The High Cost of Nuclear Jobs

Backers see job creation, but I see high costs for ratepayers.

“The project workforce has reached an all-time high with approximately 9,000 workers now on site. With more than 800 permanent jobs available once the units begin operating, Vogtle 3 & 4 is currently the largest jobs-producing construction project in the state of Georgia.” — Georgia Power, Press Release, February 11, 2020.

I understand why Georgia Power is emphasizing the jobs created by the Vogtle nuclear power plant project. Many policymakers, and perhaps even some utility commissioners, view these jobs as a significant benefit. I’m happy for the workers who are employed on this impressive project.

But when I see 9,000 workers on site, and 800 permanent jobs, I don’t see job creation. I see high costs for ratepayers. Electricity bills are already going up to pay for Vogtle.

These higher electricity rates hurt households, particularly lower-income households for whom bills are a larger share of the household budget. Higher electric rates also hurt small- and medium-sized companies and lead energy-intensive companies to move elsewhere.

The broader point is that counting jobs created in one sector misses the overall impact. Promoting labor-intensive energy sources makes energy more expensive if they aren’t cost effective, which leads to lost jobs in other sectors. Energy is an input into almost everything, so making it more expensive hurts the economy and reduces growth.

Not the Time for Economic Stimulus

During a recession, many economists will argue for short-term Keynesian-style economic stimulus. There are times when this makes sense, but now is not one of those times. Despite the recent volatility in the stock market and virus-related uncertainty, the United States is not in a recession. Friday’s job report showed a national unemployment rate of only 3.5%. In Georgia, it is even lower.

What this means is that Vogtle is not creating many jobs. If it weren’t for the Vogtle project, the vast majority of these talented people would be working elsewhere in the economy. They would be somewhere else, doing some other job, creating value in another industry. When we employ workers in one place, we give up the gains we would have enjoyed from them working elsewhere. This is the opportunity cost of labor, and during good economic times, the opportunity cost is high.

There is also a fundamental mismatch between multi-year projects like this and fiscal stimulus. For fiscal stimulus you need jobs that can be quickly deployed at the right moment, and then pulled back when the economy starts to recover. Nuclear projects aren’t like that.

Unusually Labor-Intensive

Perhaps I’m being unfair in singling out nuclear. There is a tendency across energy sectors to talk about job creation. Not coincidentally, job creation tends to be discussed more often in relatively labor-intensive sectors (like rooftop solar and weatherization), than in less labor-intensive sectors (like grid-scale renewables).

But the labor costs for nuclear are striking. The sheer scale and complexity of the Vogtle project requires an unusually large labor force, many of them highly-skilled, highly-specialized engineers. These high labor costs are one of the reasons why it costs so much to build a nuclear power plant.

Perhaps even more striking are the ongoing labor costs. Georgia Power anticipates 800 permanent jobs at Vogtle once the new units are operational. A natural gas combined cycle plant of similar generation capacity would employ less than 100. That is a big difference. Nuclear power is not only capital-intensive, but it is also labor-intensive.

What About The Future?

Can we view the Vogtle project as an investment in human capital? Will the skills learned on the job at Vogtle position U.S. workers on the vanguard of a growing market? Could this investment be a way of moving the entire economy to a different equilibrium path?

Maybe, but I doubt it. The Bureau of Labor Statistics doesn’t see bright prospects for U.S. nuclear engineers. There are dozens of nuclear reactors currently under construction worldwide, but only Vogtle 3 & 4 in the United States, and it’s not clear whether U.S. workers and U.S. firms will be able to leverage their experience at Vogtle to join these international projects.

It seems more likely that the primary legacy of Vogtle will be higher electricity rates. Ratepayers will be paying for this $25+ billion project for a very long time. Higher electricity rates will raise the cost of doing business for everyone, leading to fewer jobs throughout the economy. Just because it is harder to point to these jobs in a press release doesn’t mean they are any less real.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas.

Suggested citation: Davis, Lucas. “The High Cost of Nuclear Jobs” Energy Institute Blog, UC Berkeley, March 9, 2020, https://energyathaas.wordpress.com/2020/03/09/the-high-cost-of-nuclear-jobs/

Categories

Lucas Davis View All

Lucas Davis is the Jeffrey A. Jacobs Distinguished Professor in Business and Technology at the Haas School of Business at the University of California, Berkeley. He is a Faculty Affiliate at the Energy Institute at Haas, a coeditor at the American Economic Journal: Economic Policy, and a Research Associate at the National Bureau of Economic Research. He received a BA from Amherst College and a PhD in Economics from the University of Wisconsin. His research focuses on energy and environmental markets, and in particular, on electricity and natural gas regulation, pricing in competitive and non-competitive markets, and the economic and business impacts of environmental policy.

Thanks for the illuminating discussion.

I’d like people to consider the fact that the nuclear plants were designed in the 1960’s, prior to the invention of the transistor, or any kind of reliable automation. Or any kind of sophisticated modeling. Or CAD or CAM. Or today’s materials.

When we design a 2020 nuclear plant, starting with a blank Solidworks file, the numbers you are relying on, all go away.

Imagine if we argued about the Solar and wind of 1964 instead of today’s? Solar and wind didn’t work at all in those days. They are good and constantly getting better. We have learned to bank on in.

Over-regulation of the nuclear industry, especially the complete embargo of consenting test sites or fuel to startups, has left us without any modern tech numbers to extrapolate from.

The prophets known as Economist’s write off technological evolution so they can defend 30 year business plans. In reality, we haven’t a clue what tech we will have in 30 years. Betting against innovation is not safe.

Nuclear tech innovation will happen. The US doesn’t lead anymore. China, South Korea and even Russia are allowing innovation in nuclear.

Nuclear will get better and keep doing so. Hollywood anti-vaxers and Gas industry tycoons won’t be able to stop the whole world from advancing as USA leadership exits stage left and stage right.

The problem is that nuclear produces energy from fuel one million times more efficiently than fossil fuels can. No industry will voluntarily tolerate declining profits. Oil’s main problem is the oversupply that drives profits to zero whenever the cartels and govt subsidies miss a beat. Nuclear’s problem is one million times worse. How do you make money in a supply and demand world, if you can only sell each person 2 kg of Uranium (at the price of silver) in their lifetime? Done properly (eg:DeepIsolation.com) waste disposal is even cheaper. And if you spend a couple more years in the design studio, you can use Thorium, at the price of Lead, in place of Uranium.

This economic question is how do you get the “industry” that wants to live off of selling people energy, out of the way of people getting clean cheap energy?

In Abraham Lincoln’s America the big obstacle to freeing the slaves was how much the govt would pay the “property owners” for “taking” “their” slaves. Ironic and wrong as it seems today, they came up with a number and paid it.

