non-solar homes.

- Higher electricity prices make the shift to electric vehicles, space heating, and water heating less and less appealing to the majority of Californian’s whom the state’s own climate scoping plan is counting on to electrify their lifestyles.

Critics of the CPUCs proposed decision point to the fact that in the parts of California where NEM has already been changed – places, by the way, with publicly-owned utility systems and not “profit-seeking” investor-owned utilities – solar installations have declined sharply. The implication is that this is in turn stalling progress toward renewable energy goals. That’s just not true. This perspective ignores the fact that residential rooftop solar isn’t the only way to generate clean electricity. It’s not even the only way to generate solar electricity. It is only the most expensive way to generate clean electricity.

“Dirty” Energy Displaced by Rooftop Solar

Given that the state has already committed itself to 100% clean electricity, rooftop solar doesn’t make the grid any cleaner, it simply crowds out other, less expensive, types of clean electricity. So NEM reform won’t hurt the solar industry, or make our electric system any less clean, it will just hurt the residential rooftop solar industry.

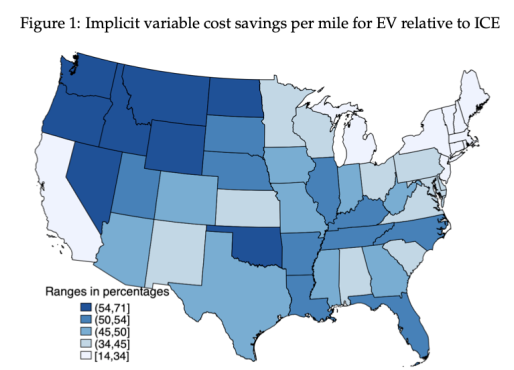

What NEM reform would do is help slow the inexorable increase in electricity prices for non-solar homes. This in turn would help stave off the very real possibility that fueling an electric car in California becomes more expensive than fueling a conventional one. According to research by Dave Rapson and Erich Muehlegger at UC Davis, fuel savings from EVs are already lower in California than almost anywhere else.

Savings per mile from driving EVs (Rapson and Muehleggar, 2022)

My own recent research with Severin Borenstein indicates that electric appliances and vehicles should be much cheaper to use than they actually are at current electricity prices. Heating houses and water with electricity is penalized relative to gas in California, even though it should cost about the same. So, if we really cared about climate goals, we wouldn’t be focused on providing electrification incentives just for solar homes at the cost of everybody else.

The solution, which makes too much sense to ever be widely adopted in California, is to make NEM irrelevant. We have spent too long arguing about the rates paid by solar homes and not enough time talking about the rates paid by everyone else. The proposed monthly fixed charge (e.g. solar tax) is simply a means of recovering the fixed costs of distributing electricity in California. But we shouldn’t stop at only the solar homes. The road to electrification is to shift everyone to a rate structure that encourages electrification, one that accurately reflects the high costs of connecting to the grid and the low costs of actually consuming electricity.

