When Did Environmentalists Stop Hugging Trees?

If a cap is not really a cap, what does that make an offset?

Even though the Biden administration has made it very clear that they do not want to even talk about a carbon tax or cap-and-trade program as part of their current climate strategy, debates over the role of these “market-based” policies keep emerging. The latest policy instrument in the news recently has been the carbon “offset.” Traditionally, offsets have been deployed as “alternative compliance mechanisms” for emissions caps. The idea is that firms that are regulated under caps can pay firms who are not capped – because they are in an unregulated industry, or are in another state or country – to reduce their carbon emissions instead. The theory is simple. If we want to reduce GHG emissions at lowest cost, why force costly reductions from capped company A when uncapped company B can do it for half the cost?

Generally, offsets are the environmental policy that environmentalists love to hate. Offsets seem to combine all of the negative stereotypes of market-based environmental policies in one package. Buying your way out of having to reduce your own pollution? Yep! Paying someone else to do stuff they maybe should have to do anyway? Sure! Allowing companies from [insert your location here] to pay to reduce pollution in [insert some other location here]? Bingo!

Generally, offsets are the environmental policy that environmentalists love to hate. Offsets seem to combine all of the negative stereotypes of market-based environmental policies in one package. Buying your way out of having to reduce your own pollution? Yep! Paying someone else to do stuff they maybe should have to do anyway? Sure! Allowing companies from [insert your location here] to pay to reduce pollution in [insert some other location here]? Bingo!

The newest wrinkle in the offset world is Climate Vault, a new company with a new (old) take on offsets. They will operate in the voluntary offset space. But instead of paying for some kind of carbon-reducing project, the main strategy of Climate Vault is to buy up, and then retire, the official allowances that form the “currency” of any cap-and-trade program. Under a classic cap-and-trade program, every ton of pollution from a regulated industry needs to acquire an official allowance, so reducing the number of allowances in circulation would reduce the amount of pollution from regulated industries.

By going straight for the official allowances, Climate Vault is avoiding a lot of the baggage normally associated with offsets. There are no arguments over whether trees will be cut down later, or if those clean energy projects in China would have been built anyway. In a setting with a “pure” emissions cap, retiring one allowance would force the equivalent reduction from a local, regulated source.

So then I must be a big fan of Climate Vault’s idea? Not exactly. Both proponents and critics of offsets, in any form, are stuck arguing over the wrong paradigm. They use language and arguments that imply that GHG caps like those in California or Europe are “pure” caps. But they are not. Not even close. No matter how many times we point out that California’s cap is not really a cap, many people continue to act like it is.

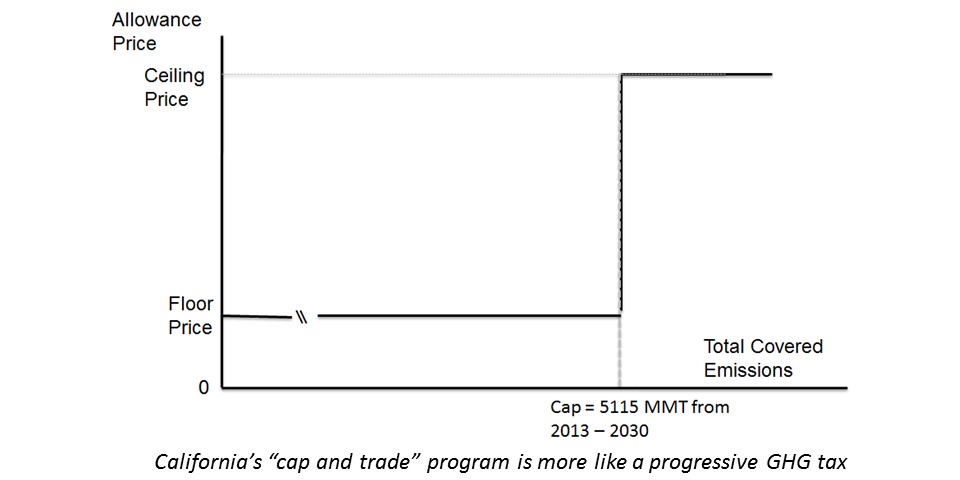

But I’ll say it again, the cap is not really a cap. The quantity of carbon allowances put in circulation by the Air Resources Board (and therefore the quantity of carbon emissions) is a function of the allowance price. It is similar in Europe, just way more complicated. When the price is too low, allowances are withheld from the market. When the price is too high, more allowances are made available. The 2017 law extending California’s cap-and-trade program committed the ARB to limit how high the allowance price would go, meaning that it is the price, not the quantity, of carbon that is truly “capped.”

