Peakers Out, Batteries In?

A new paper suggests this may not be economical in many cases – yet.

I realize that on this blog we often pour cold water on what at first glance seem like obviously good ideas. But such is the role of science sometimes. The simplest answers often are not correct when one takes a step back and thinks about all possible intended and unintended consequences of an action or policy.

Readers of this blog know that many power plants “fallow” except for during the hottest, “peakiest” days of the year. During those times so called peaker plants, which are mostly gas powered, often highly inefficient, expensive and dirty turbines come online to make sure our lights stay on. When they run, they emit lots of NOx, particulates and other nasty stuff which ends up in people’s lungs. Further, these plants are often located near major load centers (translate – people cooling homes) and hence have been at the top of the list of “machinae non gratae” of environmental and especially environmental justice groups.

In New York State and here in California there is a major push to replace these pollution cannons with Lithium-Ion batteries. This seems like a great idea on the surface. Clean & quiet batteries versus a noisy airplane engine spewing NOx. I thought so too, but wanted to understand whether this intuition was right and hence joined forces with the awesome Corinne Scown – who is an expert in life cycle analysis – to study the whole enchi”li-on”ada.

In a peer-reviewed paper published this week in the fine journal Environmental Science and Technology we, together with Jason Porzio and EI alum Derek Wolfson, report what we learned over the past two years. We analyze the life-cycle cost, climate, and human health impacts of replacing the 19 highest-emitting peaker plants in California with Li-ion battery energy storage systems (BESS). And we mean soup to nuts.

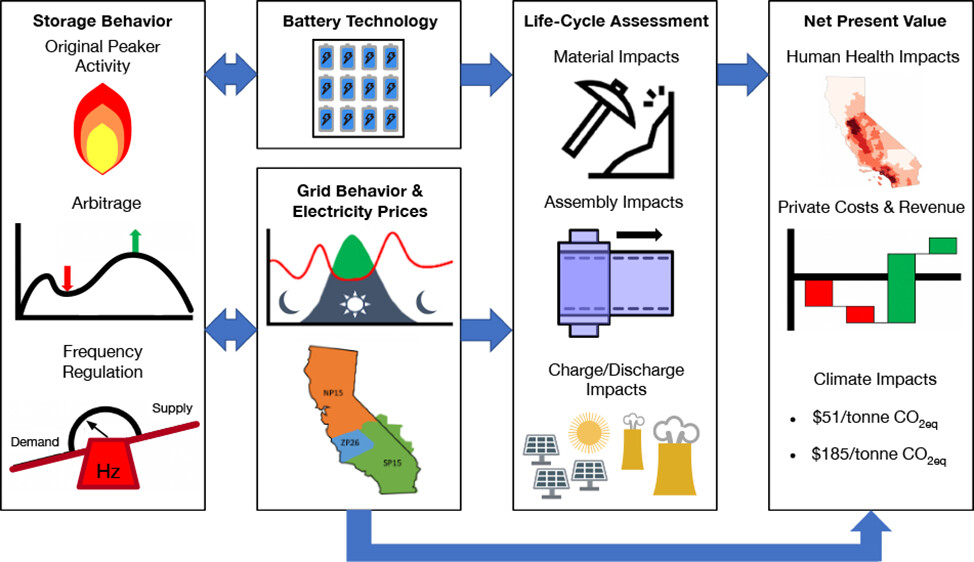

Figure 1: A visual representation of modeling the replacement of peaker plants with Lithium-Ion Batteries.

The figure above shows what we did visually (in reality this is hundreds and hundreds of pages of computer code). We start with the impacts of the assembly of the battery including the material impacts of the ingredients required to make and assemble the battery. We also include the impacts of maintaining and disposing/recycling the battery at the end of its life. All of this was done by consulting the literature and conducting many hours of interviews with experts in the battery industry (thanks for taking our calls!).

We then move on to model grid behavior of the battery once it is installed. We allow it to do things that gas powered peakers don’t really do, which is participating in arbitrage between low and high price periods and frequency regulation to generate revenue. We use an optimization model which simulates current-day replacement of these peaker plants, letting these batteries charge smartly (meaning when it’s cheap to the operator). We of course also hold these batteries accountable for the emissions they cause. If our model predicts that natural gas is on the margin when the battery charges, we account for the pollution from that electricity.