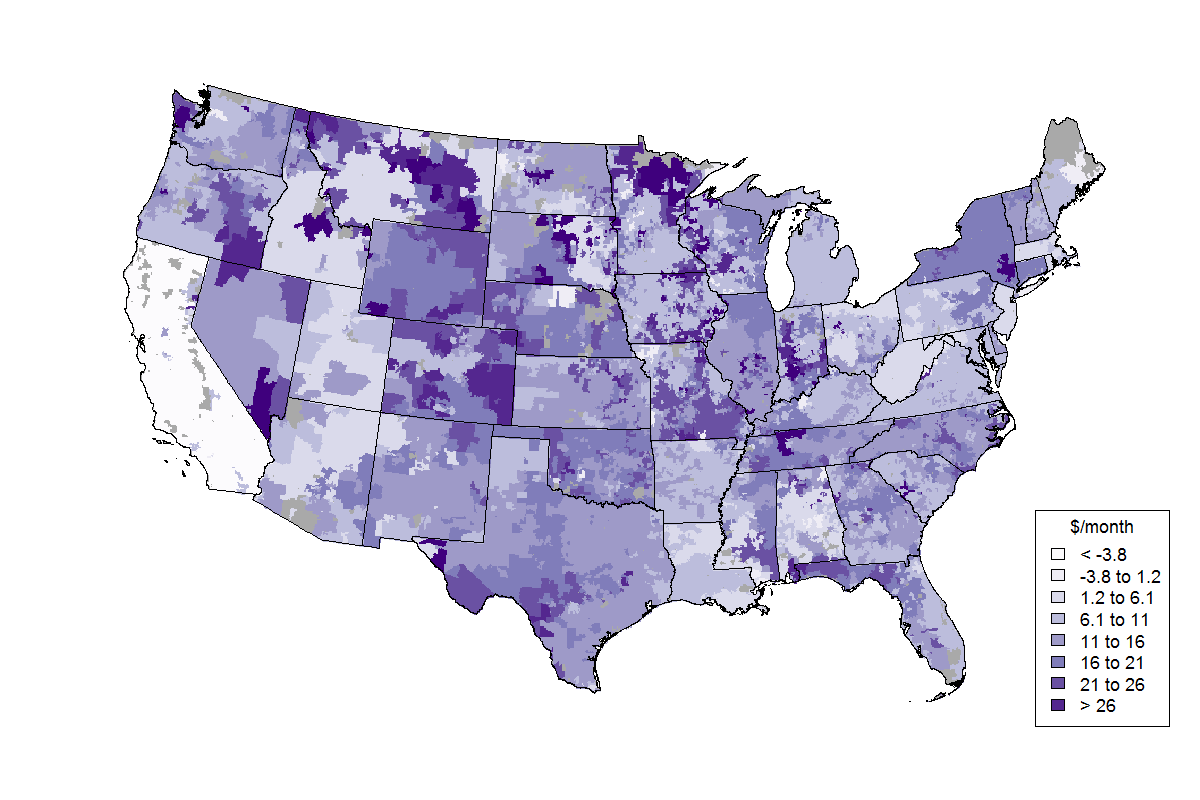

This means moving everyone to a monthly connection charge and lowering the marginal price of electricity by an amount that offsets the revenues raised by the connection fees. It’s not a revolutionary idea. Lots of electric utilities already do it. Our gas utilities in California already do it. In fact, California’s CPUC regulated electric utilities are about the only utilities in the country to not charge a monthly connection fee.

Monthly Fixed Charges for Residential Electricity Service (Darker is Larger)

Monthly Fixed Charges for Residential Electricity Service (Darker is Larger)

So why hasn’t California moved toward this two-part pricing structure? One reason has been equity concerns. These can be dealt with by creating low-income connection fees, or other more creative solutions. The other reason is that it would hurt the rooftop solar industry. If all homes faced volumetric (per kWh) prices that reflected the true cost of electricity, few would see an appeal to paying twice as much for rooftop solar power. However, in California, we seem to be more concerned with making 10% of our households really, Really, REALLY clean than with getting serious about actually reducing total statewide greenhouse gas emissions.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas.

Suggested citation: Bushnell, James. “Everyone Should Pay a “Solar Tax”” Energy Institute Blog, UC Berkeley, February 14, 2022, https://energyathaas.wordpress.com/2022/02/07/monster-trucks/

Categories

This position completely fails to account for the tens of thousands of personal dollars homeowners have to pay, up front, just to have solar installed. Even with incentives the payback ROI is not likely before at least ten years. Take the NPV of that number into this accounting and you will find it is solar households that have made the grid stronger and less reliant on carbon sources.

As it stands, this analysis prescribes an apparent investment cost of zero, as if all homeowners do is flip a switch and suddenly live off the largess.

This article, prettt half-baked.

Jim,

In 2014 I conducted a detailed analysis of a typical residential rooftop solar installation in Southern California Edison’s service area. The expected after-tax rate of return was 17 percent! That’s almost twice the average pre-tax return that the stock market has returned to investors since 1929. Now that was under NEM 1.0. I haven’t done a similar analysis for NEM 2.0 but the fact that homeowners were still investing in solar under NEM 2.0 suggests that the AT-ROR was still very attractive.

Residential solar has reduced reliance on carbon resources (whether it has made the grid stronger is debatable) but few people invest in solar to save the planet; they invest in it to avoid paying the high energy prices in their retail tariffs.

NEM as it now exists is certainly a cross-subsidy from poor to rich. How would your proposed changes interact with the new mandate to put solar panels on new construction? Is there any way around doubling down on a poor policy?

The so-called cost shift is an example of the confusion created by mixing NEM customer-generator’s wholesale export compensation with the utility’s retail charges to NEM customer-generators for power imported from their utility. Because wholesale energy exports are regulated federally by the FERC, and retail energy imports are regulated by the CPUC, by separating wholesale from retail components under its NEM 3.0 proposal CARE’s proposal alone had a ratepayer impact measure (RIM) score of 1.0 in E3’s analysis of all the NEM 3.0 proposals

Why isn’t the media talking about this?

The elephant in the room is the CPUC’s and IOUs’ don’t want you to talk about is the avoided cost, and how it’s calculated, and who decides.

Who decides this is not the CPUC but a Federal Judge in the U.S. District Court Central District California Honorable John W. Holcomb, presiding. [CARE v. CPUC, Case# 2:11-cv-04975-JWH-JCG.]

The dispute is CPUC wants to use it’s avoided costs calculator (ACC) which works out to around 6 cents per kilowatt hour export compensation. Full avoided cost is based on the utility’s system cost for their utility owned generation (UOG) [not the customer-generator’s system costs] which for Pacific Gas and Electric Company (PG&E) last year was 35.6 cents per kilowatt hour at the full avoided cost compensation rate. [See UOG Solar Photovoltaic 0-3 MW pages 23 and 24 of the CPUC’s 2021 Padilla Report https://www.cpuc.ca.gov/-/media/cpuc-website/divisions/office-of-governmental-affairs-division/reports/2021/2021-padilla-report_final.pdf ]

Michael, I’m confused over why you think the procurement cost of a small sliver of solar owned by an IOU is an appropriate measure of its system avoided cost. Assuming that a kWh of residential rooftop solar validly displaces utility procurement of a kWh of solar, seems to me that the marginal resource is something much larger than 3 MW, the cost of which is more like 10 to 13 cents per kWh, not 35.6 cents.