Maybe we should have a conversation with the Sovereign oil producers and companies about how they can pivot to a sustainable business and get their knee off our necks.

My dream would be to buy a lot more energy, at a lower price, protecting the industry. We need to clean up ALL pollution in a perfect way, and we can, even with existing technology. It seems too expensive now… but if we drop the price of energy just one order of magnitude we can clean up greenhouse gasses, erosion, sprawl, wastelands, biohazard, nitrogen, phosphorous, overfishing, fugitive plastics…. and it won’t be expensive.

We know that American’s want nuclear power, and aren’t afraid of the word. (Source: EcoAmerica’s annual surveys. https://ecoamerica.org/american-climate-perspectives-survey-2019-vol-vi/ )

People do want Cost, waste, and safety in spec, but we have known how to do that since JFK was President and started Oak Ridge’s MSRE. We have been short on leadership, but leadership is a renewable resource.

If we don’t ask for what we need, we won’t get it!

The rest of the world has advanced its technology, and its costs have not declined, and even risen. There have been numerous studies posted in the comments on this site showing that 1) nuclear costs seem to be immune to the usual technological innovation trends with costs actually rising with increased global capacity and 2) average costs remain at about $100/MWH globally. Maybe there’s a breakthrough awaiting us, but we’ve been promised numerous such breakthroughs that have never appeared.

“average costs remain at about $100/MWH globally…”

Who cares if the U.S. is pumping up the average cost of nuclear? That’s the point. The Chinese are less tolerant of spurious lawsuits and stonewalling regulatory policy.

“Six Chinese-designed 1000 MW reactors at Yangjiang will be a huge nuclear power base for China General Nuclear, and will cost only US$11.5 billion for over 6000 MWe, a third of the cost in western countries…”

China Shows How to Build Nuclear Reactors Fast and Cheap

https://www.forbes.com/sites/jamesconca/2015/10/22/china-shows-how-to-build-nuclear-reactors-fast-and-cheap/

“we’ve been promised numerous such breakthroughs that have never appeared…”

“In 20 years, 20% of U.S. energy will come from the sun…”

Still waiting for the breakthrough Jimmy Carter promised us in 1979.

The average is from global nuclear construction costs which have very few US plants. BTW, solar costs are also proportionately lower in the developing world than in the US as well, so you need to make the comparisons on a nation by nation basis.

How about from Lewis Strauss, NRC Chair in 1954: nuclear power will be “too cheap to be metered, just as we have water today that’s too cheap to be metered.” You can find one statement about solar from 40 years ago. We have many instances, including SMRs from 15 years ago, Diablo being budgeted at $500M in 1969 and costing more than $5B, and the “promise” of nuclear fusion. There are so many failures in the nuclear industry that it’s hard to find any true successes.

Diablo Canyon Power Plant is already a true success: since 1985, DCPP has delivered 630 TWh of carbon-free electricity on a capital investment of 1.26¢/kWh, with at least 45 years of life left on the plant.

“…you need to make the comparisons on a nation by nation basis.”

Good! Let’s compare Diablo Canyon to Topaz Solar Farm. Over its 30 years of total lifetime, Topaz will deliver 39 TWh of electricity on a capital investment of $2.2 billion, or 5.6¢/kWh.

Based on capital costs for the first 30 years, solar electricity is 4.4 times that of nuclear. Its total lifetime cost is 8.8 times that of nuclear.

If you want to get into O&M costs, including replacing 6 square miles of solar panels, including natural gas backup, negative pricing, ancillary services – nuclear blows solar away. But you didn’t want to get into that, did you?

BTW, Topaz is an example of a poorly negotiated PPA that created this legacy problem where early renewables are very expensive compared to the current technology. Thanks to AB 57 and the CPUC’s bulloxed implementation, IOU shareholders had NO incentives for cost containment and even had an incentive to overbuy renewables no matter what the price. This is a clear example of regulatory failure.

“There are so many failures in the nuclear industry that it’s hard to find any true successes.”

Richard, that’s not true.

Many of the existing and retired nuclear plants, even those that incurred substantial cost overruns, recouped those costs through the savings gained from many years of displacing generation from fossil fueled plants – particularly gas-fired plants. Natural gas was not always as cheap as it is today.

I was talking about the technological and economic promises. That gas has even been competitive as a baseload resource was supposed to never be in question, yet as you point out, gas has often been cheaper.

So it took a $61 million bribe to convince the Ohio legislature to subsidize nuclear power: https://www.utilitydive.com/news/firstenergy-share-price-plummets-following-subpoena-in-61m-racketeering-br/582160/

Edison/Sempra got San Onofre’s shutdown done for only $25 million –

https://www.sandiegouniontribune.com/news/watchdog/sdut-ucla-peevey-25-million-2015may05-htmlstory.html

but California had a governor with everything to gain.

Jerry Brown’s Secret War on Clean Energy

https://environmentalprogress.org/big-news/2018/1/11/jerry-browns-secret-war-on-clean-energy

“So it took a $61 million bribe to convince the Ohio legislature to subsidize nuclear power….”

I just saw this comment. Richard, this is a cheap shot and I think you are intelligent enough to know that.

Regardless of the bribes involved (which is contemptible) the idea of providing limited support to keep the Ohio nuclear plants in service is good policy. Even the Ohio Governor made this point – before he changed his tune to score political points.

Providing nuclear plants with Zero Emissions Credits (ZECs) is no more a “subsidy” than the Production Tax Credit that wind farms get, or the 30 percent investment tax credit that solar facilities get. I’m not familiar with the details of how the ZECs were calculated in Ohio but generally they are determined by the value of the CO2 emissions avoided due to the nuclear generation. In New York the ZECs are determined by multiplying the avoided CO2 emissions by the Social Cost of Carbon.

The opponents of ZECs rant about how they increase in consumers’ electric bills but remain silent about how much higher those electric bills will be if the nuclear plants are retired, which will result in plants with higher marginal costs running more and setting higher market energy prices in more hours. Those price increases will be paid by all consumers. This is an example of the well-known DRIPE effect, which the Greenies love to trot out to justify energy efficiency and renewable energy investments even though it produces no societal benefit.

So Richard, do you oppose rewarding generators for producing emissions-free energy?

Bob, HB 6 repealed Ohio’s Renewable Portfolio Standard (RPS), which after eleven years and a cost to ratepayers in the $billions, increased the penetration of solar and wind by a whopping 3%. Not surprising, given the CFs for solar and wind in Ohio are abominable.

The CF of Perry Nuclear Power Plant is 89%, higher than any solar or wind plant in the world; the CF of Davis-Besse is 100.57%. “Over 100%? How can a power plant possibly generate more power than its maximum capacity would allow?”, you might ask. Davis-Besse, unlike the aging rustbucket it’s portrayed as in anti-nuclear lore, generates even more power than when it opened half a century ago thanks to improvements in equipment and its operating system – even with downtime for refueling factored in.

