The West Coast’s Bleak Energy Winter

What do record natural gas prices tell us about cost risks of fossil and renewable energy?

Much of the US and Europe are breathing a collective sigh of relief as a warmish winter and growing natural gas supplies deliver much lower than expected prices. But on the West Coast, we’ve seen the opposite. Since the beginning of December, spot prices of natural gas in California, the Northwest, and parts of the Southwest have been at least three times higher than further east. Marginal electricity generation is mostly from natural gas, so electricity prices have followed gas to extreme levels.

This comes amid debates about phasing out gas stoves and restricting oil and gas drilling locations in California. It makes for a good narrative that it’s all the left coast’s comeuppance for not being sufficiently supportive of fossil energy production and use. But that story doesn’t line up with the realities. The affected states have little natural gas of their own and import over 95%.

(Source)

(Source)

The huge price differentials between the West Coast and the rest of the country tells us that transport capacity between the areas is constrained. In fact, we knew this coming into the winter. A pipeline explosion from 2021 reduced capacity to move gas from the producing regions in and around Texas, the source of much of our supply. We have seen these pipeline issues before and government investigations have sometimes found companies have taken advantage of them to further restrict supply and jack up prices. Just as with California’s gasoline price debate, it’s difficult to tell whether a spike is due entirely to real scarcity or is being exacerbated by sellers who strategically reduce supply.

Daily PG&E Citygate spot natural gas price ($/MMBTU) (Source)

Daily PG&E Citygate spot natural gas price ($/MMBTU) (Source)

The transport problems alone may not have been enough to spike the price if it weren’t for the unusually cold weather and the unusually low inventories in the West. Inventory problems are in part due to storage locations being hobbled by leaks and other operational issues. It has been a near-perfect storm of factors to boost the price of natural gas.

And now, those prices are hitting customer bills.

From Wholesale to Retail

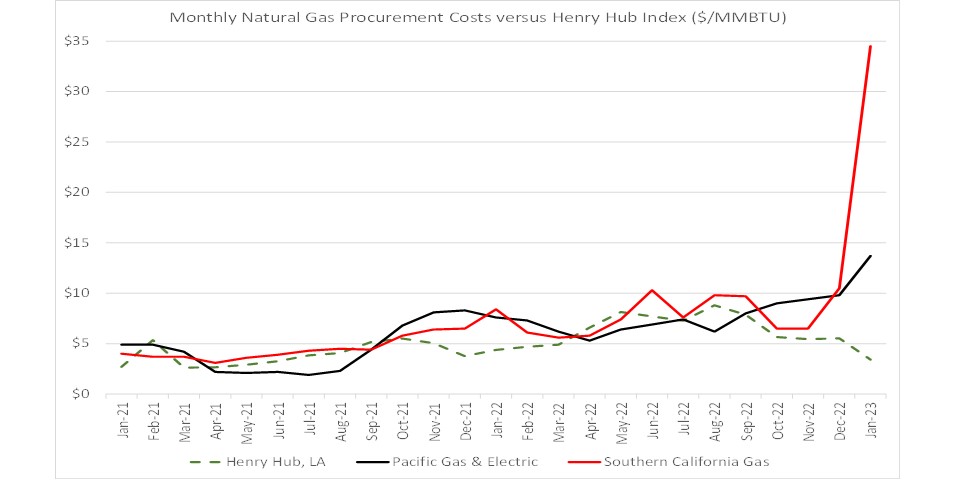

For customers of some utilities, the good news is that through long-term contracts, ownership of some pipeline rights, and a bit of financial hedging, the retail price effect of the gas spike will be dampened. Even though spot prices in Northern and Southern California have tracked closely, customers of Southern California Gas have seen a quadrupling in their commodity cost of gas, while customers of PG&E in the north have seen slightly less than a doubling. Hedging doesn’t usually save money on average, but it can greatly reduce the cost swings.

(Source: Energy Information Administration and company websites linked above)

(Source: Energy Information Administration and company websites linked above)

The other (sort of) good news for residential customers is that the commodity cost of the gas in normal times only makes up half or less of the retail price we pay. The rest goes to pay for pipes and other infrastructure, and to public purpose programs. Those haven’t seen the same spike, so our prices overall are not going up as much as the commodity cost of the gas.

The Renewable Energy Hedge

Renewables advocates point out that wind and solar generation, besides delivering huge environmental benefits, also offer much less cost volatility. These variable energy resources (VERs) incur nearly all expenses upfront as capital, and are not vulnerable to fuel cost fluctuations such as the sort of geopolitical shocks that we have seen in the last year. A natural hedge! That’s true, but if the goal is to protect customers, the argument is a bit more complicated.

