California’s Mystery Gasoline Surcharge Strikes Back

2019 was a record year for the Mystery Surcharge, which is bad news for drivers and the state’s economy.

If the price of gasoline stays inexplicably high and the media have grown tired of writing about it, does it still make a sound? That’s what I was wondering as I updated the calculation of California’s Mystery Gasoline Surcharge.

For anyone who is less obsessed with gasoline prices than I am – which is pretty much everyone – the Mystery Gasoline Surcharge (MGS) is the premium of California gas prices above the rest of the US, AFTER accounting for the fact that we have higher taxes and environmental fees, and we use a cleaner gas formulation. Those cost factors currently justify a $0.72 differential between California and the average in the other states. But this morning that differential is $1.18. The 46 cent difference is the MGS today.

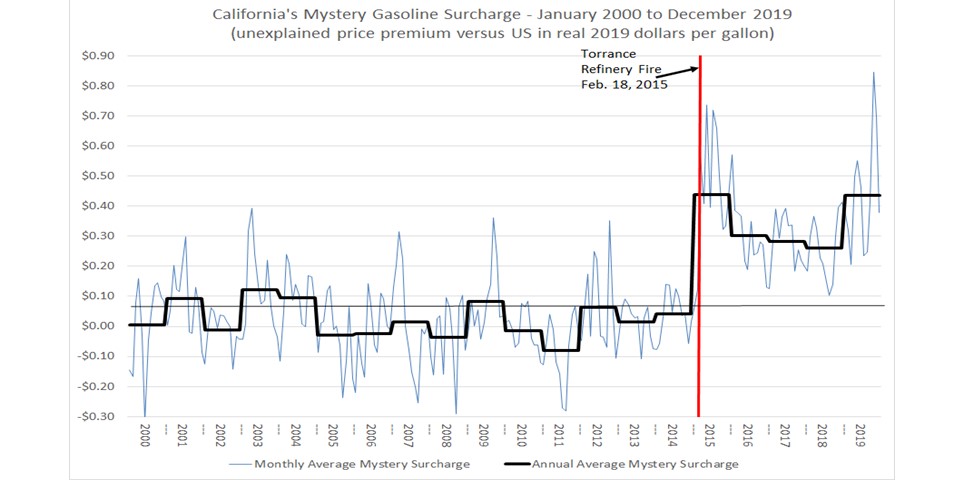

Prior to 2015, there was no Mystery Gasoline Surcharge. California gasoline prices were higher than elsewhere in the US by an amount that on average reflected the well-known taxes, fees and other cost factors. The MGS appeared in February 2015 after a fire at a Southern California refinery caused gas prices to spike. However, unlike previous spikes, this one never disappeared. In 2015, it cost California drivers an extra $6.7 billion.

Media Attention Deficit

I’m in many reporters’ Rolodexes under “gas price spike”, and I have noticed a pattern in media coverage. When the price rises, I get a lot of calls, but if it stays high, the media just sigh and move on to covering other issues. The irony is that temporary price spikes can be part of the normal, healthy operation of the gasoline market, reflecting a short-term supply shortage, generally due to a refinery disruption. It’s an extended price premium that signals something is amiss, and that costs consumers the big bucks.

The MGS had been gradually declining since 2015, though it still averaged at least 26 cents per gallon in 2016, 2017, and 2018, more than twice as much as in any year prior to 2015. However, just like the Kansas City Chiefs (too soon?), the MGS was down, but not out. It came roaring back in 2019. Except with the MGS, the only possible winners are gasoline suppliers and their shareholders.

The MGS increased by 68% in 2019 to just over $6.7 billion, or 44 cents per gallon. In the five years since 2015, the MGS has cost Californians over $26 billion, versus just $0.4 billion in the previous five years – 2010 to 2014. The difference works out to over $2600 for a family of four. In an earlier blog, I put the size of the MGS in the context of California’s economy, including that it’s more than the state spends on the entire University of California system.

Lame Industry Explanations

Industry folks often respond to discussions of the MGS by pointing to California’s high gas taxes and environmental fees. We not only have the cap and trade program, but also the Low Carbon Fuel Standard and a fee for cleaning up leaking underground storage tanks, which total about 30 cents per gallon. In addition, California gas taxes are about 32 cents above the average of the other states. But the MGS is what is still unexplained after accounting for those costs, as well as the cost of producing California spec gasoline.

Another response has been that California has made itself a “gasoline island” by using a different (and cleaner) formulation than any other place in the world, as we have since 1996. But if the problem were an island effect that creates gasoline scarcity, that would show up in the commodity (or “spot”) price of California gasoline, the price for trading million-gallon shipments of California gasoline. In a previous blog post, I showed that the Los Angeles spot price has gradually declined over the last 15 years relative to New York and Gulf Coast spot prices for gasoline, though it did spike in 2015 and, to a lesser extent, in 2019.

The Problem Downstream

Let’s assume for a moment that those spot gasoline prices were just reflecting costs and scarcity, not any market power on the part of producers. I am inclined to think market power has also played some role in the commodity price, but let’s set that aside for today. Let’s look at the distribution and retailing margin, the differential between the average retail price and the spot price, again after removing differences in taxes and environmental fees (which are imposed in the distribution and retailing sectors). The graph below shows the Distribution and Retailing Mystery Gasoline Surcharge (DRMGS), which is the same as the MGS except we’ve also removed the spot prices of gasoline in California and the rest of the US. (These data are only available back to June 2003.)