So Ohio lawmakers afforded all zero-carbon producers a zero-emission credit, solar and wind included, based on EPA’s Social Cost of Carbon. But because solar developers were no longer allowed to double-count their clean generation using Solar Energy Credits (SECs), they cried foul. Why? Because solar can’t compete on a level playing field, and never will.

I agree, that Larry Householder used his non-profit as a personal slush fund is contemptible. I have no idea why they’ve indicted the lobbyists; if you think the American Petroleum Institute wasn’t lobbying Ohio Democrats to shut Perry and Davis-Besse down, you don’t know Ohio politics. Even if HB 6 is repealed the ZEC stays put – it’s still supported by Gov. DeWine and a majority in both houses, and Ohio’s RPS is toast. But we already knew that.

I oppose subsidizing an extremely expensive technology that shows no signs of ever being able to stand by itself financially without subsidies. Solar and wind are now at that point and we can see a point where those technologies won’t need subsidies (at least not beyond what all other technologies are getting already).

And the fact is that it did take a $61M bribe. That’s a fact, not a cheap shot.

“I oppose subsidizing an extremely expensive technology that shows no signs of ever being able to stand by itself financially without subsidies. Solar and wind are now at that point and we can see a point where those technologies won’t need subsidies (at least not beyond what all other technologies are getting already).

And the fact is that it did take a $61M bribe. That’s a fact, not a cheap shot.”

Richard,

Solar and wind deserve a side payment equal to the value of the GHG and other emissions avoided by their energy displacing that produced with fossil fuels. Such a payment is not a subsidy; it is a vehicle for internalizing the external benefits. But the same argument applies to new and existing nuclear power plants and is the basis for providing them with ZEC payments.

And, yes, your comment is a cheap shot, even if you didn’t intend it to be so. Presenting a fact that besmirches something that, in and of itself, provides a societal good is a cheap shot.

I disagree that it provides a social benefit commensurate with its exorbitant cost. Therefore it’s not a cheap shot. Again, I presented a fact that showed that it took a massive bribe to provide that excessive subsidy.

What is exorbitant about the ZEC cost? Do you believe that paying several cents per kWh is too high a price for eliminating CO2 emissions at an equivalent price of $40 per Ton?

For Diablo Canyon it would be close to $70/MWH.

We appear to be talking past each other. I never mentioned Diablo Canyon in my question.

Diablo Canyon is my reference point because this blog is mostly about California

More importantly, are you trying to justify a $62M bribe?

For Diablo Canyon it would be close to $70/MWH…”

That would be laughable, if an analyst wasn’t being paid to pad its cost so owner PG&E can justify plowing the plant into the ground:

“Programs in Illinois, New York, New Jersey, and Ohio show ZEC prices ranging from $10.00/MWh to $17.50/MWh”.

https://www.eia.gov/todayinenergy/detail.php?id=41534

A pittance compared to the cost of California’s RPS – and it’s rumored Entergy has expressed interest in buying Diablo Canyon, should a ZEC in California come to pass. A sale would allow PG&E to provide ~$5 billion to help wildfire victims instead of hiking customers’ rates even higher. But that would upset the utility’s master plan to replace it with gas, wouldn’t it?

RECs in California cost about $16-$17/MWH based on the public data reported by the CPUC Energy Division, so in the same area at the the ZECs.

A ZEC for nuclear isn’t happening in California as that would likely require a change in state law.

I suspect that all of us would be more comfortable with a carbon tax providing the “bonus” for non-carbon resources, treating wind, solar, energy efficiency, nuclear, geothermal, and smart rate design to compete fairly. Ohio did not choose that path. Instead they chose a path that subsidizes SOME technologies, but eviscerated their energy efficiency programs, which provided clean energy at a much lower cost.

Remember that efficiency displaces not only the energy and capacity measured at the meter, but also all of the line losses and reserves needed upstream of the meter to ensure reliable service. That can be almost 50% at peak hours. See Valuing the Contribution of EE to Avoided Marginal Line Losses http://www.raponline.org/document/download/id/4537 In addition, there are many non-energy benefits from energy efficiency that wind, solar, and nuclear do not provide, including health, local economic development, and reliability benefits. See Recognizing the Full Value of Energy Efficiency http://www.raponline.org/document/download/id/6739

One would think that keeping an existing nuclear plant operating would be a good deal. Unfortunately, particularly for a single unit plant (no economies of scale in site management), that appears to be incorrect.

We have a nuclear plant still operating in the Pacific Northwest, the Columbia Generating Station (previously known as WPPSS #2) which has variable operating costs about two-times the market clearing price for energy at Mid-C. It is severely compounding the BPA financial condition, by about $200 million per year. In the past ten years, there have been only a few months when the power from CGS was more valuable than the operation and maintenance costs, plus capital additions, needed to keep it running. In only one short period (the West Cost Power Crisis of 2000-2001) was the power worth more than the AVERAGE total cost (including capital). At times, the operation of CGS clogs the market with power, forcing BPA to curtail wind turbines. And this on a system with 30,000 MW of fairly flexible hydropower. It would be worse on a system with fewer flexible generating units.

BPA is chicken under the current federal administration to take it down. That may change in late January.

There may be a future nuclear technology that can compete with wind, solar, storage, energy efficiency, demand response, and smart pricing. I don’t rule out future technological changes. But Plant Vogtle is a money pit, at $25 billion, much of it paid by electricity consumers through rates during the construction process, because the financial markets were unwilling to provide traditional project financing (that includes interest during construction).

We’ll see if it runs. The most recent report from the site monitors working for the Commission are not encouraging:

Meanwhile, government staff and monitors wrote that they were “shocked” by an “astounding 80%” failure rate for new components installed at the site. The results meant the components, when tested, “did not initially function properly and required some corrective action(s) to function as designed.”

https://www.ajc.com/news/local/georgia-vogtle-nuclear-report-more-delays-extra-costs-flaws/mBxlgXiDcf0SIaTFr0cZXL/

“…so in the same area at the the ZECs.”

Ah, so a ZEC in California wouldn’t cost $70/MWH, or even “close to $70/MWH”, but something closer to 20% of that figure. Would that be correct in your estimation now?

“A ZEC for nuclear isn’t happening in California as that would likely require a change in state law.”

Like HB 6 in Ohio? Or “The Future Energy Jobs Act” in Illinois, or the “Clean Energy Standard” in New York? I had no idea such a drastic step was required, but not to worry. The next best thing is already in the works:

“Assembly Bill 2898, authored by Assemblyman Jordan Cunningham (R-Paso Robles), would add nuclear power to the California Renewables Portfolio Standard Program. This would redefine nuclear power as a renewable energy source and would give PG&E an additional resource in meeting renewable energy goals. Another company could also theoretically buy it and use it as their own renewable source.”

