Where There’s a Well There’s a Way

New Energy Institute research charts a path to lower methane emissions.

Last month, the French company ENGIE hit the brakes on a multi-billion-dollar contract to import liquified natural gas from the United States. Why the cold feet? It seems the French are understandably concerned about the climate impacts of US methane emissions.

This news helps fuel arguments that we should be doubling down (versus backing off) on regulating our methane emissions. But this is easier said than done. It’s hard to track – let alone regulate- emissions seeping from a million active wells and hundreds of thousands of miles of pipelines across the United States.

In this new Energy Institute working paper, graduate students (and job market candidates!) Karl Dunkle Werner and Wenfeng Qiu argue that new ways of detecting methane emissions could give regulators the tools they need to cost-effectively regulate emissions from natural gas wells. Before unpacking this important paper, let’s first review some mind-blowing facts about methane.

Methane math

Methane is a greenhouse gas that deserves more attention than it gets. Molecules of methane spend less time in the atmosphere than CO2, but they’re far more potent. Over 20 years, a ton of methane will warm the planet 80 times more than a ton of CO2. If CO2 adds a t-shirt of warmth to the globe, methane adds a down comforter.

Clever science-types have been hard at work developing new ways to measure how much methane leaks out of the oil and gas supply chain. Using satellites, drones, and airplanes, researchers have been collecting measurements from thousands of well pads across the country.

A 2018 paper scales measurements from several of these studies to a national level. The news is not good. It’s estimated that, on average, 2.3% of upstream US natural gas production is leaking. That’s more than 60% higher than official EPA estimates.

Multiply U.S. natural gas production in 2018 by a 2.3% leak rate and you get over 13 million tons of methane emissions. Make the CO2 equivalent conversion for a 20-year time horizon (think t-shirts to down comforters), and the warming impact of these gas leaks is comparable to the carbon emissions from all US passenger cars and trucks in 2018. In other words, methane emissions from natural gas production are a big deal.

Another key finding is that the majority of emissions seem to be coming from a small number of big leaks. These “super-leaks” are typically caused by maintenance and equipment failures.

The role of super-leaks helps explain why EPA engineering estimates can significantly under-estimate real-world methane emissions. It also suggests that if more effort was invested in safe operations, methane emissions could be significantly reduced.

Firms are already invested in abatement (not enough)

The natural gas industry has been quick to point out that they are “already incentivized to prevent methane emissions”. Firms are in the business of selling natural gas which is 90% methane, so leaked gas means lost profits!

The problem with this argument is that the market price for natural gas is less than 1/10th of the per-unit environmental cost of a gas leak. If firms faced the full cost of methane leaks, they would invest more in leak prevention. How much more? This is a question that Karl and Wenfeng tackle in their paper.