Also, the utilities are not allowed to freely use RECs produced by residential solar to count toward their RPS obligations (I’m not sure why; maybe because the energy produced by residential solar is not separately metered).

The CPUC avoided cost calculator is supposed to account for the cost impact of reducing net demand by one MWh. I used it in a 2014 study but I’m not convinced it is correct.

Robert, Thank you for your response, it is appreciated.

You stated ” I’m confused over why you think the procurement cost of a small sliver of solar owned by an IOU is an appropriate measure of its system avoided cost. Assuming that a kWh of residential rooftop solar validly displaces utility procurement of a kWh of solar, seems to me that the marginal resource is something much larger than 3 MW, the cost of which is more like 10 to 13 cents per kWh, not 35.6 cents.”

The IOU’s system cost data is the first factor necessary to determining full avoided cost [capacity and energy] which is based on the IOU PG&E’s UOG solar costs reported to the legislature in the 2021 Padilla Report in this case. That’s because under 18 C.F.R. § 292.304(e) CPUC has the responsibility of calculating avoided cost, but FERC has set forth factors that they should consider. (1) the utility’s system cost data; (2) the terms of any contract including the duration of the obligation; (3) the availability of capacity or energy from a QF during the system daily and seasonal peak periods; (4) the relationship of the availability of energy or capacity from the QF to the ability of the electric utility to avoid costs; and (5) the costs or savings resulting from variations in line losses from those that would have existed in the absence of purchases from the QF.

To become a QF you have to export some of your generated energy back into the grid, and under FERC regulations customer-generators of 1 MW nameplate capacity automatically become a Qualifying Facility (QF). The full avoided cost [capacity and energy] includes the cost of capital to construct the UOG resources. Historically this has been referred to as long run avoided cost (LRAC). The terms of any contract including the duration of the obligation [for energy] has been referred to as short run avoided cost (SRAC).

Around 12 GW of NEM solar has been installed across the state and their installed capacity is on the customer side of the utility meter making that capacity 100% delivered. Since more than 99% of the NEM solar customer-generators are less than 3 MW nameplate capacity, the 0-3 MW range of PG&E UOG resources seemed applicable. 35.6 cents per kWh would be the full avoided cost export compensation rate for PG&E’s NEM customer-generators.

The CPUC’s ACC include RPS RECs which are not part of the FERC factors identified since RECs are strictly a part of California law they are not included in the full avoided cost calculations.

Why not simply assess every household a new $140,000/yr tax regardless of whether they’re solar or not.

NEM 3.0 is a band aid for the Power Generation Market. The market has changed dramatically in the last hundred years, and we need to change our rules to keep up with it. The outdated laws incentivize the investor owned utilities to build more power lines because they can charge customers for the power lines and add profit on top. The Legislature should modify the laws to eliminate this incentive.

The markets that work best are free competitive markets with lots of players. We are now in a position to transition most of the electricity market to free competition. This can be done because it is becoming easier to determine what is generated where. Adjustments to generation and use can be made quickly by both users and consumers.

Electricity producers should pay to transport the energy to the users. Then we can use the delivered price of energy in the free market rather than the generated price. If it costs more to transmit the energy than it is worth, the transmission lines shouldn’t be built. Energy that is generated near where it is used, will make more sense because no additional transmission lines will need to be built. This will make rooftop solar more cost efficient and subsidies won’t be necessary. In addition, the costs of mitigating fires will be minimized.

There is always a chance that demand for electricity will exceed supply. Two recent technologies will significantly reduce that problem.

1) Batteries are becoming cheaper.

2) Smart Electric Panels are becoming more common.

We now have 2 kinds of electricity pricing. Fixed pricing and Time Of Use. With Smart Electric Panels and Local batteries, dynamic pricing will make sense for customers. This means that the price of electricity will constantly change depending on supply and demand forces. If the price of electricity is very low, I can set the system to charge the battery and the car and to run the laundry and dishwasher. If the price of electricity is high, I can set the system to release energy from the battery. As it gets higher, I may choose to shut off some appliances. Lots of circuits have a low level of usage so that they can be turned on quickly, or respond to a wifi request. If the cost of electricity exceeds $1 or $10/kwH, I may decide to turn off many of these appliances at the circuit breaker rather than at the wall switch to save some additional electricity. At very high levels, I may also choose to turn off the refrigerator for a short time, or turn off computers, televisions and heating/cooling systems that run on electricity. Many companies already do this. By adding residential consumers to this system, consumers who are willing to accept targeted brown outs will have their least important appliances turned off first.

I hope the legislature can make these changes.

I would like to have us pay lower volumetric rates per kWh and to a connection charge based on the size of our connection to the grid. E.g. a 10 cents per Amp monthly charge for the size of our main disconnect on our service line next to the meter. So small panel homes might pay $6/month for a 60 Amp connection, the common 100 Amp connection homes would pay $10/ month and the 200 Amp homes would pay $20/month. All this is regardless of rooftop solar. It would be a small charge encouraging us to electrify quickly and more cost effectively using lower Amperage devices (like 15 Amp heat pump water heaters, efficient heat pump space heat and 20 amp EV charger circuits ( 130 miles per night = 47,000 miles per year, etc. )).