It is instructive to instead think of GHG markets in California, and to a lesser extent Europe and RGGI in the US northeast, as kind of like progressive carbon taxes. They are taxes in the sense that emissions caps are enforced with a financial penalty for emitting carbon and not having an allowance. You could have a “cap” on street parking of five minutes, but when the fine for the violation is $4 an hour, then it’s essentially a fee. The taxes are progressive in the sense that the tax rate increases as the quantity of economy-wide carbon emissions increases. At low quantities of (aggregate) carbon emissions, the price (tax rate) is lower, at higher quantities, the price (tax rate) is higher. But “price collars” are in place to ensure that the tax rate is neither too low nor too high.

If one thinks of these markets as effectively dynamically adjusted carbon taxes, and I think we should, then what does that make an offset? Traditional offsets, like those for forest preservation, are essentially carbon “tax credits.” Instead of paying the carbon tax, you make a donation to a renewable energy project or to preserve a forest, and your tax bill goes down by the price of an allowance. Sounds crazy? Firms that buy into a renewable energy startup get income tax credits. Even buying a car can get you a $7,500 Federal Income tax credit. And don’t even get me started on residential rooftop solar.

If one thinks of these markets as effectively dynamically adjusted carbon taxes, and I think we should, then what does that make an offset? Traditional offsets, like those for forest preservation, are essentially carbon “tax credits.” Instead of paying the carbon tax, you make a donation to a renewable energy project or to preserve a forest, and your tax bill goes down by the price of an allowance. Sounds crazy? Firms that buy into a renewable energy startup get income tax credits. Even buying a car can get you a $7,500 Federal Income tax credit. And don’t even get me started on residential rooftop solar.

Donations to the Nature Conservancy, which buys up and “vaults” natural lands, have been deductible from income taxes for years. To my knowledge, this didn’t spark much outrage as a tax dodge. More recently they started selling carbon offsets for similar activities, and now they are drawing fire over questions of additionality. These are voluntary offsets that do not even impact formal cap-and-trade programs. My point is not that we should ignore the question of additionality, but rather that it takes on a whole different meaning if we think of these programs as taxation, let alone as voluntary contributions.

The problem with Climate Vault’s business model becomes clear when one engages in the “cap is really a tax” thought exercise. Say someone gives money to Climate Vault, and CV turns around and buys California allowances with the money. Most likely, one of two things will happen. The California carbon price might be at its floor, in which case ClimateVault will purchase and retire an allowance that would have otherwise been withheld from the market by the ARB anyway. Or, the California carbon price might be at its ceiling, in which case Climate Vault will purchase and retire an allowance out of the ARB’s containment reserve which, you guessed it, would otherwise have been withheld from the market by the ARB. In other words, carbon emissions do not change and the money given to Climate Vault is converted into a donation to California’s carbon revenues. Thanks!

The problem with Climate Vault’s business model becomes clear when one engages in the “cap is really a tax” thought exercise. Say someone gives money to Climate Vault, and CV turns around and buys California allowances with the money. Most likely, one of two things will happen. The California carbon price might be at its floor, in which case ClimateVault will purchase and retire an allowance that would have otherwise been withheld from the market by the ARB anyway. Or, the California carbon price might be at its ceiling, in which case Climate Vault will purchase and retire an allowance out of the ARB’s containment reserve which, you guessed it, would otherwise have been withheld from the market by the ARB. In other words, carbon emissions do not change and the money given to Climate Vault is converted into a donation to California’s carbon revenues. Thanks!