New Assembly Bill Could Save Diablo Canyon Nuclear Power Plant

https://californiaglobe.com/section-2/new-assembly-bill-could-save-diablo-canyon-nuclear-power-plant/

Let’s assume a California ZEC would cost $16.50/MWH – in the same neighborhood as RECs do currently.* But RECs in California, like other states and unlike ZECs, allow gas-fired electricity generators to buy credit from solar and wind farms to magically scrub carbon they’ve already emitted from the air. Like indulgences in the Catholic Church (back when windmills offered more than a tax credit), carbon emitters can buy forgiveness for their sins, thanks to a 2011 CPUC decision, which allows two generators to take credit for the clean-energy contribution of one. Because this sleight-of-hand fraudulently doubles the credit to which both are entitled, a California REC of equivalent value to a ZEC now costs $33/MWH, nearly twice that of the most expensive ZEC.

“…so in the same area at the the ZECs.”

Not even even close.

*Not that I assign much clean-energy credibility to the corrupt California Public Utilities Commission, the commissioners of which were appointed by a man whose early career was financed by bestie / oil heir Gordon Getty.

A GOP bill isn’t happening in the Legislature, not this year, and perhaps not for a long time. Wishful thinking.

Of course $16-17/MWH is in the same area. There may be a difference in fungibility, but the prices remain in the same ballpark. Diablo could not go forward with only a $17/MWH ZEC. That’s now a moot point at the CPUC.

“A GOP bill isn’t happening in the Legislature, not this year, and perhaps not for a long time. Wishful thinking.”

What “GOP bill”? AB 2898 has bipartisan support. Turns out, there are some Democrats in Sacramento understand why prematurely abandoning a plant paid for with $11 billion in customers’ hard-earned cash, and the ensuing $5 billion payoff in decommissioning fees, are not in the best interests of the public. Even Joe Biden understands why keeping Diablo Canyon open is critically important in efforts to fight climate change, and Alexandria Ocasio-Cortez now says her Green New Deal “leaves the door open for nuclear”:

Times, they are a’ changin’.

“Of course $16-17/MWH is in the same area…”

Seems ZECs were in the area of $70/MWH just a few hours ago…

There may be a difference in fungibility, but the prices remain in the same ballpark.”

Fungibility or fraud? Value received for money spent is half of what renewables advocates claim it to be.

“Diablo could not go forward with only a $17/MWH ZEC…”

Another statement for which you have no basis. Though PG&E wants to bury DIablo to sell gas, both Entergy and Berkshire-Hathaway have other ideas.

“That’s now a moot point at the CPUC…”

Who cares what the CPUC, CEC, or local radiophobes think? The premature abandonment of Diablo Canyon and anti-competitive behavior at PG&E aren’t moot points at the Federal Energy Regulatory Commission (FERC), which has ultimate say in the matter. I know that for a fact.

“Diablo could not go forward with only a $17/MWH ZEC…”

Carl, you are correct to challenge this statement.

Firstly, based on the social cost of carbon, the price premium paid for zero-emissions energy should be priced at $25 to $30 per kWh based on a study done for the State of Minnesota by Clean Power Research (Napa CA firm). The ZEC price in New York is lower than this figure because it is adjusted downward to account for the RGGI allowance price, which the nuclear plant also receives.

Would the additional revenue from fully price ZECs make Diablo Canyon economically viable? I don’t know but it seems to be worth exploring. Assuming the going forward cost actually is $70/MWh, the ZEC would reduce the breakeven market price to $40 to $45/MWh. But Diablo Canyon also deserves to be compensated for the capacity it provides.

The CAISO’s Market Monitor’s report for FY2019 states that the annual fixed carrying cost of a gas-fired combustion turbine in California is $140/KW. Subtracting off the net energy revenues earned by a new CT in the SP-15 area reduced the capacity payment to $120/KW. Each KW of Diablo Canyon produces about 8,000 kWh per year so the capacity value adds another $15/MWh. So now the breakeven market price is $25 to $30/kWh.

The 2019 Market Monitor report shows that the average ISO-wide energy price in FY2019 was $41/MWh. While the average annual price in the SP-15 region, where Diablo Canyon is located, is typically somewhat lower than in the NP-15 region, the above calculations raise serious doubts about whether Diablo Canyon should be retired. Perhaps Richard McCann can tell us what is wrong with my (admittedly rough) calculations.

“Who cares what the CPUC, CEC, or local radiophobes think? The premature abandonment of Diablo Canyon and anti-competitive behavior at PG&E aren’t moot points at the Federal Energy Regulatory Commission (FERC), which has ultimate say in the matter.”

Carl, my understanding of the Federal Power Act is that it grants to the states exclusive jurisdiction over all decisions regarding generation. The FERC only has jurisdiction over transmission decisions and the pricing of wholesale energy, i.e., sales for resale.

When I said that Diablo Canyon’s excess cost would be $70/MWH I had already subtracted the market value of $45-$50/MWH. So you are double counting the market value in your calculation. A relicensed DCPP would cost $120/MWH according to PG&E. In that context, the rest of your discussion is irrelevant.

I’ll wait to see if any of your political assessments are correct. Not a great track record so far.

I said that Diablo costs an extra $70/MWH, and that ZECs would be $17/MWH. That’s a $53/MWH gap.

“Assuming the going forward cost actually is $70/MW,..”

Bob if I understand correctly, that’s Richard’s calculation in a hypothetical analysis he performed, for PG&E, to be submitted with their application to shut down the plant. I know from PG&E’s FERC Form 1 filing the cost of generating electricity at Diablo Canyon was $27.10/MWH in 2019, but it’s possible that didn’t include the cost of assembling Richard’s analysis.

The Federal Power Act has been around in various incarnations since 1920. Since the repeal of the Public Utility Holding Company Act in 2005, FERC has played a hodgepodge of roles, including interstate gas pipeline transmission, as well as oversight of anti-competitive behavior in interstate energy holding companies. Whether PG&E conducts interstate business (specifically sales) of electricity, once a matter of contention, is no longer – if any electricity is sold over state lines, all utilities contributing electricity to the CAISO grid at the time are conducting interstate business. Under the Act, PG&E is also required to obtain federal authorization before disposing of any asset worth more than $10 million. Diablo Canyon, by various estimates, is considered to be worth roughly five hundred times that.

There are fraud-related issues involving Renewable Energy Credits (RECs) under review by the Federal Trade Commission as well, which may factor into Diablo Canyon’s future viability in a market where renewables are properly valued.