After all, another area of debate and research in electricity markets is how much more volatile wholesale electricity prices will be in a market dominated by VERs. With variable generation and fluctuating demand, market price changes will be more extreme than in the past. And those extreme prices can last for long periods, part of why Max has taught me how to pronounce dunkelflaute (doon-cull-flauta).

(Source) Dunkelflaute

(Source) Dunkelflaute

The problem is that wind and solar come with more predictable costs, but with less predictable output. Thus, a VER owner’s revenues are more volatile even though their costs are more stable. Electricity storage will reduce this problem somewhat, but will not eliminate it unless storage gets super cheap.

But if the profit booms and busts of producers are the mirror image of consumers’ bill shocks and smiles, shouldn’t they be able to work out a contract that lowers risk for both sides? Well, yes and no.

Yes, because so long as the seller has the product to deliver and the buyer knows how much they will want to consume, the two sides can agree in advance to a moderate price that doesn’t skyrocket when overall demand strains supply, or plunge when the opposite occurs. The contract avoids the extreme wealth transfers that transactions at the market price would create when supply and demand are out of whack.

No, because sellers are only reducing their risk when they lock in a price for output that they know with high probability they will have. And buyers are only partially reducing their risk if the quantities they have contracted for may not show up – especially on the days when prices hit the stratosphere – or if the buyer ends up needing much more than they’ve contracted for.

On average, a wind farm in a certain location will produce a certain amount each year, and on average that will correspond to a certain price level, but risk mitigation is not about the averages. If the wind isn’t blowing in a high-price hour when the farm is contractually obligated to deliver, then what seemed like a hedge turns into weight that can drown the firm in liabilities. Gas-fired generation faces some of these risks as well, as we saw in Texas two years ago. Of course, a supplier with diverse renewables in diverse locations can reduce its quantity risk, but that makes the business, and the contracts, more complicated.

Seconds after I post this, there will be a comment below arguing that this whole problem is avoided if the consumer just owns the generation, as with rooftop solar. Alas, not so. Owning the generation has much the same effect as the hedge contract I just described. It stabilizes the cost for the product delivered, but it doesn’t reduce the quantity risk. If that customer with their own generation is connected to the grid, then they still risk needing to buy additional power when prices are high or sell power when prices are low. If they are not connected to the grid, then they will adjust to supply/demand mismatches entirely with demand, which in my brief experience using an inverter during a power outage is not all that much fun.

Wind and solar power offer immense environmental benefits and real cost savings. They can also reduce the economy’s vulnerability to fossil fuel price volatility, but there are important trade-offs. To make all the pieces of the energy transition into a successful package, and avoid bleak energy winters (or summers) in the future, we need to be clear eyed about what each technology – wind, solar, batteries, demand flexibility, nuclear, geothermal, and others – can bring to the table.

I’ve joined Mastodon and am now posting most days on energy topics @severinborenstein@econtwitter.net

Keep up with Energy Institute blog posts, research, and events on Twitter @energyathaas.

Suggested citation: Borenstein, Severin, “The West Coast’s Bleak Energy Winter”, Energy Institute Blog, UC Berkeley, January 30, 2023, https://energyathaas.wordpress.com/2023/01/30/the-west-coasts-bleak-energy-winter/

Categories

Severin Borenstein View All

Severin Borenstein is Professor of the Graduate School in the Economic Analysis and Policy Group at the Haas School of Business and Faculty Director of the Energy Institute at Haas. He received his A.B. from U.C. Berkeley and Ph.D. in Economics from M.I.T. His research focuses on the economics of renewable energy, economic policies for reducing greenhouse gases, and alternative models of retail electricity pricing. Borenstein is also a research associate of the National Bureau of Economic Research in Cambridge, MA. He served on the Board of Governors of the California Power Exchange from 1997 to 2003. During 1999-2000, he was a member of the California Attorney General's Gasoline Price Task Force. In 2012-13, he served on the Emissions Market Assessment Committee, which advised the California Air Resources Board on the operation of California’s Cap and Trade market for greenhouse gases. In 2014, he was appointed to the California Energy Commission’s Petroleum Market Advisory Committee, which he chaired from 2015 until the Committee was dissolved in 2017. From 2015-2020, he served on the Advisory Council of the Bay Area Air Quality Management District. Since 2019, he has been a member of the Governing Board of the California Independent System Operator.