That way we can all electrify rapidly without overwhelming the distribution grid.

And the rooftop solar industry could focus on new ways to help customers meet their needs with solar, well-controlled batteries, well sized electrification and smaller utility connections.

Not surprisingly, Jim Lazar and I disagree – again.

Jim begins by pointing out that most investor-owned utilities have low monthly customer/connection charges and recover a substantial portion of their fixed costs through volumetric energy charges, whereas most publicly-owned utilities do not. Why is that? Obviously it’s because the IOUs are regulated and the publicly-owned utilities are not. So what he is describing is a artifact of regulation, not some fundamental principle of how rates should be designed. In fact the publicly-owned utilities have come up with far more economically efficient rate designs than the regulators have because their energy prices are closer to the marginal costs of delivering energy to their customers.

Jim claims that 13 cents per kWh is a valid representation of a utility’s marginal cost; it is not. Apparently he believes this because he embraces long-run marginal cost as the appropriate metric. In contrast, economic theory informs us that short-run marginal cost is the appropriate one. However, this requires that short-run marginal costs is defined to include a congestion surcharge that is added when the generation, transmission and/or distribution capacity approach its (their) limit(s). When that happens

the short-run marginal cost can be raised to long-run marginal cost, or go even higher.

Economic theory also informs us that when a system is in equilibrium short-run marginal cost and long-run marginal cost are equal. But this is a pedagogical tool; power systems are never in equilibrium due to many factors. In light of that fact of life short-run marginal cost is the metric that optimizes real time production and consumption and also long-term investment decisions (which are not rationally made based on today’s prices but rather on forecasts of future prices).

Utilities typically overbuild their transmission and distribution systems, which means that the short-run marginal costs of using these systems are close to zero (except for marginal energy losses). Nonetheless, the utilities must recover these investments and the most efficient way to do so is through the fixed monthly customer/connection charge that cannot be bypassed. Note that residential solar is essentially a bypass scheme.

There is no way that the $4 to $10 per month that Jim advocates is going to recover a utility’s fixed costs. The monthly customer/connection charge needs to be more like $50 per month. When and if congestion surcharges are needed to constrain demand those surcharges are rebated to customers, effectively lowering their customer/connection charges.

Time of Use (TOU) rates are a crude but practical way to approximate short-run marginal costs if the fixed costs allocated to the time periods are roughly equal to the congestion surcharges needed to constrain demand to the capacity to supply it. The primary drawback to TOU rates is that they are not dynamic so they do not respond to changes in the power system’s contemporaneous conditions.

Jim claims that in everyday life we pay for fixed charges through volumetric prices. Yes, we do. And you know what? Those prices all include congestion charges designed to constrain demand to what the businesses can supply. Furthermore, many of those prices are dynamic. Airlines charge higher fares are the planes fill up; hotels charge higher rates on busy days and super high rates when demand is super high due to conventions, the Super Bowl, etc. Gasoline prices are in a constant state of flux. What Jim is observing in the real world confirms the short-run marginal cost pricing approach I described earlier.

Robert Borlick points out that one version of economic theory holds that short run marginal cost is the appropriate metric for composing efficient prices. And he points out that short-run (SRMC) and long-run marginal costs (LRMC) should converge in equilibrium. So implicitly he is saying that long run marginal costs are the appropriate metric if as a stable long-run measure based, as he states, on forecasts.

Even so, he misses an important aspect–using the short-run MC relies on important conditions such as relatively free entry and exit, producers bear full risk for their investments, and no requirements exist for minimum supply (i.e., no reserve margins). He points out that utilities overbuild their T&D (and I’ll point out the generation) systems. I would assert that is because of the market failures related to the fact that the conditions I listed are missing–entry is restricted or prohibited, customers bear almost all of the risk, and reserve margins largely eliminates any potential for scarcity rents. In fact, California explicitly chose its reserve margin and resource adequacy procurement standards to eliminate the potential for pricing in the scarcity rents necessary for SRMC and LRMC to converge. He correctly points out that apparent short run MC are quite low (not quite zero)–a statement that implies that he expects that short run MC in a correctly functioning market would be much higher. In fact, as he states, the SRMC should converge to the LRMC. The fact is that SRMC has not risen to the LRMC on an annual average basis in decades in California (briefly in 2006, 2001 and 2000 (when generators exerted market power) and then back to the early 1980s). So why continue to insist that we should be using the current, incorrect SRMC as the benchmark when we know that it is wrong and we specifically know why its wrong? That we have these market failures to maintain system reliability and address the problems of network and monopolistic externalities is why we have regulation

It’s not clear that utilities “must” recover their investments. One the first fixes that should occur to the current regulatory scheme to improve efficiency is having utilities bear the risks of making incorrect investment decisions. Having warned (correctly) the IOUs about overforecasting demand growth for more than a dozen years now, they will not listen such analyses unless they have a financial incentive to do so.