Robert is correct that FERC authority on asset disposal applies only to hydro and transmission plant. Again, we have shown you both the code and the cases that limit FERC authority. You need to provide examples of other generation assets that are retired gaining FERC approval.

As to PG&E’s going forward cost, its about $45/MWH. It’s total current cost is over $80/MWH including captial recovery that is rolled into PG&E’s current rates. It’s relicensed cost would have been $120/MWH. Your $27/MWH is the fuel only cost and doesn’t include capital additions or staff costs.

I oppose subsidizing an extremely expensive technology that shows no signs of ever being able to stand by itself financially without subsidies. Solar and wind are now at that point and we can see a point where those technologies won’t need subsidies (at least not beyond what all other technologies are getting already).

And the fact is that it did take a $61M bribe. That’s a fact, not a cheap shot. That the speaker was able to persuade the governor is why the company paid the bribe–they got what they paid for. Don’t be so naive as to believe that such a bribe was intended to buy only one vote.

“The opponents of ZECs rant about how they increase in consumers’ electric bills but remain silent about how much higher those electric bills will be if the nuclear plants are retired, which will result in plants with higher marginal costs running more and setting higher market energy prices in more hours. ”

Market prices have little to do with customers’ retail bills. The embedded costs of legacy power plants and the cost of PPAs signed outside of the market exchanges are by far the largest driver of retail rates. That’s why retiring Diablo Canyon will reduce PG&E rates so much in 2025.

“Market prices have little to do with customers’ retail bills. The embedded costs of legacy power plants and the cost of PPAs signed outside of the market exchanges are by far the largest driver of retail rates. That’s why retiring Diablo Canyon will reduce PG&E rates so much in 2025.”

Richard,

We have already had this discussion. Yet you still claim that retail rates are unaffected by wholesale market prices – and you are still wrong.

Although it is true that a vertically integrated utility recovers the embedded costs of its generators and the costs of PPAs signed with other generators, those PPAs were negotiated based on the utility’s and the IPPs’ respective expectations of future wholesale spot market prices, i.e., the forward curves. When these market prices unexpectedly change so do the forward curves and the prices in future PPAs.

As existing PPAs expire they will be replaced by new PPAs whose prices are based on the then current forward curves. The only relevant question is how soon will the impact of the higher market prices find they way into retail rates. This could take years in some states but not in those with robust retail choice, such as Ohio, where customers can choose among a plethora of competitive retail electricity providers (REPs).

In Ohio, essentially all of the REPs sell electricity to retail customers through fixed price contracts of short duration e.g., one year, at which time the retail customers are free to switch REPs. To avoid being caught with excess supply the REPs hedge their retail contracts through contracts of similar lengths with generators. As these supply contracts expire they are replaced with new ones whose prices are based on the expected future wholesale spot market prices, as described above, and these new supply contract prices are then passed through to the newly acquired retail customers. So in Ohio a systemic change in wholesale spot market prices will affect retail prices rather quickly and the DRIPE effect is alive and well – albeit with a short time lag.

Lastly, I submit that retiring Diablo Canyon WILL raise retail rates, though perhaps not as soon as 2025. However, even the 2025 impact needs to be determined through a rigorous modeling exercise. Has such an analysis been done? Can you provide a reference to it?

In California, the CAISO MCPs have little impact on the retail rates. They only really affect the allocation of costs between bundled and departed customers at this point. California is now dominated by renewable PPAs. They have little relationship to forward price curves. They are driven by installed technology costs, not hourly MCPs.

I have run the generation rate calculations out past 2025 with PG&E’s own data. Generation rates will fall.

“In California, the CAISO MCPs have little impact on the retail rates. They only really affect the allocation of costs between bundled and departed customers at this point. California is now dominated by renewable PPAs. They have little relationship to forward price curves.”

Really Richard?

How do you think the prices in the PPAs are determined? Pulled out of thin air?

For renewables, which have been almost 100% of PPAs since 2010, the prices have been set by the relative costs of the renewable technologies without reference to CAISO market prices. The renewables have been competing amongst each other without reference to the wholesale market. When natural gas prices have entered the picture, they’ve generally been simple energy cost calculations using the heat rate for a combined cycle plant times the forecasted price of natural gas as disembodied from the CAISO market.

“I said that Diablo costs an extra $70/MWH, and that ZECs would be $17/MWH. That’s a $53/MWH gap.”

An extra $70/MWH? Relative to what? The average energy LMP at Diablo Canyon’s connection point? Very confusing.

Relative to the MPB in PG&E’s ERRA filing.

“Market prices have little to do with customers’ retail bills.”

Nonsense. You have no basis for that statement.

“The embedded costs of legacy power plants…”

What “embedded costs”? When PG&E shuts down its state-of-the-art nuclear plant prematurely in 2026 it will own the plant free and clear, wasting 40 years of capital invested by their customers, then adding $5 billion in unnecessary decommissioning costs to their bills. There is no possible way this scam will lower their costs for electricity – and that’s the point.

“…the cost of PPAs signed outside of the market exchanges…”

If you’re referring to the PPAs unregulated community choice aggregators have signed with Wyoming coal plants, they’re the best argument for keeping Diablo Canyon open. Like other “middlemen” stuck between utilities and their captive ratepayers, CCAs add nothing but higher emissions and cost to electricity, while providing nothing of value in return. Or did you really believe their “100% renewable” plans were delivering 100% renewable electricity?

– For PG&E (SCE is similar), the generation revenue requirement is about $5B. Its CAISO procurement costs are about $700M of that. That cost might vary up or down by $200M at most, which is about 5% of retail generation rates (ignoring the other $7B in other costs).

The reason that the generation costs are $5B is due to about half from legacy utility owned generation embedded costs and half from PPAs signed prior to 2015.. Those are all embedded costs. Diablo cannot be relicensed without environmentally required upgrades that drive the cost to $120/MWH according to PG&E.

California IOUs sign NO PPAs through the hourly CAISO market. It has done various auctions, but those are not hourly markets. (CCA PPAs have nothing to do with PG&E signing these PPAs. The rest of your comment is off topic.)

“The reason that the generation costs are $5B is due to about half from legacy utility owned generation embedded costs and half from PPAs signed prior to 2015”

Neither “legacy utility owned generation embedded costs” nor “PPAs signed prior to 2015” will have anything to do with Diablo Canyon after 2026. PG&E will own the plant free and clear, and there is no reason PG&E would have spent significantly more for Diablo’s electricity in a 2015 PPA than they are now, given its extremely low cost basis and stable cost of fuel.

“Diablo cannot be relicensed without environmentally required upgrades that drive the cost to $120/MWH according to PG&E.”