Heat pump heating will take pressure off of our over-used gas system in winter, even if all of the marginal electric energy were supplied by in-state gas fired combined cycle power plants. This is because the heat pump can meet the heat needs using about 1/4 of the utility energy of a gas furnace (COP 3.0 heat pump / COP 0.8 gas furnace = 3.75). And even if that electric energy had to be entirely supplied by a gas fired power plant at only 46% delivered efficiency (53% power plant efficiency minus 7% transmission losses). Heat pumps and gas fired power plants can save 0.53 therms of gas per therm of heating supplied. ( 1 therm heat requiring 1.25 therms gas into furnace* minus 1 therm heat requiring 0.72 therms of gas into power plant **).

I’m noticing that heat pumps leverage what little gas storage we have for winter, and that they also decrease our dependence on out-of-state gas pipeline companies. This assistance from heat pumps makes me want to see them adopted pronto as the default way to add or replace building cooling (that also solves our gas problems by also providing winter heating).

* 1 therm of heat/ 80% efficiency requires 1.25 therms of gas

** 1 therm of heat supplied by 3.0 COP heat pump requires 0.333 therms of electricity from a power plant delivering it at 46% efficiency that requires 0.72 therms of gas.

The gas savings improves further as we add more renewables to the mix.

Notice the gas savings are already more than three times as large and going to a 95 % efficient furnace could produce. ( only 0.2 therms of gas reduced per therm of heat provided when switching from 80% to 95% efficiency in a furnace ).

Tom,

Remember that it takes about 4+ MW of renewable to equal 1 MW of thermal or nuclear and then include the batteries to go with it. And it takes increasingly more MW of renewable to replace the last 50 to 90% of the thermal fleet.

“Seconds after I post this, there will be a comment below arguing that this whole problem is avoided if the consumer just owns the generation, as with rooftop solar.”

And seconds after that, there will be a comment arguing that this whole problem is avoided if the consumer just supports nuclear energy, and supports hauling all solar panels and wind turbines to the hazardous waste dump. He will write something like,

“For fifteen years before landmark 2006 deregulation was enacted, the price of uranium never varied more than 31%”, or

“Diablo Canyon [Nuclear] Power Plant, after 2025, will be generating electricity at a marginal cost of only $.027/kWh”, or

“Energy Sec. Jennifer Granholm has stressed that any clean energy initiative must include nuclear energy”, or

“Nuclear energy is the only source of scalable, baseload power that is 100% carbon-free.”

I just know it!

“Diablo Canyon [Nuclear] Power Plant, after 2025, will be generating electricity at a marginal cost of only $.027/kWh”

False. I suggest that you read SB 846 which sets the cost of Diablo at more than $60/MWH just for the extended operation before PG&E has to complete a new license extension (which PG&E has to restart).

https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202120220SB846

“SB 846…sets the cost of Diablo at more than $60/MWH…”

False. The marginal cost of operating Diablo Canyon for PG&E isn’t “set” by SB 846 or any other legislation. It’s determined by O&M costs – how much it costs to operate and maintain the plant. For 2021 that was 2.7¢/kWh, and there’s no indication those costs will increase significantly going forward.

Please provide a breakdown of how you’re arriving at the “more than $60/MWH” for which you claim customers will be billed for power from Diablo Canyon, however. Yes, there are additional incentives for PG&E to keep the plant open, approved by all but three members of California’s legislature in September. Why would both California and the U.S. Dept. of Energy agree to support the plant, if it didn’t offer benefits in grid reliability and clean, baseload power – ones unavailable from all of California’s “renewable” resources combined?

The only incremental cost that matters is what is paid by ratepayers, and that includes whatever incentives are paid. That amount is is set in law at over $60/MWH. Read the law and you can do the calculation yourself with the added information from the FERC Form 1.

The incremental cost of running the plant matters very much to PG&E, who joined California’s legislature, the U.S. Dept. of Energy, the Governor of California, and the majority of Californians, who believe Diablo Canyon should continue to provide a steady, reliable supply of clean energy.

POLL: Strong local and statewide support for Diablo Canyon Nuclear Power Plant

SACRAMENTO, Calif. , May 19, 2022 /PRNewswire/ — Newly released polling shows strong local support for extending the operations of the Diablo Canyon Nuclear Power Plant, California’s largest source of carbon free energy generation. Statewide support for extending operations of the plant was also strong, according to the poll conducted by FM3 Research. Gov. Gavin Newsom recently announced his intent to explore options to continue operations at the Diablo Canyon Nuclear Power Plant. The poll was commissioned by Carbon Free California with input and support from Data for Progress.