It’s not efficient to charge customers a fixed charge beyond the service connection cost (about $10/month for residential customers for California IOUs). If the utility charges a fixed cost for the some portion of the rest of the grid, the efficient solution must then allow to sell their share of that grid to other customers to achieve Pareto optimal allocations among the customers. We could set up a cumbersome, high transaction cost auction or bulletin board to facilitate these trades, but their is at least another market mechanism that is nearly as efficient with much lower transaction costs–the dealer. (The NYSE uses a dealer market structure with market makers acting as dealers.) In the case of the utility grid, the utility that operates the grid also can act as the dealer. The most likely transaction unit would bein kilowatt-hours. So we’re left back where we started with volumetric rates. The problem with this model is not that it isn’t providing sufficient revenue certainty–that’s not an efficiency criterion. The problem is that the producer isn’t bearing enough of the risk of insufficient revenue recovery.

An alternative solution may be to set the distribution volumetric rate at the LRMC with no assurance of revenue requirement on that portion, and then recover the difference between average cost and LRMC in a fixed charge. This is the classic “lump sum” solution to setting monopoly pricing. The issue has been how to allocate those lump sum payments. However, the true distribution LRMC appears to be higher than average costs now based on how average rates have been rising.

“Robert Borlick points out that one version of economic theory holds that short run marginal cost is the appropriate metric for composing efficient prices. And he points out that short-run (SRMC) and long-run marginal costs (LRMC) should converge in equilibrium. So implicitly he is saying that long run marginal costs are the appropriate metric if as a stable long-run measure based, as he states, on forecasts.”

Not quite Richard.

What I said is that LRMC is the appropriate metric only if it happens to equal SRMC – but it almost never does in the real world, which is not static but rather is always in a state of change.

“He points out that utilities overbuild their T&D (and I’ll point out the generation) systems. I would assert that is because of the market failures related to the fact that the conditions I listed are missing–entry is restricted or prohibited, customers bear almost all of the risk, and reserve margins largely eliminates any potential for scarcity rents.”

The overbuilding of capacity does largely eliminate scarcity rents. But that flaw is not cured by resorting to a hypothetical LRMC metric. Overbuilding occurs primarily because of mandates imposed on the utilities by regulators or the legislature but it can also occur because demand forecasts always contain uncertainty. Lastly, reserve margins that are properly sized to minimize total costs, including outage costs imposed on customers that are involuntarily interrupted, are not excess capacity.

“In fact, California explicitly chose its reserve margin and resource adequacy procurement standards to eliminate the potential for pricing in the scarcity rents necessary for SRMC and LRMC to converge.”

Richard, you can’t seriously believe that statement. That is not how utility resource planning is done in California or anywhere else (with the possible exception of Southern Company, which does set their generation reserve margin based on minimizing total costs, including the cost of unserved energy).

“He correctly points out that apparent short run MC are quite low (not quite zero)–a statement that implies that he expects that short run MC in a correctly functioning market would be much higher. In fact, as he states, the SRMC should converge to the LRMC.”

Yes, SRMC should include a congestion surcharge and will rise to LRMC if supply costs and demand growth remain static – which they won’t. SRMC without that surcharge is improperly defined.

“The fact is that SRMC has not risen to the LRMC on an annual average basis in decades in California (briefly in 2006, 2001 and 2000 (when generators exerted market power) and then back to the early 1980s). So why continue to insist that we should be using the current, incorrect SRMC as the benchmark when we know that it is wrong and we specifically know why its wrong? That we have these market failures to maintain system reliability and address the problems of network and monopolistic externalities is why we have regulation.”

Perhaps the reason for the “market failures” IS REGULATION, at least the form of regulation in California today.

You cite the high prices in 2000 and 2001. Those were largely caused by the CPUC not allowing the utilities to raise retail prices when demand exceeded supply, causing rolling blackouts. If retail prices had been increased demand would have decreased and generators’ ability to exercise market power would have been restricted. But no, the CPUC would not allow the utilities, who were being driven into bankruptcy from having to buy energy at high wholesale prices and sell it at a loss, to charge more. Instead it forced customers to go without electricity. This is the quintessential example of bad regulation.

“It’s not clear that utilities “must” recover their investments. One the first fixes that should occur to the current regulatory scheme to improve efficiency is having utilities bear the risks of making incorrect investment decisions. Having warned (correctly) the IOUs about overforecasting demand growth for more than a dozen years now, they will not listen such analyses unless they have a financial incentive to do so.”

I largely agree with this. It is the primary reason why California (and other states) created competitive wholesale markets to substitute competition for cost-of-service regulation of generation. Unfortunately, because T&D networks are natural monopolies, they can’t be treated the same way.

What you are arguing for is ex post disallowances of costs based on future outcomes (I made that same argument back in the mid-1980s). This very issue was addressed and decided by the Supreme Court in the Duquesne v. Barasch (1989). If you are not familiar with it I recommend that you read that decision.

The SC concluded that it is acceptable to disallow utility costs ex post if the utility were allowed to include the appropriate risk premium in its rates ex ante. The problem is that it is difficult to determine how large that risk premium should be and regulators are reluctant to allow its inclusion. This is discussed in a book authored by three of my former Brattle colleagues: “Regulatory Risk.”