To be fair, I am oversimplifying the dynamics of price-collars in these markets. While California’s carbon market has often cleared at the price floor it doesn’t always. However, my work with Severin Borenstein, Frank Wolak and Matt Zaragoza-Watkins, suggests that over the long run, a system like California’s will settle in at either a floor or ceiling price. In this system, retiring permits does not do nothing. Removing allowances from circulation raises the odds that the carbon price will settle in at the price-ceiling, or higher “tax-rate,” rather than at the price floor. So there is an effect, but it is likely an effect on the price of carbon. I’m not sure about the appeal of the slogan “do your part to help raise marginal carbon tax rates.”

This brings us to an underappreciated point about offsets (the traditional kind), which is that they aren’t just about reducing emissions. We don’t justify the tax deductibility of charitable contributions because we think they could reduce the need for government spending (although they might). We do it because it provides an incentive to support “good” works. The idea behind offsets is that they could help fund worthwhile energy and ecosystem management projects, sometimes in developing countries, that are deserving of support in their own right. Providing some regulatory relief to the source of the funding gives an incentive to make those investments. The fact that they may not yield exactly the amount of true carbon reductions that they are nominally “offsetting” should be balanced against the other benefits those investments could produce. That is why the original offset program was called the clean development mechanism. A lot of its supporters were as interested in the development part as the clean part.

This is why I never fully understood the high level of moral outrage created by offsets, relative to say, the tax deductibility of donations to the nature conservancy, or the fact that the Low Carbon Fuel Standard program appears to be awarding massively more credits for residential EV charging than the data support. We are willing to accept mismeasurement or imperfections when it results in support for projects or technologies society deems worth supporting.

This is how we should think about the appeal (or lack thereof) of traditional offsets. Maybe those “other” benefits are worth it. Maybe these projects will stimulate learning-by-doing, or start communities on a sustainable development path, maybe not. Clearly some offset projects were not worthwhile. The better run oversight programs have hopefully learned to weed these out. It is worth having those debates. However, a debate that begins and ends with whether an offset violates the integrity of “the cap” is just wasting breath. The cap is not really a cap.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas.

Suggested citation: Bushnell, James. “When Did Environmentalists Stop Hugging Trees?” Energy Institute Blog, UC Berkeley, June 7, 2021, https://energyathaas.wordpress.com/2021/06/07/when-did-environmentalists-stop-hugging-trees/

Categories

Modern environmentalists, if they deserve the title “environmentalist”, remain too in love with trees. While felling of old growth and mature forests ought to be prohibited, frankly, the only way young growth forest sequesters Carbon is if it is cut for lumber, and the lumber is used in structures which persist for a hundred or two years.

Facts are we’ve allowed greenhouse gas emissions to go on for so long in such intensity that dramatic measures are now required, and this is going to demand ecological triage. Otherwise, if we don’t, the ecological damage, and direct damage to flora and fauna is going to be horrific, well more than the transformation of ecosystems which accompanies conversion of farmland to either sole- or dual-use with solar PV, or wind (which has a long history of coexisting with farmlands), and accepting the felling of short term growth forests.

Indeed, many of those who suddenly espouse “environmental values” are suburbanites who consume lots of electricity and will consume a good deal more once necessary electrification is advanced, and simply don’t want their favorite walking woods disrupted in fact or in scenery. It’s not an ecological tradeoff, it’s a Walt Whitmanesque emotional response to a bunch of greenery. Modern environmentalists are for the most part innumerate, and act based upon tents which they think of as moral principles and ideals, but are no more than tribal agreements of belonging: Shun all plastic, preserve all trees, we should cut back our use of electricity rather than build out zero Carbon generation to meet it, ride bicycles instead of cars, etc. Each of these deny any tradeoff or balance or quantitative consideration.

As a consequence, reducing emissions is not at all the objective of modern environmentalists. They are laying on top of that necessary project many side conditions, constraints, and occasionally (like shunning all plastics) principles which increase emissions not decrease them.

I am no supporter of nuclear power or of “albedo hacking”, that is, solar radiation management. But clueless support of uninformed feel good policies is going to drive societies to desperation and those are some of the objects, particularly the latter. We need to move fast, and there are enough obstacles in the way from fossil fuel enthusiasts, big engineer gearheads, and other Carbon worshippers. To have people who are supposedly informed about climate disruption and the climate emergency also erect impediments is not only discouraging, it very likely will cause the project of drastically reducing emissions to fail.