Our results show that designing Li-ion BESS to replace peaker plants puts them at an economic disadvantage, even if battery facilities are only sized to meet 95% of the original plants’ load events and are free to engage in arbitrage. Let’s dive into that for a moment for a specific plant – a peaker in Long Beach.

Figure 2: Costs and benefits of peaker replacement.

Blue bars indicate dollah dollah bills, meaning actual expenditures on the battery and its operation or revenues. Red bars mean unpriced pollution impacts (both local and global priced at the current -$51 – and proposed -$185 – social cost of carbon). The beige bar indicates the net present value of putting all of it together. We see that batteries are expensive to make and install. Operation and maintenance are a relatively small cost. On the benefits side, the gains from offsetting peaker mortality damages are not very big. And neither are revenues from arbitrage. Most of the modeled revenues come from participating in frequency regulation markets. The net present value is centered around zero, with significant uncertainty. So did Max just pick a plant that looks like this? No. Here’s all 19 we modeled. The left panel shows you the net present value, the right panel focuses in on the global warming potential.

Figure 3: Net cost and emissions of peaker replacements.

Five of the 19 potential replacements do achieve a positive net present value after including monetized climate and human health impacts, 14 do not – which depends on the size and location of the peaker. We also show that these battery systems cycle far less than typical batteries on the grid and rely massively on the limited frequency regulation market for most of their revenue. All projects offer net benefits in local air pollution, but increase net greenhouse gas emissions due to electricity demand during charging and upstream emissions from battery manufacturing.

So what’s the takeaway? This is a snapshot of what things look like today. If batteries get cheaper and the grids cleaner – both of which seems likely – batteries will look better. But we should be keeping an eye on the value of frequency regulation going forward, as that is where most of the revenue comes from. If we install lots of battery storage on the grid, that revenue is likely not going to be there for later installations.

So just to be clear one more time (before my inbox overfloweth)- the analysis in our paper is for the *current* state of technology and the market, that will surely change. What we are showing here is that we should maybe not take it as a slamdunk that batteries are the right way to transition away from natural gas in all cases.

Suggested citation: Auffhammer, Maximilian, “Peaker’s Out, Batteries In?”, Energy Institute Blog, UC Berkeley, March 20, 2023, https://energyathaas.wordpress.com/2023/03/20/peakers-out-batteries-in/

Categories

Maximilian Auffhammer View All

Maximilian Auffhammer is the George Pardee Professor of International Sustainable Development at the University of California Berkeley. His fields of expertise are environmental and energy economics, with a specific focus on the impacts and regulation of climate change and air pollution.

“What we are showing here is that we should maybe not take it as a slamdunk that batteries are the right way to transition away from natural gas in all cases.”

Max, it’s reassuring to see economists finally beginning to understand what physicists and electrical engineers have always known: trying to power an electricity grid with electrochemical batteries is a really, really stupid idea. There are many reasons why:

• Because batteries waste energy, they end up increasing CO2 emissions (in effect, they increase the carbon footprint of a gas peaker to that of a coal plant).

https://pubs.acs.org/doi/abs/10.1021/es505027p

• They are too expensive by at least two orders of magnitude (to power California for a single day with Li-ion batteries, at today’s prices, would require battery capacity costing 2x our state budget -and they would need to be replaced every 15 years).

• Not a single country, state, or community in the world is powered by renewables + batteries, for the simple reason it isn’t remotely practical.

Instead of relying on the advice of natural gas hucksters and solar panel installers, maybe we should be listening to climate experts – like Dr. James Hansen (Columbia), Kerry Emanuel (MIT), Ken Caldeira (Carnegie-Mellon), and many others who agree: “Nuclear power paves the only viable path forward on climate change” – before it’s too late.

https://www.theguardian.com/environment/2015/dec/03/nuclear-power-paves-the-only-viable-path-forward-on-climate-change

“• They are too expensive by at least two orders of magnitude (to power California for a single day with Li-ion batteries, at today’s prices, would require battery capacity costing 2x our state budget -and they would need to be replaced every 15 years).”