This figure tells a somewhat different story than the first graph. In 2015, when the spot price spiked after the refinery fire, distribution and retailing margins went up relative to the rest of the country, but they went up even more in the subsequent years. From 2016 to 2019, the distribution and retailing margin differentials were much higher than any time going back to 2003.

This decomposition of California’s elevated gasoline prices shows the significant source of the problem. Comparing 2010-2014 to 2015-2019, the spot price of California gasoline rose just 2 cents relative to spot gasoline elsewhere in the country, but the distribution and retailing margins increased 29 cents relative to the rest of the country. 29 cents per gallon translates to over $22 billion of the $26 billion MGS since 2015.

What is California Doing About the MGS?

When I last wrote about the Mystery Gasoline Surcharge in May 2019, the California Energy Commission had just put out a very brief report on the issue, but announced it would issue a more detailed report in October. That report dug into the data more, but did not attempt to reach conclusions about the cause. Like my analysis, it suggested that the problem is more downstream in distribution and retailing than with gasoline production itself.

Governor Newsom then tasked the Attorney General’s office with investigating the cause. The AG’s office doesn’t talk publicly about open investigations, but I presume that they are following the governor’s directive. In a previous blog, I talked in more detail about what might be going wrong in gasoline distribution and retailing, including concentration among the refiners who control large shares of the distribution network and a dearth of low-cost off-brand stations. I’m hoping the AG has a crack team of lawyers, economists, and industry experts digging into this.

The media may have moved on, but there are still many things Californians could do with an extra $26 billion.

I am still tweeting interesting (to me) energy news articles, research papers and blogs – and occasionally my political views – @BorensteinS

Keep up with Energy Institute blogs, research, and events @energyathaas.

Suggested citation: Borenstein, Severin. “California’s Mystery Gasoline Surcharge Strikes Back” Energy Institute Blog, UC Berkeley, February 10, 2020, https://energyathaas.wordpress.com/2020/02/10/californias-mystery-gasoline-surcharge-strikes-back/

Categories

Severin Borenstein View All

Severin Borenstein is Professor of the Graduate School in the Economic Analysis and Policy Group at the Haas School of Business and Faculty Director of the Energy Institute at Haas. He received his A.B. from U.C. Berkeley and Ph.D. in Economics from M.I.T. His research focuses on the economics of renewable energy, economic policies for reducing greenhouse gases, and alternative models of retail electricity pricing. Borenstein is also a research associate of the National Bureau of Economic Research in Cambridge, MA. He served on the Board of Governors of the California Power Exchange from 1997 to 2003. During 1999-2000, he was a member of the California Attorney General's Gasoline Price Task Force. In 2012-13, he served on the Emissions Market Assessment Committee, which advised the California Air Resources Board on the operation of California’s Cap and Trade market for greenhouse gases. In 2014, he was appointed to the California Energy Commission’s Petroleum Market Advisory Committee, which he chaired from 2015 until the Committee was dissolved in 2017. From 2015-2020, he served on the Advisory Council of the Bay Area Air Quality Management District. Since 2019, he has been a member of the Governing Board of the California Independent System Operator.

8% of the California CARB fuel free market evaporated 11 days ago on 2/1/2020 when PBF Energy completed the purchase of Shell’s refinery in Martinez California

This now leaves market share at Chevron 27% Marathon 27%,PBF 16%, Philips 14% and Valero 12%

Good blog and comments (especially about the increased concentration). Now you just need one more ingredient–the behavior of the FTC.

Hi Severin,

Thanks for your analysis. Like you, I get calls from reporters when gas prices spike, but nobody calls about this issue.

My opinion is that as long as retail gasoline is under $4/gal, nobody gets upset enough.

The market has always been pretty concentrated, however it would appear the current set of owners are exploiting the concentration unlike the prior set of owners. Between 2010 and 2016 ConocoPhillips, ExxonMobil, and BP got out of the gasoline refining and retailing businesses in CA (BP to a large degree but not quite all).

The timing doesn’t quite align, but I wonder if the workforce requirements in SB 54 have anything to do with this. The resulting high unionization rates in CA refineries may have increased production costs. It would be rather shocking if they increased costs by 26 – 44 cents/gallon, but maybe it’s a factor.

Great and Assertive Analysis Severin, Thank you!

Last week I drove from LA to Phoenix to visit family. Upon my return, it occurred to me that I could save a few bucks by refueling in Ehrenberg, AZ, rather than waiting to cross the Colorado River. In checking today’s gasoline pricing I note that Ehrenberg gas prices for unleaded gasoline are $2.75 per gallon, and Blythe, CA unleaded gas prices are roughly $3.80 per gallon. This premium is certainly well above the “should be” premium of $.72 per gallon.

I’ve watched the irrational CA gas price rollercoaster for decades. The only reduction/compression of the MGS seems to occur when there is more than one LA Times article about gas “price gouging” within 30 days. Within about 60 days retail gas prices seem to fall moderately.

We’ll be rid of this ridiculousness when electric vehicles gain significant market share——-I hope.

I look forward to your article on market power!

Thanks again,

Jim