Billing Tweaks Don’t Make Net Metering Good Policy

Just before Christmas, an administrative law judge at the California Public Utilities Commission put a shiny package with a big bow under the tree for distributed solar PV companies, and gave the state’s regulated utilities a lump of coal. That ALJ’s proposed decision, which will next go to the CPUC commissioners, rejected the utilities’ attempts to end net energy metering (NEM) for new residential solar customers. Around the same time, the Nevada Public Utilities Commission came to the opposite conclusion.

The immense challenge we face from climate change, and the limited resources the political landscape is willing to allocate to it, means it is critical to design energy policy that gets the greatest long-term greenhouse gas reduction bang for the buck. In previous blogs, I’ve argued that net metering is an inefficient and opaque way to support the growth of low-greenhouse gas technologies (see here, here, and here), and should be replaced with more direct and transparent subsidies.

Rather than rehash that argument, however, I thought I would start the new year discussing two rate structures that are being proposed as alternatives to repealing NEM: minimum bills (mostly proposed by rooftop solar supporters) and demand charges (mostly proposed by those on the opposite side).

Rather than rehash that argument, however, I thought I would start the new year discussing two rate structures that are being proposed as alternatives to repealing NEM: minimum bills (mostly proposed by rooftop solar supporters) and demand charges (mostly proposed by those on the opposite side).

Minimum Bills

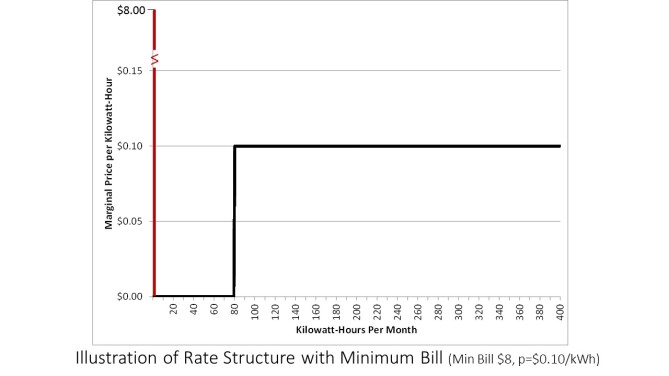

Here’s the simple math: a minimum bill is identical to a fixed charge plus giving every customer a set quantity of free electricity.

For instance, let’s say that electricity costs $0.10 per kilowatt-hour (kWh) and there is a minimum bill of $8 per month. This is identical to a fixed charge of $8 per month and each customer receiving the first 80 kWh for free each month. Either way, it will make no difference to the bill of anyone who consumes more than 80 kWh. Either way, any customer consuming less than 80 kWh per month will face an increased bill and an incremental cost of zero for consuming one more kWh of electricity. The same math holds whether retail rates are constant or tiered (though there is an extra step to calculating the number of free kilowatt hours if it goes beyond the first tier). A minimum bill yields exactly the same bill for every single customer every single month as the equivalent fixed charge and free quantity of electricity.

If the minimum bill is set at a low level, such as $10 per month, then nearly all customers will exceed the minimum level and it will make no difference to either customer bills or utility finances. If the minimum bill is set at a higher level, such as $50 per month, then it will raise the bills of a significant number of low-use customers. And it will also give those customers an incentive to consume more, because until they hit $50, their incremental cost of consuming one more kWh is zero. If you are already a small user who is nonetheless forced to pay $50 every month, why bother turning off the lights when you go out this evening?

If the minimum bill is set at a low level, such as $10 per month, then nearly all customers will exceed the minimum level and it will make no difference to either customer bills or utility finances. If the minimum bill is set at a higher level, such as $50 per month, then it will raise the bills of a significant number of low-use customers. And it will also give those customers an incentive to consume more, because until they hit $50, their incremental cost of consuming one more kWh is zero. If you are already a small user who is nonetheless forced to pay $50 every month, why bother turning off the lights when you go out this evening?

