What Can Futures Markets Tell Us About Biden’s LNG Pause?

Prices for 2025, 2026, and 2027 shed light on what could lie ahead for consumers.

The biggest energy/climate policy news of the year so far is Biden’s decision to pause approvals of liquefied natural gas (LNG) export facilities. Regardless of your opinion about the decision, the economic, environmental, and political impacts of the move are fascinating and complicated, and this story is likely to stay in the news for some time.

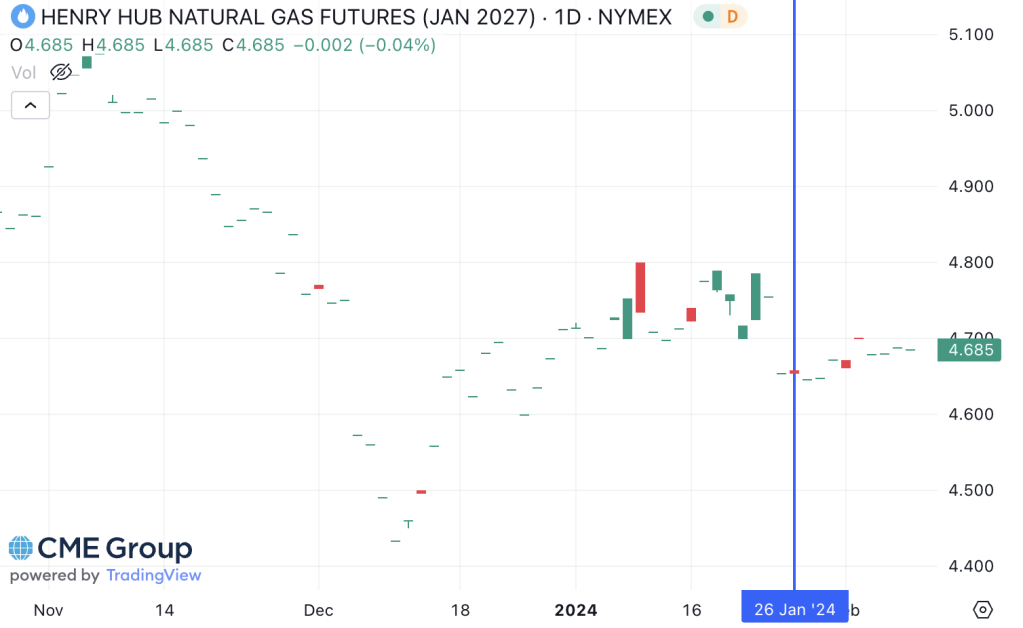

For today’s blog post, I want to look at the data on futures prices to see how they were affected by the decision. I look at prices from NYMEX for natural gas contracts at Henry Hub in 2025, 2026, and 2027. This is one of the most heavily-traded futures markets in the world, and, though this information cannot answer all questions, these prices contain a lot of information about where buyers and sellers think the market is headed.

This is particularly relevant because part of the discussion about the LNG pause has focused on potential impacts for U.S. natural gas consumers. The Biden press release mentions that one of the potential impacts of LNG exports is “energy cost increases for American consumers and manufacturers” and consumer advocates are celebrating the pause as an important step towards “reducing economic pressures on low income families.”

When Was Information Revealed?

A big challenge in analyzing the market impact of this kind of event is figuring out exactly when information was revealed. Commodities prices capitalize all available information – official and unofficial – so it isn’t enough to know when a policy is implemented, you have to ask whether the policy change was anticipated.

In this case, there is pretty good evidence that the pause was a surprise. The White House announced the decision on January 26. This same day the New York Times and Wall Street Journal ran major articles about the decision. I see a bit of related media discussion in the days leading up to the announcement, but nothing before that.

So I’m going to take the week of January 26 as the “start date” for the pause. I’m not trying to claim that the decision came as a 100% complete surprise. Critics have long argued against LNG exports, but until that week of January 26, it wasn’t clear that such a pause was ever going to happen.

Prices for 2025, 2026, and 2027

The figure below shows contracted prices for natural gas delivery in January 2025. Each observation is a day.

- Green indicates a day the price went up

- Red indicates a day the price went down

- Thick bars show opening and closing prices

- Thin bars show high and low prices

The vertical blue line indicates January 26. Before and after the pause is announced there is essentially no change. Prices fluctuate from day-to-day, but are essentially flat during the week around January 26.

—

The evidence below for contracts delivering in January of 2026 and 2027 is similar. The farther out you go, the lower the transaction volumes, with a dash indicating that the contract was not traded that day. But in all cases, prices are essentially flat around the week of January 26.

—

—

Why Didn’t Gas Prices Respond to the LNG Announcement?

I think this tells us that the supply of natural gas is highly elastic. Particularly in the medium- and long-run, there is considerable scope for U.S. natural gas producers to change supply substantially in response to even fairly small price changes. We already kind of knew this. U.S. natural gas reserves have increased nearly every year since 2000, and much of it can be accessed at relatively low marginal cost.