How $3 billion for two cooling towers could quadruple the cost of an $11 billion power plant’s electricity escapes me entirely. But I suppose it makes as much sense as forcing PG&E to spend $3 billion to save the 710 pounds of fish that die against Diablo’s intake screen each year. At $106,000/pound, that’s some expensive sushi.

Heaven help us if anti-nuclear activists were required to pick up the tab for $378M in carbon costs their shutdown of Diablo Canyon will exact – or, if the 1,200 raptors chopped in half by wind turbines in the U.S. each year died instead from radiation poisoning at nuclear plants. The wailing would never end.

PG&E would not own Diablo free and clear after 2024 because it would have to pay for the relicensing cost. Your opinion about what costs are required is meaningless since that issue was settled more than a dozen years ago for once-through cooling plants. Given that most of Diablo’s power will be replaced by renewables and energy efficiency as shown in the various IRPs files with the CPUC, I have no idea where you come up with the carbon costs.

“PG&E would not own Diablo free and clear after 2024 because it would have to pay for the relicensing cost.”

Do you not own your car free and clear, even if you have to pay California each year to relicense it? Please.

“Your opinion about what costs are required is meaningless…”

What’s meaningless is to you is irrelevant to me. All I care is whether costs I cite are accurate.

“Given that most of Diablo’s power will be replaced by renewables and energy efficiency…”

Nonsense. Just yesterday in a hearing about the status of Aliso Canyon Gas Repository, CPUC admitted PG&E will be building the new Stanton Peaker plant specifically to provide reliability after the shutdown of Diablo Canyon.

“…that issue was settled more than a dozen years ago for once-through cooling plants.”

You mean when CPUC decided one fish is worth $4.9 billion?

Tale of the $4.9 Billion Fish

1) 4/1/2009 – The Supreme Court of the United States, in the case Entergy Corp. vs. Riverkeeper, approved the use of cost-benefit analysis in deciding whether power plants abide by cooling system regulations enacted in the Clean Water Act (1972). Justices noted that “respondents [Riverkeeper] concede that the EPA ‘need not require that industry spend billions to save one more fish’. This concedes the principle, and there is no statutory basis for limiting the comparison of costs and benefits to situations where the benefits are de minimis rather than significantly disproportionate.”

2) 9/12/2014 – California’s Subcommittee of the Review Committee for Nuclear Fueled Power Plants meets in closed session.[1] Participants are limited to four groups invited by the Water Resources Board, consisting of the California Energy Commission (CEC), California Public Utilities Commission (CPUC), the Alliance for Nuclear Responsibility (A4NR)[2], the Center for Energy Efficiency and Renewable Technologies (CEERT)[3]. The subcommittee concludes the death of 2 pounds of fish during the daily intake of 2.5 billion gallons of water constitutes a “chronic stressor to the state’s coastal aquatic ecosystems,” and declines to exempt Diablo Canyon Power Plant from California’s Once Through Cooling (OTC) Policy.

Meeting the requirements of OTC Policy will require significant earth removal and the construction of two cooling towers adjacent to the plant. Total cost is estimated at $9.9 billion.[4] Thus on a daily basis, and assuming each fish weighs one pound, PG&E is required to spend $4.9 billion to save one more fish.

[1] The California Bagley-Keene Open Meetings Act requires “the meetings of public bodies and the writings of public officials and agencies shall be open to public scrutiny.”

[2] A4NR seeks to protect the citizens of the State of California and future generations from perceived “radioactive contamination” and “dangers of aging nuclear plants.”

[3] CEERT’s primary source of funding is The Energy Foundation, a pass-through investment group funded by oil and gas megatrusts The Pew Foundation and The Rockefeller Foundation and the anti-growth Macarthur Foundation.

[4] Bechtel Corporation.

SWRCB and CPUC already have made the decisions and rejected the appeals. Closure of Diablo Canyon is a done deal. You can believe that you’re right, but it will have absolutely no impact on the final decision.

Interestingly, on the other side there’s a group trying to close Diablo even earlier than 2025. They tried a strategy of getting CCAs to reject their allocations of nuclear generation that PG&E had offered in an advice letter last fall. The fact is whether the CCAs accept that share or not, they will be paying for Diablo until it closes. There is no effective way of shutting Diablo ealier short of an untoward event.

A new CT will run at less than a 5% capacity factor, and more like 1%. That’s a far cry from Diablo’s 90% CF. As I said, most of the remainder will come from renewables and energy efficiency.

“Closure of Diablo Canyon is a done deal.”

You keep saying that, but you’re wrong. PG&E is required to obtain authorization from FERC to dispose of any asset worth >$10 million. That authorization has not been granted. If you don’t believe me, a review of the Supremacy Clause of the U.S. Constitution would be in order.

“…but it will have absolutely no impact on the final decision.”

And “20% of U.S. energy will be provided by the sun by the year 2000.” Got it.

“Interestingly, on the other side there’s a group trying to close Diablo even earlier than 2025. They tried a strategy of getting CCAs to reject their allocations of nuclear generation that PG&E had offered in an advice letter last fall.”

I remember that, it was hilarious. As if CAISO engineers can separate nuclear electrons from renewable ones. I understand an ordinance passed by a city powered by nuclear energy (Berkeley) prevents it from doing any business with corporations involved in nuclear energy. Only in California.

“As I said, most of the remainder will come from renewables…”

Untrue, but say it all you like. In A16-08-006 PG&E admitted it could only account for replacing 20% of Diablo Canyon’s generation with renewables, so they kicked the can down the road to a future “Integrated Resource Plan”, a technique which will be repeated indefinitely.

“…and energy efficiency.”

A ratio cannot replace a scalar quantity. Efficiency is limited, energy is unlimited. The second lights a bulb; the first lights nothing.

Like demand response: energy non-use is only a replacement for energy sufficiency in the homes of people with lots of energy to waste. All of the world’s residents should have that luxury. Most don’t.

“You keep saying that, but you’re wrong. PG&E is required to obtain authorization from FERC to dispose of any asset worth >$10 million.”

No, that’s not true. The CPUC must authorize such a disposal under PUC Section 851. However, PG&E needs no authorization to retire an asset. It will require CPUC authorization to access the decommissioning fund. FERC has no say over these assets.

What do your comments have to do with the mix of energy in the US?

In A.16-08-006, the amount of replacement power was never litigated and never directly addressed. It was correctly deferred to the IRP. In addition, most of the replacement energy will be coming from CCAs, not PG&E, as almost the entire output of Diablo was about equal to the CCA’s load at the time. Most of those CCAs are on track to be well above 50% renewables before 2025.

I didn’t say that the entire amount of Diablo’s output would be replace by EE. Diablo supplies power only the Western US. It does not power Africa or Asia or even South America. Why do you continue to twist my words?