Then why in the world are some environmental groups among the proponents of minimum bills? Perhaps because they will effectively maintain the status quo of recovering all revenues through volumetric charges. No one is seriously talking about a minimum bill of $50. Both NRDC and some solar companies have endorsed $10. The Regulatory Assistance Project is also advocating very low minimum bills, proclaiming that their virtue is that almost no customers would be affected.

That would be just fine if volumetric charges reflected the social marginal cost of a kWh, that is, the utility’s marginal cost plus all emissions externalities from greenhouse gases, NOx, SO2, and particulates. But in California, and many other states with high electricity rates, the prices exceed any realistic estimate of a kWh’s social marginal cost, as I wrote about a year ago.

Maintaining a high volumetric electricity price is not a worthy goal if that price greatly exceeds the full cost to society. It not only prevents customers from getting as much value from electricity as they can, it also discourages efficient switching from other energy sources, such as natural gas for heating and gasoline for transportation. I recognize that fixed charges are no panacea either, creating a difficult trade-off between efficiency and equity/distributional concerns.

In any case, rather than hiding behind a minimum bill, regulators should just admit that they are making no changes and continuing to put all costs into the volumetric price of electricity. A minimum bill either does nothing or takes rate design in the wrong direction.

Demand Charges

A demand charge is a fee based on the customer’s highest usage in any one hour (or shorter timeframe) during the billing period, regardless of whether that individual customer peak occurred when the system was stressed or during a time with plenty of spare capacity. With the technology of the mid-20th century, it was extremely expensive to meter usage in every hour, so a simpler device was used, which captured peak consumption, but not the time at which it occurred.

Back then, a demand charge may have been the best available approximation to a customer’s usage during system peak periods, but it was never a very good approximation as the customer’s peak may not be coincident with the system peak. Furthermore, the customer’s single highest consumption hour during each billing period is not the only, and may not even be the primary, determinant of the customer’s overall contribution to the need for generation or transmission capacity.

In any case, the value of such approximations has been mostly eliminated with smart meters that record usage in hourly or shorter intervals. Smart meters permit time-varying price schedules that can easily be designed to more effectively capture the time-varying costs that a customer imposes on the system, including their contribution to the need for generation, transmission, and distribution capacity.

Interestingly, some utilities and others are proposing a fee based on the customer’s usage during system peaks and calling it a “demand charge.” That gets a lot closer to Critical Peak Pricing, a form of time-varying pricing, though the details of such “demand charges” still make them a poor alternative. They tend to focus on one or two hours of highest system demand within the billing period, regardless of whether that demand level actually stresses supply capability. In one year, the hottest day in June may be a real scorcher and may occur when some major generation is off-line, while in another year June might be mild and have plenty of available capacity every day.

Sure, such a nouveau demand charge may be a small step in the right direction towards time-varying pricing, but it requires all the same infrastructure as pricing alternatives that are much bigger steps and are likely to seem much less risky to customers, because they are not driven entirely by just one or two hours.

An additional explanation for demand charges is that they capture the customer-specific fixed cost of providing a certain level of service capacity to the customer’s site. Such capacity, however, is established by making up-front and largely sunk investments in the local distribution network and the final connection to the customer. These may constitute substantial fixed costs, but those costs are determined by the attributes of the connection, not by the customer’s peak usage after the connection is established. A monthly fixed charge based on the customer’s service capacity would more appropriately capture these costs.

The use of demand charges has also created a large market of consultants advising customers on how to reduce their peak demand (see here, here, and here for examples). Those strategies yield little benefit to the utility or society. Customers faced with demand charges place high private value on reducing their very highest hour of usage even if there are other hours in which usage is nearly as high, and even if none of those hours are coincident with system peak times.