The LNG pause represents a potentially large decrease in future demand for U.S. natural gas. There are currently 17 natural gas export projects seeking permits across the country, and the pause throws these projects into uncertainty. If we thought supply were inelastic, then we would expect this leftward shift of the demand curve to push prices down sharply. But this is not what we see in the futures market. Futures prices did not change much, which is what you would expect if supply were highly elastic.

I want to emphasize two caveats. First, the timing. These futures markets provide information only for the next couple of years. The pause is affecting facilities that could have begun operating during this period. The Calcasieu Pass 2 project, for example, which is caught under the pause, was expected to begin operations in the second quarter of 2025. Moreover, markets are linked across time through storage and production decisions, so it would be unusual, for example, to see no change for 2027 and then large impacts in future years. Still, one could argue that consumer impacts are indeed coming, but that they won’t arrive until the end of the decade.

Second, it could simply be that the market doesn’t believe the pause will hold up. At a Senate Hearing February 8th, Senator Murkowski guessed that the DOE review will, “conveniently not be concluded prior to the election”. But it could well be that market participants expect an LNG “unpause” shortly after the election. I am an economist, not a political scientist, so I won’t speculate about this except to say that this alternative explanation would fit the data from the futures markets.

The evidence here is not airtight. But I do think it is suggestive. The lack of a change in the futures market suggests to me that, regardless of what happens with the LNG pause, the impact for U.S. natural gas consumers is likely to be pretty modest over the next several years.

—

Follow us on Bluesky and LinkedIn, as well as subscribe to our email list to keep up with future content and announcements.

Suggested citation: Davis, Lucas. “What Can Futures Markets Tell Us About Biden’s LNG Pause?” Energy Institute Blog, UC Berkeley, February 12, 2024, https://energyathaas.wordpress.com/2024/02/12/what-can-futures-markets-tell-us-about-bidens-lng-pause/

Categories

Lucas Davis View All

Lucas Davis is the Jeffrey A. Jacobs Distinguished Professor in Business and Technology at the Haas School of Business at the University of California, Berkeley. He is a Faculty Affiliate at the Energy Institute at Haas, a coeditor at the American Economic Journal: Economic Policy, and a Research Associate at the National Bureau of Economic Research. He received a BA from Amherst College and a PhD in Economics from the University of Wisconsin. His research focuses on energy and environmental markets, and in particular, on electricity and natural gas regulation, pricing in competitive and non-competitive markets, and the economic and business impacts of environmental policy.

I wouldn’t read too much into these nearer-term contract prices yet. The market may very well be waiting to see if the pause becomes a moratorium. And it is likely the market assumes that projects under construction will eventually get their permits.

But this could freeze planning on projects earlier in the development cycle, which would eventually manifest in outer-year contracts, where there is not much trading activity.

It’s ironic to recall of the intense efforts during the Schwarzenegger Administration to build at least one LNG import terminal based on projected NG shortages in California. Then came fracking and other “unconventional” oil and gas extraction methods and the precipitous decline in NG prices. That was not anticpated when California’s RPS was enacted in 2002. Between 2004 and 2009, 22 more states (and DC) ennacted mandatory RPS targets that had to contend with the much lower NG prices. Thanks to Obama and Steven Chu — and yes, then VP Joe Biden — for that $90B investment in sustainable energy in 2009 in the ARRA. Sustainable energy had to play catch up — but it did over the next decade. Alternative energy passed coal and nuclear as an electricity source in the U.S. a couple years ago. It will be interesting to see if the Biden’s IRA investments, now augmented by this LNG export freeze, will help alternative energy catch and pass NG as an electricity source. That’s a daunting challenge, but hopefully it’s incrementally achievable. (I know: we don’t have the luxury incrementalism;-)

Some of you reading this blog don’t believe that we are at the beginning of a climate catastrophe. Others of you act as if it is not not their concern or that it’s not a big deal.

You will belive any economist that says that this climate buhaha is going to cost you monay. But you won’t believe hundreds of the world’s reknowned climate scientist.

Some put it very simple: If we don’t do something, it’s going to be worse than anything any human has ever seen.. If we only do a little, it’s going to be very very bad.

How bad? Like, all-of-your-assets-are-going-to-be-worthless bad.

This article is a discussion about how many angles are on the head of a pin (ans. 360)

How about a serious discussion on what we can do to mitigate climate change and then convince the powers that be to do them?

LNG exports are a timely topic given the spurt in new articles and political commentary. I do not believe that you’ve made a case that “think this tells us that the supply of natural gas is highly elastic.” However, you can make a case that the natural gas futures market is highly elastic, particularly near term prices. Moreover, term markets react to prices in the near term–high near term prices move midterm prices higher and vice versa. Therefore the relatively low prices the market is setting for 2025-2026-2027 reflects the very low prices that market is signaling in the near term. Of further note is the fact that much of the recent production growth has been associated gas, which is driven by crude oil economics.