“It’s not efficient to charge customers a fixed charge beyond the service connection cost (about $10/month for residential customers for California IOUs). If the utility charges a fixed cost for the some portion of the rest of the grid, the efficient solution must then allow to sell their share of that grid to other customers to achieve Pareto optimal allocations among the customers. We could set up a cumbersome, high transaction cost auction or bulletin board to facilitate these trades, but their is at least another market mechanism that is nearly as efficient with much lower transaction costs–the dealer. (The NYSE uses a dealer market structure with market makers acting as dealers.) In the case of the utility grid, the utility that operates the grid also can act as the dealer. The most likely transaction unit would bein kilowatt-hours. So we’re left back where we started with volumetric rates.”

This long statement is correct. That’s exactly what a scarcity surcharge on energy price would do. Customers who choose not to use the energy effectivy sell some of the scarce capacity to others who are willing to pay the higher price. But this requires putting in place locational marginal energy pricing at the distribution system level, as I described in other posts here.

“The problem with this model is not that it isn’t providing sufficient revenue certainty–that’s not an efficiency criterion. The problem is that the producer isn’t bearing enough of the risk of insufficient revenue recovery.”

The revenue certainty needed to cover fixed system costs is provided by the fixed monthly connection charges. The scarcity rents that the congestion surcharges produce are then rebated back to customers, effectively lowering their connection expenses. The question of whether the producer is bearing enough risk goes back to the ex post disallowance I addressed earlier.

“An alternative solution may be to set the distribution volumetric rate at the LRMC with no assurance of revenue requirement on that portion, and then recover the difference between average cost and LRMC in a fixed charge. This is the classic “lump sum” solution to setting monopoly pricing. The issue has been how to allocate those lump sum payments. However, the true distribution LRMC appears to be higher than average costs now based on how average rates have been rising.”

If we set the volumetric energy rate equal to some hypothetical LRMC it will be too high or too low most of the time – even assuming that it is correct on average. This is clearly inefficient. To be economically efficient the volumetric rate must be dynamic to reflect real time system conditions, including capacity constraints.

Richard, despite your attempt to defend LRMC I give you credit for coming around to recognizing the advantage of allowing customers to trade upstream capacity allocations by responding to the energy price. Kudos.

Robert

You’re missing my point. In the electricity world due to the market failures that I’ve listed, the SRMC can never reach or exceed the LRMC on a sustained basis sufficient to provide adequate returns to investors. To achieve economic efficiency requires that SRMC = LRMC on average in the long run. In a world where price is regulated in multiple ways, the appropriate metric then is LRMC not SRMC.

Overbuilding has been endemic to the utility industry for decades, long before any claims that mandates are creating this problem. For example, the very existence of a planning reserve margin sufficient to provide 99.99% reliability means that sustained price spikes necessary to give returns to investors based on SRMC pricing will not occur. (Reserve margins are NOT set in consideration of minimizing total outage costs–that most certainly has not been part of the process in California, and I have not heard of that being done elsewhere.) That is the single most important “mandate” and we have collectively decided that reliable electricity supply is more important than theoretically efficient pricing.

I have been part of the policy discussion on the issue of setting reserve margins and resource planning to avoid market manipulation in California since the 2000-01 energy crisis. The CPUC’s recent Green Book explicitly notes the need to have sufficient resources to avoid market manipulation. The DWR contracts signed in 2001 were sized to avoid market manipulation. My statements are not speculative–they are based in empirical evidence.

As I have pointed out, the utility system is oversized to provide high reliability and to prevent sustained market manipulation. This is includes suppressing congestion pricing in the transmission network. Additions to the grid are made in anticipation of potential congestion based on LRMC assessments, not responses to SRMC pricing.

Passing on generation costs in retail prices would not have solved the 2000-01 crisis. The problems started long before January 2001. I explored some of the deeper causes of the crisis in a paper I wrote in 2003 and is posted on my blog site. (I would make some revisions to it now.) I modeled the system economics for the CPUC in May 2000 as part of its divestiture evaluations and found that a generator with a portfolio as small as 1,500 MW could profitably manipulate the CAISO market prices. And then that’s exactly what happened. That ability would have continued regardless of whether costs were passed on to retail customers. The actual problem was in how stranded asset costs were recovered that presented this ability to manipulate prices.

California utilities have excessive risk premiums in their ROEs. (I’ve testified on this point.) A working paper just released by a UCB grad student shows the industry wide excess is between 0.5 and 4%, consistent with what I’ve found. We can see how this excessive premium is priced into shares in that the market value of California IOUs are close to double the book value. The two should closely coincide if there is not risk premium. We can see how shareholders have been shielded inappropriately by just looking at how PG&E has ridden out two bankruptcies largely unscathed.

And you are ignoring the generators who have PPAs and have risk premiums priced into their returns. The IOUs are largely passing through these costs in rates without investment return. If the CPUC wants to abrogate the agreements with existing NEM customers it should do the same with a larger source of the cost problem, the grid scale renewable PPAs.