At their very best, demand charges capture some customer-specific fixed costs and may very imperfectly reflect the time-varying costs of the customer’s consumption. But customer-specific fixed charges that reflect service levels and time-varying pricing accomplish these goals much more effectively, so why would one use demand charges?

So What Should We Be Doing About Net Energy Metering?

The reality is that a customer who consumes 300 kWh in a month is imposing very different costs on the system than a customer who consumes 1500 kWh over some hours and also injects 1200 kWh into the grid during other hours. NEM treats them the same. That may have been a convenient benign fiction back when solar PV barely existed. But today it is a costly distortion that has the potential to create huge economic inefficiencies and unfairly shift billions of dollars in costs among customers.

The CPUC needs to dig into the studies and take a stand on the real value that distributed generation brings to the grid. And to be transparent about any additional subsidies based on learning or other technology development arguments. Then the Commission needs to craft a tariff that accurately accounts for these values. Continuing NEM is just politically ducking the hard questions. If California is going to be a leader in alternative energy and combating climate change it has to be willing to make serious and defensible policy choices.

I’m still tweeting energy news articles and new research papers @BorensteinS

Categories

Severin Borenstein View All

Severin Borenstein is Professor of the Graduate School in the Economic Analysis and Policy Group at the Haas School of Business and Faculty Director of the Energy Institute at Haas. He received his A.B. from U.C. Berkeley and Ph.D. in Economics from M.I.T. His research focuses on the economics of renewable energy, economic policies for reducing greenhouse gases, and alternative models of retail electricity pricing. Borenstein is also a research associate of the National Bureau of Economic Research in Cambridge, MA. He served on the Board of Governors of the California Power Exchange from 1997 to 2003. During 1999-2000, he was a member of the California Attorney General's Gasoline Price Task Force. In 2012-13, he served on the Emissions Market Assessment Committee, which advised the California Air Resources Board on the operation of California’s Cap and Trade market for greenhouse gases. In 2014, he was appointed to the California Energy Commission’s Petroleum Market Advisory Committee, which he chaired from 2015 until the Committee was dissolved in 2017. From 2015-2020, he served on the Advisory Council of the Bay Area Air Quality Management District. Since 2019, he has been a member of the Governing Board of the California Independent System Operator.

A minimum fee will kill low income people, who can’t afford solar, and already have to keep their usage low to be able to afford current costs.

If the minimum fee is greater than $50, that might be the case. However the discussion in California at least has been more at $10 to $20, which almost always higher than the minimum of any non-solar household. And there’s a very easy fix for this–eliminate the minimum for any CARE-qualified household.

My question with respect to the article is why the discussion in most analyses is exclusively about the utility desire for a charge for facilities and does not simultaneously consider the time-of-day value of the electricity provided by solar systems. Perhaps this is already accounted for in California but this is not the case elsewhere–at least not here in MD where there is no time of day variation in costs for residential systems. Here, as I understand it, the incentives for solar are in part paid for by eliminating the need for a new tie-line connection to the Ohio River Valley fossil-fueled power plants and even without time-of-day pricing, I am getting essentially a guaranteed 9-10% after-tax return on a prepaid lease arrangement started several years ago. In my view, fine for utilities to get some sort of fee for infrastructure if homeowners simultaneously get the benefit of time-of-day pricing, but this tradeoff does not seem to get discussed by analysts, and certainly not by the utility executives making their case. Am I missing something about why these issues are not discussed together?

Mike,

I also live in Maryland. Our utility just provides us wire services. The electricity comes from PJM, sometimes with PEPCo as the middleman, but increasingly with a marketer as the go between. With the result, PEPCo and other distribution utilities (such as the ones in California) are concerned about the cost of distribution wires. Such distribution utilities look at generation and transmission costs as something to pass through. Often regulators do not allow the distribution utility to make any markup on such costs. Getting the billing systems correct for hourly (or 15 minute) pass through has been taxing for utilities. And, I understand that TVA is trying to prevent one of its distribution utilities from implementing such a system.