“We found that Californians broadly support the continued use of Diablo Canyon Power Plant to generate electricity,” said Dave Metz, partner and president at FM3 Research. “Closer to the plant, in San Luis Obispo County specifically, we saw that support intensify.”

https://www.prnewswire.com/news-releases/poll-strong-local-and-statewide-support-for-diablo-canyon-nuclear-power-plant-301551747.html

Re: your $60/MWH figure: I provided the information from FERC Form 1. If you make a claim, you can back it up. That’s your job, not mine.

On managing the risks of intermittent resources such as solar and wind, regulatory policies matter as well, affecting both efficiency and the distribution of economic rents. FERC has adopted a generic rule on the “insurance standard” to be applied to the frequency distributions that measure the moment-to-moment variability in solar and wind, which leads to utility-specific filings that use one-minute data to calculate various frequency distributions (with different definitions of “variability”) and to assign “stand ready” costs to loads and resources (e.g., cover the “inner 95%” of the frequency distributions). Jousting witnesses push and pull on the data, statistical analyses and the % rule, and the results can be unpredictable. The back and forth can also lead to black-box settlements, not orders, which undermine the value of the decisions for future cases by enhancing regulatory risk. Research might unveil the impacts on efficiency and rents of these decisions and settlements. The stand-ready charges may be sub-optimally high or low from an efficiency standpoint (taking social costs into account) and/or may just push rents between buyers and sellers. The existence of settlements suggests that the division of rents is acceptable to both buyers and sellers, but payments by solar and wind developers may be “too high” if they reduce the diffusion of carbon-free resources below optimal levels.

“People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.” Adam Smith

Dr. Borenstein legitimizes the case for all utility customers to have CHOICE for their supplier and their contract hedging options. Prudent options do exist through third party suppliers, even if our legislature and CPUC have no trust in the free market. Thank you for a thoughtful analysis of this winter.

Ron, the idea you have a choice of who is providing your electricity is illusory.

Everyone connected to CAISO’s grid in California has the same electricity mix – there’s no way to separate your electrical energy from that of anyone else. If you live in PG&E’s service area, you might be surprised to learn a significant percentage of your electricity is provided by PG&E, then resold (at a higher cost) to your Community Choice Aggregator (CCA), then resold (at a higher cost) to you.

FYI, if you’ve purchased a “100% Solar” or similar clean energy plan, you’re being swindled (because electricity travels at the speed of light, you would never be able to turn on your lights after the sun goes down). To justify it, CCAs buy Renewable Energy Certificates (RECs) from a solar farm, which are supposed to represent the “clean energy attributes” of solar energy generated during the day, then sell them to you. Selling the same clean energy twice, they claim, is legitimate.

The Federal Trade Commission disagrees:

“Among the relevant language in the Green Guides is, §260.15 Renewable energy claims,

‘(d) If a marketer generates renewable electricity but sells renewable energy certificates for all of that electricity, it would be deceptive for the marketer to represent, directly or by implication, that it uses renewable energy.'”

What You Can Say about RECs is Regulated by the FTC

https://www.greenbuildinglawupdate.com/2019/11/articles/codes-and-regulations/federal/what-you-can-say-about-recs-is-regulated-by-the-ftc/

“But…how can they get away with that?!”, you might ask. To that question I don’t have an answer. Maybe one of the renewable energy advocates here can explain why the deception is allowed to go unpunished.

I’m curious how much of this sharp deviation between West Coast natural gas prices and national prices is explained by two specific situations: The reduced storage in SoCal, due to the Aliso Canyon gas storage field problems, and the unavailability of gas from Texas due to a pipeline outage.

This is an N-2 condition: two very major components of the interconnected system unavailable.

The 2000-2001 West Coast Power Crisis was made much more severe by a similar N-2 situation: a drought, reducing hydroelectric power supply (BPA stopped exporting to California in May, 2000), and the explosion in a New Mexico campground that took an El Paso Natural Gas transmission pipeline out of service.

Planning for N-1 is something that the utilities have generally done pretty well. Planning for N-2 not so much. Longer-duration storage, particularly hydro, is the most obvious answer.

Jim

A correction that I testified to in the FERC Energy Crisis docket – West Coast hydropower supplies in the summer of 2000 were at 90% of average conditions–hardly an N-1 condition. In 2000 California was classified as an Above Normal water year (while 2001 was Dry, that didn’t have an impact until the summer after the crisis was over). https://cdec.water.ca.gov/reportapp/javareports?name=WSIHIST Hydro availability had a negligible impact on market prices then.