But the larger point is that we have the regulatory framework that we have. And I agree that framework is the problem–the issue is that it cannot be solved by simplistic solutions of rate design reform of NEM tariffs or how real time costs are passed through to retail customers in a scarcity premium. (And based on the real time price discussions I’ve participated in, large scale retail RTP implementation is both extremely complex and physically difficult due to computing limits.) Those are just fig leaves for the biggest downfall in both economic efficiency and distribution–that generally wealthier shareholders are protected from any risk, so they make poor management decisions. Relying solely on retail customers to somehow rescue the current system through pricing reform ignores all of the other deeper institutional problems that got us here. Again, why would we shift the entire burden of solving this problem onto the backs of customers who have no control over the resource management decisions and are currently forced to bear 100% of all excessive costs? And why would we take away one of the tools they have to protect themselves economically against poor management decisions that have no consequences for utilities’ management and shareholders?

BTW, I did not come around to see the advantage of allowing customers to trade upstream capacity allocations–you apparently missed my point that the transactions of such a market would be so large that we would devolve back to a dealer market which is what we already have. Proponents of RTP and similar retail reforms ignore these transaction costs which is another market failure that leads to the need for regulation.

Responding to a few other points:

– I conducted a couple of studies on the returns to investment in small community scale solar projects. To break even, the SCE retail rates had to increase at a rate faster than 3% a year. Solar installers had been telling their customers the average increase was 6% a year, but from about 2010 to 2016, those rates increases less than 3% a year and at the time looked like they would track inflation. That meant that the investments had an element of risk. It turned out that rate increases subsequently return to the high annual escalation rates of pre 2010 and now those who invested in solar rooftops have realized higher returns–but their initial investment decisions were based in a riskier environment. (I agree the prime motivation for rooftop solar has been to hedge against utility price increases–a mechanism that should be in agreement with.)

– Residential solar represents one third of distributed solar because residential consumption is about one-third of the total load. The differential in the forecast vs actual load is for the TOTAL, not residential, load. The avoided increases are proportional across customers (the relative shares haven’t changed much over that period.) So the total savings attributable to distributed solar can be extrapolated proportionately down to residential rooftop solar.

– The RECs created by NEM customers are retired, and the reduction in load reduces the RPS obligations of the IOUs which are based on retail sales. Note that installing NEM solar has largely been the only way for bundled customers to gain 100% renewable energy. Even the GTSR/ECR tariff programs have not supplied anything close to 100% green power–the utilities have transferred resources from their RPS portfolios to meet (a very small) demand.

– Aeroderivative CTs are the only CTs that have been installed in California since the 1980s for a variety of reasons including air quality regs. There is not a single Frame 7F CT in the state. (I did the survey of every plant.) These were installed long before anyone considered ramping needs for renewables. There has not been a new once since 2010. You are making a false comparison and the $1366/kW cost is the appropriate benchmark.

– Again, we did not finance our solar with a tax deductible mortgage loan. In fact, unlike IOUs, this debt cost is not tax deductible.

– As for comparing to the average IOU RPS portfolio costs to that of rooftop solar, this is the perspective of the customer. You have suggested that your solution is to reform retail prices which implies that it should come from customer decisions. Utility customers see average, not marginal, costs and average cost pricing is widely prevalent in our economy. To achieve 100% renewable power a reasonable customer will look at average utility costs for the same type of power. We use the same principle by posting on energy efficient appliances the expect bill savings–those are not based on the marginal acquisition costs for the utilities.

And customers who would choose to respond to the marginal cost of new utility power instead will never really see those economic savings because the supposed savings created by the decision will be diffused across all customers. In other words, other customers will extract all of the positive rents created by that choice. We could allow for bypass pricing (which industrial customers get if they threaten to leave the service area) but currently we force other customers to bear the costs of this type of pricing, not shareholders as would occur in other industries. Individual customers are currently the decision making point of view for most energy use purposes and they base those on average cost pricing, so why should we have a single carve out for a special case that is quite similar to energy efficiency?

So, you are saying, the average user that uses 600 kilowatt hours per month and pays 26 cents per kilo watt hour and gets a $156.00 bill on today’s volumetric system with a $10.00 meter charge totaling $166.00 per month. with a Fixed fee of $50.00 and 600 watts of power at 19.34 cents per kilo watt hour would also gross $166.00. What about the below average user that now uses 300 kilowatt hours a month, like apartment dwellers, and has a bill of just $78.00 plus $10.00 =$88.00 dollars. on your plan it would be $58.02 plus $50.00 = $108.02 or a 23% price jump imposed on low users. Now let’s look at it the other way around. The high user that uses 1200 kilowatt hours per month is now 26 cents per kilo watt hour times 1200 = $312.00 plus $10.00 = $322.00 now. under your plan the high-end user would have 19.33 cents times 1200 kilo watt hours = $231.00 plus $50.00 = $281.96 or a 12% discount over todays metrics. You could make more tiers that balance the equation but how is that any different than the system they use now in cost to upper-level users and lower-level users? Again, the rich high-end users would still pass off their costs to low end users even more and this could discourage conservation in that more you use, the less you pay per kilo watt hour.