Mark Lively

Utility Economic Engineers

Gaithersburg, MD 20879

MbeLively@aol.com

Mark,

Thanks for the note, and I can understand why the cost of the distribution wires is all they want to talk about. What I find troubling is that reporters interviewing various industry leaders on the issue don’t simultaneously ask them about time of day pricing–so raise the aspect of the issue related to consumer interests. What I would think the various regulatory commissions should be doing is considering the two issues simultaneously on the public’s behalf.

Severin, I have a couple of questions about a minimum bill policy. You say it results in no effective difference in the bill for any but very low use customers unless the minimum charge is quite high. Let’s take a $15 monthly minimum bill and an energy charge of 10 cents/kWh; this will affect only those who use less than 150 kWh/month (presumably very few customers). But it also affects NEM customers who had a low, or no, bill. That additional $15/month does increase the contribution to fixed costs paid by NEM customers and does add to the utility revenue (reducing the variable energy charge, however slightly, for everyone). Especially for utilities without smart meters, isn’t a minimum bill better than just straight up NEM with no minimum bill or, as you say: “A minimum bill either does nothing or takes rate design in the wrong direction.”?

As opposed to a minimum bill, a fixed, or customer, charge would affect all customers, not just NEM (and very low use) customers. Is a fixed charge preferable, if the goal is to increase the contribution that NEM customers pay for the systems that support them?

I do get that installing smart meters is a first step opening the door to many possibilities!

The Regulatory Assistance Project is not advocating the minimum bill option. Rather, we present it in rate design discussions because we feel that decision-makers need to appreciate all their options, many are unfamiliar with how it works and we can’t know their priorities which hopefully include the good economics discussed here as well as politics which are largely set aside in this analysis. We do see the minimum bill as superior to a straight-fixed variable rate with a high customer charge, but that is a very low bar. Happily, we converge with Borenstein on his conclusion that a time varying price with a critical peak price is superior to even a well constructed residential demand charge (and many proposals are not), but we also recognize that many decision-makers are not prepared to go there for a host of technical and social reasons. And we agree and feature in our work with states the value in a two way grid of aligning marginal consumption prices with long run marginal cost. Our mission at RAP is to help decision-makers make progress toward more value-based rates in the manner and pace that are in the realm of realism. They need options. For places with on the order of 0.1% of energy coming from DG, the simplicity of net metering may continue to be the pragmatic answer for some time.

Related comment: “The immense challenge we face from climate change” – – Do climate scientists ever think about what their data means? The surface and satellite temperature measurements indicate a temperature increase of 0.12 degrees Celsius per decade. So the global-warming, climate-crisis temperature of 2.0 C, as defined by the IPCC, is 100 years away.

As an oil and gas [petroleum] geophysicist in an early life I can estimate that the proven and projected global reserves of oil and gas are much too small — by a factor of 2 to 3 — to sustain 100 years of the emission increases causing these temperature increases.

Fortunately, as we know, emissions are declining in the US and EU, and will likely do so in Asia after 2030. Also, the IPCC notes that about 60% of CO2 emissions are absorbed by the Earth’s sinks. Thus any possible crisis will be pushed even farther away.

Maybe the climate community is concerned about their data. I understand some are considering moving the climate goal posts closer – to 1.5 C!

Dr. F. Paul Brady, Professor of Physics, UC Davis (retired)