“No, that’s not true. The CPUC must authorize such a disposal under PUC Section 851. However, PG&E needs no authorization to retire an asset. It will require CPUC authorization to access the decommissioning fund. FERC has no say over these assets.”

Yes, that is true:

“Under the revised Section 203, a public utility must obtain prior FERC approval in order to (a) sell, lease or dispose of its facilities or any portion of its facilities valued in excess of $10,000,000 without prior FERC approval, (b) merge or consolidate their facilities with any other entity; (c) purchase, acquire or take any security of any other public utility with value in excess of $10,000,000; or (d) purchase, lease or otherwise acquire a generation facility valued in excess of $10,000,000 that is used for interstate wholesale sales and is subject to FERC ratemaking authority.”

Good thing we have the Feds keeping an eye on our corrupt CPUC, isn’t it?

“In A.16-08-006, the amount of replacement power was never litigated and never directly addressed. It was correctly deferred to the IRP.”

Of course it wasn’t litigated – A16-08-006 was an application before the California Public Utilities Commission, not a lawsuit.

and it was directly addressed.

PG&E’s application included specific commitments to replace a portion of Diablo Canyon with GHG-free resources, procured in three tranches, over a fifteen-year period:

“1. Tranche #1: This tranche includes one or more competitive solicitations and potentially new utility programs to add 2,000 gross GWh of energy efficiency to be installed by the end of 2024. This tranche is intended to reduce load with a GHG-free resource before Diablo Canyon retires.

2. Tranche #2: This tranche includes a competitive solicitation for 2,000 GWh of GHG-free energy for delivery in 2025-2030. Energy efficiency and RPS energy resources, as well as other GHG-free energy resources, will compete to fill this opportunity.

3. Tranche #3: This tranche includes a voluntary 55 percent RPS commitment, which is 5 percent above the 2030 RPS mandate in Senate Bill 350. The commitment would start in 2031 and terminate the earlier of 2045 or when superseded by law or a CPUC decision.”

After party Californians for Green Nuclear Power presented testimony proving PG&E’s “tranches” of efficiency and intermittent renewable energy couldn’t possibly serve as a substitute for Diablo Canyon’s non-intermittent dispatchable generation, PG&E abruptly dropped all three tranches from its application, illegally changing the application’s scope after the deadline for amendments had passed, and without approval of other parties to its “Joint Proposal”. After claiming they could do it, they couldn’t.

“I didn’t say that the entire amount of Diablo’s output would be replace by EE.”

None of it can be replaced by “EE”. Claiming efficiency can serve as a replacement for energy is non-science magic invented by renewables promoters to make up for their pitiful, intermittent sources. “If we all just used less electricity, and used it at the right times, and covered hundreds of square miles of California desert with industrial junk and transmission wires, and it was sunny almost every day, and windy almost every night, and then we hooked up lots and lots of batteries, we might be able replace nuclear plants with natural gas, and keep the public addicted to methane for another 50 years.” Isn’t that the credo?

That’s only for FERC regulated assets that are sold (not retired.) Generation is not such an asset. A bright line has been drawn on state/federal jurisdiction on this issue. Merchant power plants have been retired with no FERC decisions in California. You’ll need to provide a specific relevant case decision to prove your assertion is true.

PG&E tranche list was rejected by the CPUC. It was deferred to the IRP as I said. Perhaps it was “litigated” to the extent that it was deferred to another proceeding. Parties presentations in that case were irrelevant once the Commission decided that the proceeding wasn’t an appropriate forum to conduct resource planning.

That’s quite a claim that NONE of the Diablo power can be replaced by EE, especially since total PG&E system load has already decreased more than 8% over the last 5 years due in large part to EE. Given that PG&E was forecasting an increase of 6% in load by 2025 in its 2016 application, that means that we’ve already reduced the load by 14% against the forecast against Diablo’s 21% share of system load. In other words, EE and rooftop solar has already replaced two-thirds of Diablo’s power projected for 2025. (You also seem to confuse energy efficiency with renewables.)

Carl,

Section 203 of the Federal Power Act states in part:

(a) Authorization

(1) No public utility shall, without first having secured an order of the Commission authorizing it to do so—

(A) sell, lease, or otherwise dispose of the whole of its facilities subject to the jurisdiction of the Commission, or any part thereof of a value in excess of $10,000,000;

However, Section 200 of the Federal Power Act describes the facilities subject to FERC jurisdiction as follows:

The Commission shall have jurisdiction over all facilities for such transmission or sale of electric energy, but shall not have jurisdiction, except as specifically provided in this Part [16 USC §§§§ 824 et seq.] and the Part next following [16 USC §§§§ 825 et seq.], over facilities used for the generation of electric energy or over facilities used in local distribution or only for the transmission of electric energy in intrastate commerce, or over facilities for the transmission of electric energy consumed wholly by the transmitter.

Admittedly, I’m not an energy lawyer but a plain language reading of the FPA contradicts your interpretation. What am I missing?

“That’s only for FERC regulated assets that are sold (not retired.) Generation is not such an asset. A bright line has been drawn on state/federal jurisdiction on this issue. Merchant power plants have been retired with no FERC decisions in California.

Wrong again, you’re batting 1,000.

Certainly an economist at MCubed knows what “asset disposal” means. You don’t? Here you go (you’re welcome):

https://corporatefinanceinstitute.com/resources/knowledge/accounting/asset-disposal/

“You’ll need to provide a specific relevant case decision to prove your assertion is true.”

No, I don’t. You need to provide a specific case where, since the Energy Policy Act of 2005 went into effect in February, 2006, a public utility has defied federal law and written off an asset 500 times more valuable than the minimum specified in Section 203 without authorization from the Federal Energy Regulatory Commission. Best of luck.

“PG&E tranche list was rejected by the CPUC. It was deferred to the IRP as I said.”

Again, you’re assuming something you said was true.

PG&E dropped the tranche list, deep into an 800+-page response to our protest (as if we wouldn’t notice), in February 2017 – long after CPUC’s Scoping Memo had been signed and sealed. And CPUC let them off the hook.

“Perhaps it was “litigated” to the extent that it was deferred to another proceeding.”

Or perhaps you misused a word you thought sounded appropriately legal.

Look, I’m biting my tongue to not get my last post on this thread banned, but I will say this: in my opinion, the comments you’ve posted here are ones of someone who is unqualified to advise anyone in California government on energy policy. I would never be so critical of someone with a trace of humility, or if the future of our natural world wasn’t in existential danger, or if you were more qualified to represent yourself as an expert while advising California policymakers, but that’s my opinion. Have a nice evening.