Your miscalculation from an obsolete 2015 EIA report has been refuted multiple times in this blog.

I don’t think anything can compare with variable retail pricing in terms of reducing the need for most peaker plants as well as smoothing the belly of the duck curve, especially over time as smarter automation is incentivized and adopted.

I agree with you but try getting the utility regulators to approve retail tariffs indexed to wholesale market prices.

Most regulators are more concerned about politics than doing the rational thing.

Max, appreciate the detailed study and evaluation framework as this should advance the state of the policy discussion within California. I will be planning to cite this work as an additional benchmark to support BESS studies in progress.

The Frequency Response issue is a concern for “near steady state” operation. There are additional concerns related to grid transients that have been raised by WECC due in part to the planned retirement of inertial generating units. Their evaluation of potential effects can be found here: https://www.wecc.org/_layouts/15/WopiFrame.aspx?sourcedoc=/Reliability/Changes%20in%20System%20Inertia%20(Final).pdf&action=default&DefaultItemOpen=1

Considerable interest has been expressed recently in studies to “re-fire” using low-carbon fuels (e.g., hydrogen or bio-derived methanol) to preserve the benefits of inertial machines (read: peakers).

For load shifting, demand response seems much more promising in the near term, particularly when driven by Highly Dynamic Pricing. As more devices are able to provide frequency regulation services, I am guessing that the market value of these will drop from today’s levels. Batteries installed for other purposes (notably resilience) seem the most opportune for use, rather than ones only installed for grid purposes.

What is the net present value of the existential threat of climate change?

case 1: Climate change is not real . NPV = 0;

case 2: Climate change is real, but not human caused. NPV = 0;

case 3: Climate change is real and sort of human caused. NPV = ?;

case 4: Climate change is real human caused and is an existential threat. NPV = -infinity.

I believe that we’re dealing with case 4, thus, anything we can do to reduce the human causation should be done. “No pockets in a shroud.”

Did you include the ‘social’ impact of sourcing Lithium [like ‘blood diamonds] ? Storage batteries degrade over time. Anecdotally Tesla car batteries lose 2% of the charge daily when not in use; grid scale storage may be less. Life cycle is often ‘soup to nuts’, it should be ‘soup to soup’.

“Did you include the ‘social’ impact of sourcing Lithium [like ‘blood diamonds] ? ”

We would then have to include the social impact of petroleum production globally since gas and oil are fungible goods. Given the millions who have died in resource-driven wars alone, ignoring other social ills, those costs easily overwhelm the costs of lithium mining to replace petroleum.

The batteries could be doing so much more than just offsetting Peaker operations. If they are sited within a microgrid boundary, the batteries can support reliability. If they are at a node in the power system where transmission constraints exist, they can avoid or defer upgrades. Or both! Given these factors, the paper analysis is a very promising outcome, as batteries are nearly there just on replacing central generation services alone.

Dear Max,

Thanks for this careful analysis. But even a back-of-the-envelope would reveal that using batteries for occasional use makes them very expensive, particularly compared to existing peakers! The occasional use of the peakers, by definition, makes operational advantages less important (eg lower emissions assuming that the batteries were charged with renewables).

Ross

With batteries you have to have enough energy to charge them. This is not always the case with renewables so they are usually less reliable than gas peakers.

Storage would be for power outages, renewables and insufficient generation. I would agree with you in this latter case only because insufficient generation shows a lack of planning. Until there is sufficient storage that sources energy from renewables, gas peakers are the way to go. As our esteemed host noted by referencing a study, storage that gets its energy from non-renewables exacerbates climate change and is more expensive in the doing.

Storage for outages has been with us for a very long time. If this were critical, it would, and is being (by those affected) employed.

There are times of over production of solar. This over production should be stored.

It was noted that CAISO curtails solar for technical and economic reasons. If one believes that climate change is an existential threat. the “economic” reasons should be dismissed.

Those with skin in the game will know all this and unlike the authors, they will anticipate far more keenly what lies ahead. Surely therein lies the value the authors seem to have little regard to