Principal, BPF Investments/Charitable Investments

Office Ph: (530) 753-5929; Cell (530) 220-3593

43182 West Oakside Pl, Davis, CA 95618

With respect to the comment about how long it will take to get to a 2 C warming, it is important to note that the baseline is the preindustrial concentration and so warming to date has been near 1 C, so only about 1 C to go. Also, the projected rate of warming absent significant emissions reductions has had the world reaching about 2 C by 2050. The problem then is that if this warming would not be the equilibrium value as there is of order 0.5 C that is deferred due to the thermal inertia of the oceans, and then the cooling offset of sulfate aerosol layer created mainly by SO2 emissions from coal fired power plants would quickly disappear if emissions went to zero, allowing another 0.5 to 1 C warming (offset a bit as soot-induced and tropospheric-ozone-induced warming also disappear. In essence, we are already essentially committed to 2 C warming unless we also make cuts in current emissions of methane as well as CO2, so there is no basis for delay in cutting emissions. The international discussions really stick mainly to CO2 emissions and either ignore or don’t quite properly consider the effects of non-CO2 warming and cooling agents; climate models do try to do this fairly well, but this all gets a good bit more complicated than the global negotiations seem capable of fully dealing with.

Mike MacCracken, Ph.D. (fro UC Davis)

Chief Scientist for Climate Change Programs

Climate Institute, Washington DC

Net Metering can be Good Policy for the recovery of some costs incurred by a utility in serving its customers, such as the cost billed to it by its ISO supplier. But for the rest of the costs incurred by the utility, such as the cost of wires and meters, a demand charge and a monthly customer charge are more appropriate.

For the cost billed by the ISO supplier, the metering periods need to be aligned, an issue that is current before FERC in Settlement Intervals and Shortage Pricing in Markets Operated by Regional Transmission Organizations and Independent System Operators, FERC Docket No. RM15-24-000. If the ISO is billing the utility based on fifteen minute intervals, it might be good policy for the utility to bill the retail consumer for those ISO costs on fifteen minute intervals using net metered amounts during those fifteen minute intervals. I filed comments in this docket on 2015 November 15, saying that the issue needs to be re-specified to include unscheduled flows within and between ISOs and interconnected systems.

This net metering paradigm seems to be only appropriate for the charges coming to the utility from the ISO, as I discussed in “Fairly Pricing Net Intervals While Keeping The Utility Financially Healthy,” 48th Annual Frontiers of Power Conference, cosponsored by The Engineering Energy Laboratory and The School of Electrical and Computer Engineering, Oklahoma State University, Stillwater, Oklahoma, 2015 October 26-27. A shorter version of this paper was published in Dialogue, United States Association for Energy Economics, 2015 September 1. The full paper is on my web site, http://www.Lively Utility.com in the library under Conference Papers. The URL for the shorter paper is http://dialogue.usaee.org/index.php/fairly-pricing-net-intervals-while-keeping-the-utility-financially-healthy

The majority of the cost incurred by an increasing number of utilities are incurred for wires. A much better way to recover the cost of wires is a demand charge. When the customer wants to have access to a specific amount of power, the customer can contract for wires access in that amount, which would be billed monthly based on contract demand. Customers with poorer information about their power requirements can rely on a demand charge based on the interval with the highest net metered amount, generally fifteen minutes or an hour, though I have seen the interval being an entire summer month. Customers who exceed their contract demand would pay for the excess demand through a multiple of the demand charge.

There are a few appropriate demand metrics, such as the customer maximum demand or more exotic demands such as the contribution to the distribution system peak or the peak on a subsection of the distribution system, all as discussed in the above paper. We are still several years away from real time pricing of the distribution system, as I discussed in “Dynamic Pricing: Using Smart Meters to Solve Electric Vehicles Related Distribution Overloads,” Metering International, Issue 3, 2010.

Delightful read as always, and thanks for the mention.

Two additional points on demand charges. First, even in coincident markets, simplification in tariff design (such as 5CP) means customers game coincident demand charges just as much as non-coincident. Secondly, most demand charge services actually find anomalous demand spikes and consumption reduction opportunities as a matter of course, meaning they have nice public benefits without the public costs.

Well said, Severin! To continue this program, basically intact, when solar’s capital costs have become extremely competitive, and the ITC will be extended, is not a well thought out policy. If we wait until 2019 to make any substantive changes, the negative effects of cost shifting will absolutely become a reality!