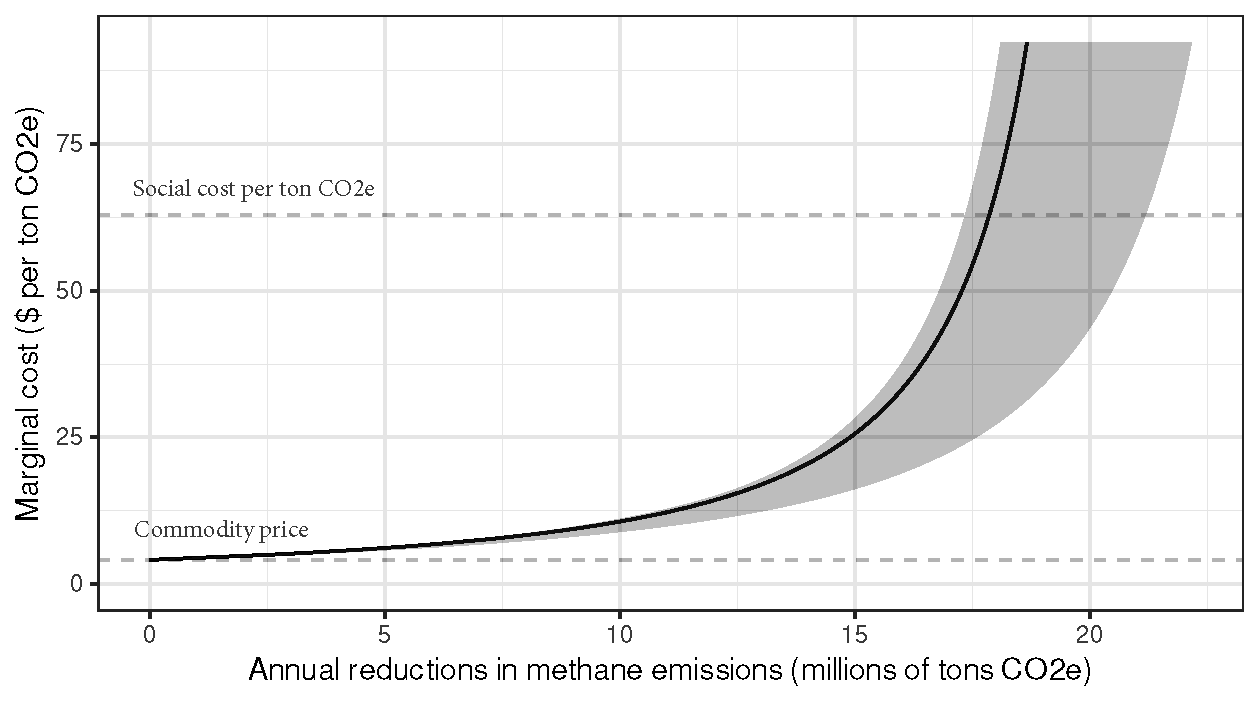

They start by estimating firms’ abatement costs. They combine airplane measurements of methane leaks with data on natural gas prices and some assumptions about how firms trade off leak risks and leak prevention costs. A key assumption is that firms will set abatement costs equal to lost profits on the margin. Making this (and other) assumptions, they can back out the implied costs of leak prevention for the wells in their study:

This graph is striking for two reasons. First, it seems there are lots of low-cost opportunities for methane abatement. Second, it suggests that methane leaks could be reduced by as much as 80% if these firms had to pay the full social cost in the event of a leak (although the authors are careful to note that this estimate requires extrapolating substantially beyond the costs they observe).

How to catch a leak?

The environmental impacts of methane leaks are high. Based on this research (and related work by Levi Marks), the cost of avoiding these leaks appears to be low. This situation seems ripe for regulatory intervention. Without it, firms face limited pressure to prevent leaks.

Karl and Wenfeng argue that an effective regulatory approach is one that audits firm operations and assesses fines on the basis of methane leaks detected, but it’s prohibitively expensive to continuously audit every well and pipeline. So regulators need to figure out how to target limited audits to catch the biggest leaks.