Logging of old growth forecasts is not necessarily the best strategy here.

https://news.mongabay.com/2019/05/tall-and-old-or-dense-and-young-which-kind-of-forest-is-better-for-the-climate/

I apparently was not clear enough. What I wrote was

[T]he only way young growth forest sequesters Carbon is if it is cut for lumber, and the lumber is used in structures which persist for a hundred or two years.

The implication is that if the idea is to allow young growth to eventually develop into old growth so it sequesters Carbon it needs to be left alone. That means no hiking through it, no disturbance at the edges, etc. If it is disturbed or will be disturbed in some way, then it might be pretty but it won’t sequester. About 40% of the Carbon in an old growth forest is in the biomass, the rest is in soils, held there by mycorrhizae. Young growth forest hasn’t a rich set of suitable mycorrhizoidal fungi. Indeed, there’s some evidence that, depending upon what the land was used for before the young growth came back, this soil sequestration might not come back for a very long time. See

Tatsumi, Shinichi, Shunsuke Matsuoka, Saori Fujii, Kobayashi Makoto, Takashi Osono, Forest Isbell, and Akira S. Mori. "Prolonged impacts of past agriculture and ungulate overabundance on soil fungal communities in restored forests." Environmental DNA (2021).Most trees in young growth forests die, fall over, and give back their Carbon to atmosphere.

It’s a really tough question (not really asked by this blog), where will the cash come from to incentivize negative emissions at scale. My guess is Climate Vault has found some low hanging fruit and messaging that hits a nerve, but this type of approach won’t work at the national scale needed to meet our 2030 and 2050 emissions reduction targets, as long as we’re only working with California offset markets. It would be nice to start getting proactively aligned with environmental groups – where will the cash come from???

https://www.canarymedia.com/articles/to-meet-bidens-new-climate-goal-we-need-forests-and-farms-to-sequester-a-lot-more-carbon/

This analysis relies on a very important premise buried half way down in the post: that the supply curve of emission reductions is “bang-bang”–first its extremely elastic and then suddenly its extremely inelastic and the allowance price will ride at either the floor or ceiling. This is an untested hypothesis that relies on what is fairly hidden data–the actual distribution of prospective cost reduction measures. This may be true, and our experience with other environmental commodity markets such as ERCs, RECLAIM and water transfers tell us different stories that neither confirm nor deny this hypothesis. However, I think being upfront about the reliance on this hypothesis is mportant.

Otherwise, cap and trade should work largely like a carbon tax, as the various papers in environmental economics point out. The difference is whether the price is controlled directly to get at a quantity target, or controlled indireclty through the quantity target. (There’s other secondary issues such as implementation that I’ll ignore). Regardless taking allowances out of the market should eventually accelerate the time that the allowance price rises, even if its to the ceiling. So it might look like it’s having no effect today, but it should have an effect “tomorrow.”

I always thought that the main problem with offsets was leakage — you plant or save tree in once place, capturing carbon cheaply, and then ignore the fact that this implicitly causes trees to be cut down somewhere else, possibly far, far away, possibly outside of California, or even the United States. This happens through supply and demand of connected markets for timber, land, and other commodities. It’s likely impossible to measure. It’s unclear whether offsets have really offset much of anything in aggregate.

On a different note, I didn’t realize offsets were something environmentalists didn’t like.

Perhaps I should have said, “environmental journalists love to hate”

A good post! Thank you 😊

The Washington Climate Commitment Act, just passed and not yet implemented, differs from the California scheme in one very important way: any offsets used automatically reduce the number of allowances issued.

In theory this should mean that the carbon cap really is a cap. We’ll see what happens when the implementing rules are drawn up.

https://www.seattletimes.com/seattle-news/washington-states-carbon-pricing-bill-could-be-most-far-reaching-in-nation-so-how-will-it-work/

As they intend to have market stability measures in place (as far as I know), I think the argument – that the cap is not really a cap – still holds.