The Inland Empire Power Energy Center was retired by GE in 2019 without FERC approval.

https://www.reuters.com/article/us-ge-power/general-electric-to-scrap-california-power-plant-20-years-early-idUSKCN1TM2MV

Several once through cooling plants have been retired without FERC approval.

Click to access dft_2019_rpt_saccwis.pdf

And I’m surprised that you haven’t brought up what should be the most obvious case that would support your assertion: the retirement of SONGS. There’s no FERC docket on the issue, much less a decision.

I’m unconcerned about your opinion on whether I’m qualified. I have received no communications that what I’ve stated has been incorrect, and quite to the contrary, I’ve gotten several messages of support from others who also are involved in California and US energy regulation and policy. I respond here to you because promulgate “fake news” and I can’t leave that unrebutted to be potentially misinterpreted by others.

Forgot to paste this link on the OTC plant retirements:

Click to access dft_2019_rpt_saccwis.pdf

How much of this is paying the piper for gutting our nuclear industry over the last few decades thanks to the short sighted and anti-science views of people like Jerry Brown and groups like Greenpeace? If we had stay investment in nuclear power, if we had been growing our skull in building and running plants over the last few decades, things would probably be much cheaper. In the United States we lost at least a generation on the learning/cost curve.

A response from a different Robert.

While I agree that the excessive cost of Vogtle plant are directly related to the US having lost the talent needed to construct a nuclear plant, the history of cost overruns that occurred in there late 1970s and 1980s, combined with the anti-nuclear propaganda scare tactics of the environmentalists, produced that loss of talent. And back then climate change was not a well-known threat. The rejection of nuclear power was a rational response given its history.

But circumstances have changed and I think we should be investing in the R&D needed to produce a new generation of smaller, cheaper, safer reactors. Our knowledge base for doing this has greatly advanced over the past 30 years.

SMRs may work and be economic, but that is far from proven yet.

“SMRs may work and be economic, but that is far from proven yet.”

Well that’s that’s of course true, but says very little. We all know the future is uncertain. So what?

“SMRs may work and be economic, but that is far from proven yet.”

Well that’s of course true, but says very little. We all know the future is uncertain. So what?

We also know that the nuclear power industry has a very poor record on delivering on “promise.” We should be very skeptical until this round of promises is proven.

“We also know that the nuclear power industry has a very poor record on delivering on “promise.” We should be very skeptical until this round of promises is proven.”

What round of promises?

Nothing wrong with being skeptical but it should not stand in the way of moving forward and investing in carefully designed R&D.

As the proverb goes, “To err is human, to forgive divine.”

I know that you have been around long enough to have seen all of these promises, starting with “too cheap to meter” in the 1950s. But let’s start a bit more recently with Diablo Canyon’s original cost estimate of $500M turning out to be over $6B and end with the promise that Vogtle would cost less than $4,000/kW but ending up at more than $12,000/kW. https://mcubedecon.com/2017/08/03/vogtle-nuke-cost-could-top-25-billion-from-utility-dive/

“I know that you have been around long enough to have seen all of these promises, starting with “too cheap to meter” in the 1950s. But let’s start a bit more recently with Diablo Canyon’s original cost estimate of $500M turning out to be over $6B and end with the promise that Vogtle would cost less than $4,000/kW but ending up at more than $12,000/kW.”

Richard, please…

What do the examples you cited have to do with investing in R&D to develop a new generation of nuclear reactors? You are making the logical error of assuming the future will look exactly like the past. Surely you are not extrapolating a 1950s statement to today.

And there are good reasons why Diablo Canyon and Vogtle had large cost overruns. The Diablo Canyon generation of plants were still being designed while they were under construction. Vogtle suffered from a workforce that had to relearn how to build a nuclear plant. Neither of these problems will apply to a SMR that are small enough to be fabricated on a factory production line.

Obviously you have closed your mind to the opportunities that new SMRs offer. The good news is that your opinion will have no effect on progress to develop these new reactors.

Have a nice day.

The nuclear industry has made numerous promises that R&D will lead to cost reductions. I already pointed out the issue with SMR. I closely reviewed these claims for the 2009 CEC Cost of Generation report. The problems of cost overruns have extended well beyond Vogtle around the world. I have posted here several studies showing how the cost of nuclear has increased rather than decreases as would be expected through learning by doing.

I’m open to whether SMRs will perform. But I am pointing out that the nuclear industry has failed repeatedly to deliver on these promises over many decades. Why should this one be any different? What has changed so dramatically to reverse a universal failure by this industry? The burden isn’t on the skeptics to support their case–it’s already well proven; it’s on the proponents to show that this time is different.

And let’s not forget that the SMR has been promised to be “right around the corner” for two decades (and discussed on an earlier blog commentary). The better aphorisms are “fool me once, shame on you; fool me twice, shame on me,” and “time to put up or shut up.”

“But when I see 9,000 workers on site, and 800 permanent jobs, I don’t see job creation. I see high costs for ratepayers. Electricity bills are already going up to pay for Vogtle.”

Lucas, of course nuclear plants are expensive – they’re an investment in the future. Georgia Power is requesting rate hikes to cover $2.2 billion in increased costs to finish Vogtle, that will add an average of $16/mo to Georgian’s electricity bills, for a period of three years. Then, Georgians will have 2140 MW more watts of clean electricity – day and night, windy or calm, for at least 80 years. Power that doesn’t require a labyrinth of added transmission, or fossil fuel gas backup.

That assumes, of course, renewables activists and their allies in Big Gas don’t succeed in getting it shut down prematurely – a big assumption. But the idea wind and solar, especially in Georgia, will ever match the carbon-free, reliable generation at Vogtle is a fantasy.

By any standard, Vogtle is a bargain.

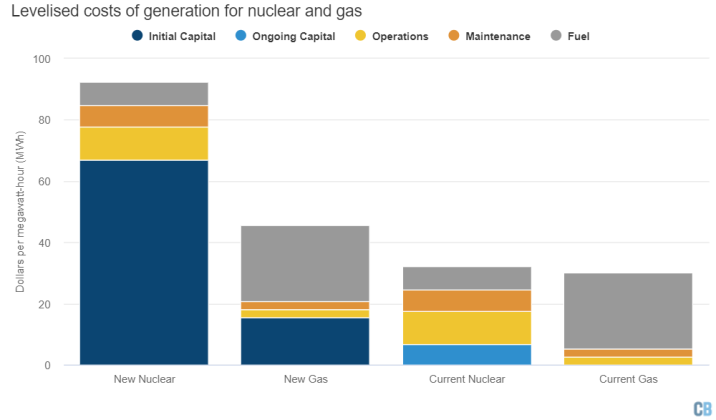

Since when is $100+/MWH power a “bargain”? That $2B request is on top of $17B that already has to be paid. This is taking the “sunk cost” principle to the extreme…