Betazeded,

I don’t think that’s what I am saying as I have not done any cost-of-service studies to determine how large the monthly connection charges need to be for the three IOUs. My guess is in the range of $50 to $100 per month (less if the social costs are removed and funded with general tax revenues) and energy rates ranging from near zero to around 6 or 7 cents per kWh in a TOU rate design, maybe a bit higher in the peak periods if the lower rates induce more demand than the system can deliver.

For equity reasons the monthly connection charge could be varied to reflect either the income of the customer or the fair market value of the residence (without the Prop 13 limitation).

It would be interesting to see what rates a legitimate cost-of-service study would actually produce.

Robert

One other point: if the IOUs are going to go further than CARE/FERA rate discounts into pricing by income or property value, how does that make the IOUs different than a governmental entity charging a means-based tax? I’m pretty sure the CPUC and IOUs would be open to a lawsuit at a minimum, or an initiative that brings electric utility rate regulation under the same constitutional requirements that public water utilities face that restrict this approach. This is a non-starter as a proposal.

Second above comment to James Bushnell–you are using a false premise. No one is arguing to leave NEM 2.0 as is.

Thanks to @Jim Lazar for a constructive discussion of a way forward that is fair, encourages storage, and optimizes DER’s. The initial results from the Vibrant Clean energy modelling while not definitive suggest that optimized DER can LOWER costs for all ratepayers by minimizing unnecessary transmission and distribution grid spending which are a substantial and increasing part of California’s IOU revenue requirement . Current CPUC modelling with RESOLVE does not even differentiate PV on distribution grid (but in front of the meter) from PV requiring transmission.

It is true that no serious stakeholder group that has made a formal filing with the CPUC “to leave NEM 2.0 as is” (though a few are pretty close). However, many people, in public comments to the CPUC and/or in the media, have made such comments and have in fact expressed indignation at even the prospect of a change. As for the Vibrant Clean Energy modelling, Severin made a notable point in a recent constructive debate on NEM with Ahmad Faruqui:

“Even the Vibrant Clean Energy study, which was commissioned by the rooftop solar industry, said that we’re only going to get 5% to 7% of our electricity, in an optimized system, from rooftop distributed generation. I think that study is flawed and overstated. But even they agree that most of our power is still going to come from the grid.”

https://www.canarymedia.com/articles/solar/live-debate-how-to-fix-rooftop-solar-policy-in-california

“…optimized DER can LOWER costs for all ratepayers by minimizing unnecessary transmission and distribution grid spending….”

The operative phrase is “…optimizing DER…,” i.e., siting distributed generation at those locations on the distribution system where it relieves congestion and the need for upgrades. That is NOT how residential rooftop solar is currently sited in California. NEM indiscriminately subsidizes rooftop soar regardless of where the home is located on the distribution system. In at least one other state the utility chooses the locations to site rooftop solar and rents using the customer’s roof. That’s a rational way to adopt rooftop solar; the chaotic, free-for-all that exists in California (and elsewhere) is not.

Phrasing and presentation matter. The crux of the problem, as both Jim Bushnell and Severin Borenstein have pointed out many times, is that we need higher fixed charges and lower volumetric (per-kWh) rates, and the per-kWh rates should vary over time.

Fix this problem, and NEM works just fine.

To deal with the crux we need to find a good way to set fixed charges. Everyone will want to pin those on someone else, probably those with the smallest voices, shallowest pockets, and who are least aware. It is a politically messy issue, but an essential one. Severin, Meredith, and Jim Sallee have an inspired solution for residential customers (tie fixed charges to income), but this kind of inspired thinking needs to be extended to all customer classes — after all, most of the load is commercial and industrial.

Making matters more complex: many customers will soon, if not already, be able to leave the grid for a levelized average cost that is less than California’s utilities. If customers have downward sloping demand curves or ways to use energy flexibly, they can economically defect even sooner under current pricing. Here in Hawaii, I think that’s already true. Grid defection is gradual for a lot of reasons (mainly, option value, I’d suggest), but I fear we’ve passed the Rubicon — we’re slamming more rate base on the grid with “needed upgrades” that may soon be obsolete.

The implications of this dynamic are clearly ominous. We need to face it forthrightly.

It would be useful to know where our kWh 1/3+ of a dollar goes today, and how much more our rates will increase, depending on the choices we make.

The California plan to be 74% renewables and 14% other decarbonized in one decade is likely to affect rates. (What other decarbonized?—we’re taking 4¢/kWh Diablo Canyon offline.) There are cheaper decarbonization plans, no?

Keeping net metering is likely to affect rates.

Building inadequate levels of housing in cities, so that people continue to move into rural areas, and more protection is needed in a state where fire season is 12 months, is likely to affect rates.

Shifting cooking to electricity between 4 and 9, and increasing electricity demand in a low renewables time of year as we shift to electric heating, are both likely to affect rates.

Is there any chance that the community choice aggregates could go bankrupt, as is happening to all those small utilities in the UK, and that this could affect rates?

What else will affect rates? And by how much?

To have kept Diablo Canyon running after 2026 would have cost 12 cents/kWh. That boat has already sailed.