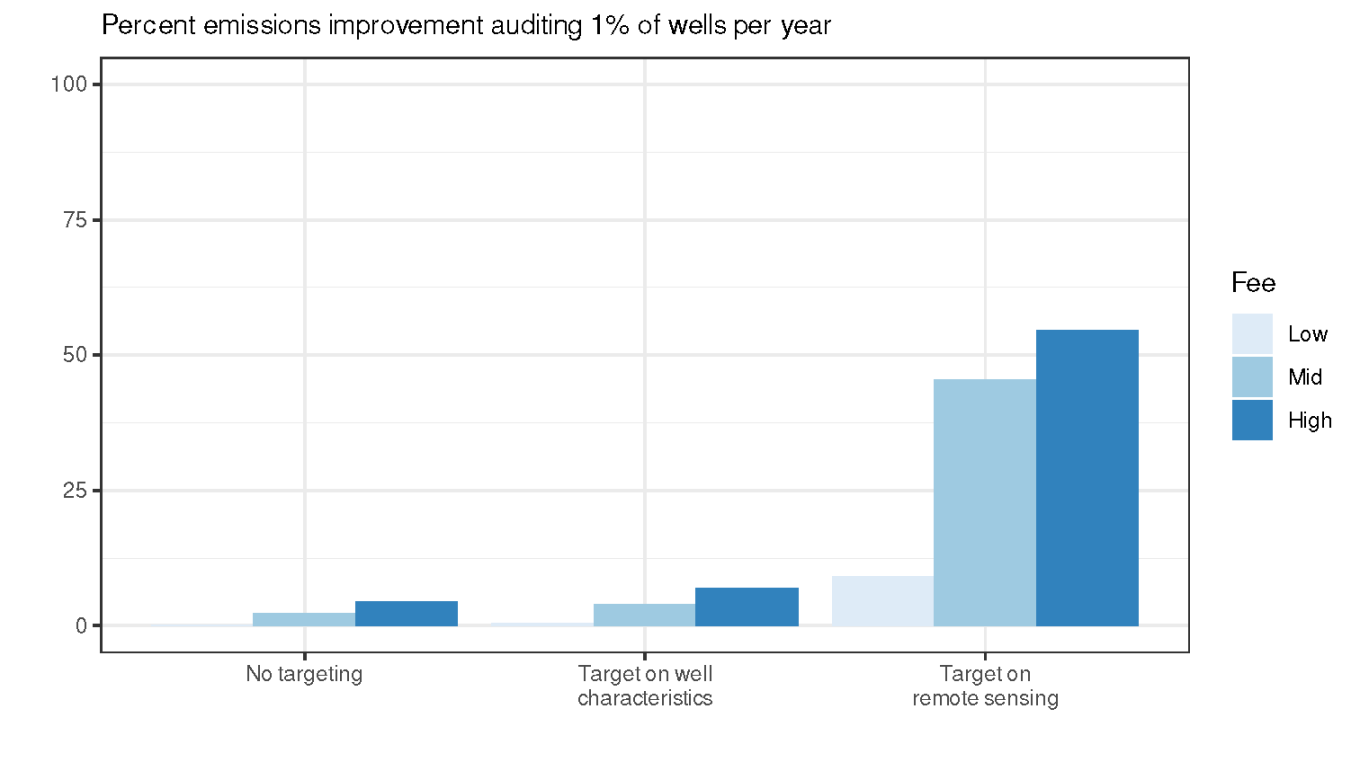

The paper considers a range of alternatives that vary in terms of targeting and the fee assessed per ton of emissions detected. I’m going to focus on three approaches, all of which impose the reality-based constraint that you can only audit 1% of wells each year.

The first approach audits facilities randomly, an audit-in-the-dark strategy. The large leaks this paper studies are rare, so leaks are detected (and fines are assessed) with low probability. Firms have little incentive to prevent leaks.

The second approach targets audits based on well characteristics like size and age. This approach does not perform much better because it’s really hard to predict when and where leaks will happen.

The third approach assumes the regulator can use satellite-based measurements to detect leaks above a certain threshold. When leaks are remotely sensed, regulatory staff are dispatched to audit. Simulated outcomes under this approach are promising. Better leak detection coupled with the higher fine per unit of emissions leaked gives firms a much stronger incentive to invest in leak prevention.

Where there’s a well there’s a way?

Scientific advances in the measurement and detection of emissions are changing the way we understand the methane pollution problem. To translate these measurement innovations into on-the-ground emissions reductions, we’ll also need policy innovations. This paper is an important step in that direction.

My friend Barry Rabe has argued that the main obstacles standing in the way of meaningful methane regulation in the US have less to do with measurement challenges and more to do with political challenges from energy producers. But the more we understand about unregulated methane emissions, the harder it is to see (and/or sell) made-in-America natural gas as a clean and green fuel. As these invisible emissions become more visible, can we find the political will to crack down on methane leaks?

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas.

Suggested citation: Fowlie, Meredith. “Where There’s a Well There’s a Way” Energy Institute Blog, UC Berkeley, November 30, 2020, https://energyathaas.wordpress.com/2020/11/30/where-theres-a-well-theres-a-way/

Categories

Solar and wind advocates often claim non-hydro renewables are replacing coal – a poster child for the adage that “correlation does not imply causation.” Solar and wind may replace some coal generation, but they will never close a coal plant. Their output is intermittent – they need backup power from natural gas, and not just for nighttime and cloudy or calm weather. Gas plays a critical role in bridging unpredictable gaps that would render either useless on an electrical grid.

Solar and wind are not only not reducing consumption of gas – they’re giving it new life. Since 2014 gas consumption for electricity has risen as fast as all renewables combined, and anyone who believes that doesn’t imply causation hasn’t looked at two consecutive power content labels from PG&E and Edison in recent years.

Combine with Meredith’s observation 2.3% of gas is leaked in production, and the fact that leaked gas is 80x more powerful than CO2 as a greenhouse gas (GHG). Then connect the dots: including necessary gas backup and leakage, the GHG footprint of solar and wind is anywhere from 60-80% worse than coal.

Renewable? Sustainable? Hardly.

I worry most about what happens when wells are abandoned following the inevitable decline in gas. That may seem remote to some, but it may also come faster than expected. A lot of gas infrastructure was built banking on the idea that we would export.massive amounts of LNG to Europe, and perhaps other places. It was part economic development strategy, part “transition fuel” strategy, and part geopolitical strategy, limiting Europe’s reliance on Russia. But with renewables so cheap and (still!) getting cheaper, storage solutions arriving, and reinvigorated efforts to curb emissions, renewables are poised to grow even faster. And if folks start to switch from gas heat to electric heat pumps, the efficiency gains will significantly cut gas demand even if gas-fired power plants supply all the new electricity (they won’t). Given razor thin margins in gas already, it’s hard to see the industry spending much to prevent leaks. Maybe if it’s cheap enough to fix. But small probability of high fines may managed with “bankruptcy for profit” — moral hazard included by limited liability (similar to what we’ve seen in finance and banking). And what happens when leaking wells are simply abandoned when no longer profitable?

These are tough issues and it looks like an interesting and important paper. This topic needs more attention.