Keeping natural Gas in the homes and not allowing every roof to have rooftop solar may be good for the utilities with GAS in their names but not good for the consumers or the grid as more EVs and electrical appliances come online in the new all electric homes. The mandated new home rooftop solar after April 14th, 2023, will be a losing proposition to the homeowner under NEM 3.0.

I have rooftop solar and even in the winter, I produce electricity from it. I may use all of it, plus buy 20 kilo watt hours per day from the utility, but my home uses 60 kilo watt hours per day for lighting, appliance and Electric heating. If I did not have my rooftop solar, my draw would be 60 kilo watt hours of electricity per day, in the winter, when heating my home or I would re-light my gas furnace and burn 80 therms of natural gas per month again. If the one third of electrical power, I use, is from efficient Natural gas generation, from the utility, and the rest is self-generated rooftop solar and batteries, the two thirds, from self-generation under NEM 2.0 would be eliminated on all new homes that currently do not self-generate and would not ever generate anything thanks to the CPUC initiating NEM 3.0 ending the value to rooftop solar. NEM 3.0 will increase natural gas usage and costs just when we need to reduce natural gas usage because of supply and cost issues.

“After all, another area of debate and research in electricity markets is how much more volatile wholesale electricity prices will be in a market dominated by VERs.”

As we discovered in 2000-2001, the important factor is to keep purchases from the short term wholesale market small. Who cares if the CAISO price is $10,000/MWH if its 1% of the generation? Great news story, but not really consequential. Further, the annual swing in solar and wind generation is much less than what hydro experiences yet we extoll the virtues of hydro. And remember if grid scale solar is as cheap as the posts here claim then we should be able to build twice the capacity that we use for the same cost as a fossil plant and have substantial excess energy. (Several papers have pointed this out.)

The emergence of V2X EV charging also will make storage virtually free for distributed resources as people will be purchasing transportation, not home energy management, in most cases. That market will be just too tempting for automakers to ignore.

Agreed. And within 15 years, any significant surplus generation from utility scale solar or off-shore wind, which is potentially massive, will be “stored” & pipelined by BigOil as synthetic jet fuel for transcontinental aviation or anhydrous ammonia for maritime fuel & fertilizer. BigOil already has most of the infrastructure required for this, and they’re not going to abandon it.

The author’s already explained his reservations about consumer owned solar, which I don’t dispute. However, the larger issue with climate & the renewable energy transition is increasing the renewable electrical supply available to consumers ASAP. Our heretofore overlooked, underutilized & most rapidly exploitable large renewable resource is parking lots. Just follow France, by incentivizing & requiring solar canopies with integrated stationary storage batteries & vehicle-to-grid chargers on ALL existing parking lots with 80 or more spaces within 5 years, & within 3 years for big parking lots with hundreds of spaces. Do this before building more utility scale solar on remote farmland & environmentally sensitive habitat.

Reduce utility bills and transportation costs for tenants of leased commercial property, like large apartment & condominium developments, neighborhood shopping centers, business parks & public facilities. Produce & store reliable power right where most energy is consumed. Shade enormous asphalt heat islands. And accomplish all this without requiring expensive new long distance utility transmission infrastructure.

This is not a utility fix-all, but it can be accomplished very rapidly, everywhere, with existing standardized technology, expedited local permitting, & an existing trained workforce. Yes, the supporting canopies cost more than existing building roofs, but the area available is massively greater, and canopy structures will last for at least 75 years….That’s 3 successive generations of improving solar panels & batteries. Make this a state or local building ordinance, like fire sprinklers or parking requirements.

For required renewable 24/7 base load power, the western US has tremendous, widely distributed untapped geothermal resources. Enhanced & Advanced Geothermal technology is poised to replace existing gas & aging nuclear generation with strategically distributed geothermal plants. Some geothermal systems are capable of being throttled, which adds storage capacity to base load capability. And some existing spent oil, gas & geothermal wells, and there are many, can be similarly repurposed for storage. This is more expensive than solar, or maybe even off-shore wind, both of which require transmission, but there’s a lot to exploit, and we’ve barely begun.

One problem I ran into was the structure of the parking garages (not surface-mount). Older buildings (residential, commercial, and parking structures) might not be able to bear the weight of the new equipment without upgrades. For my own house in Portland, Oregon (1950), the City requires an engineering study that costs a few thousand dollars, just to get a permit for rooftop solar, and I would be surprised if that is not the case elsewhere and for any rooftop installation, including parking garages. Ground-mount PV and a code requirement for new parking garages to enable future rooftop PV might avoid this problem, but might not be cost-effective, and codes apply only to new construction (or maybe massive renovations), slowing the progress. How did the French overcome these obstacles?