Charging With the Sun

You aren’t getting “green electrons”, but charging at the right times still lowers GHG emissions.

I spent a fascinating few days at the California Independent System Operator (CAISO) last month, following my appointment in January to the CAISO’s Board of Governors. The most exciting part was getting to visit the CAISO grid control room late on a Thursday afternoon as the sun was setting across much of California.

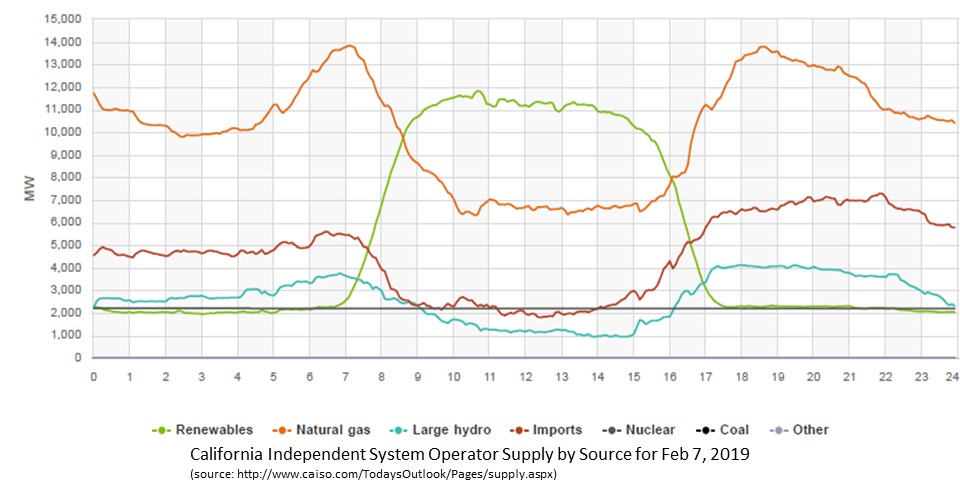

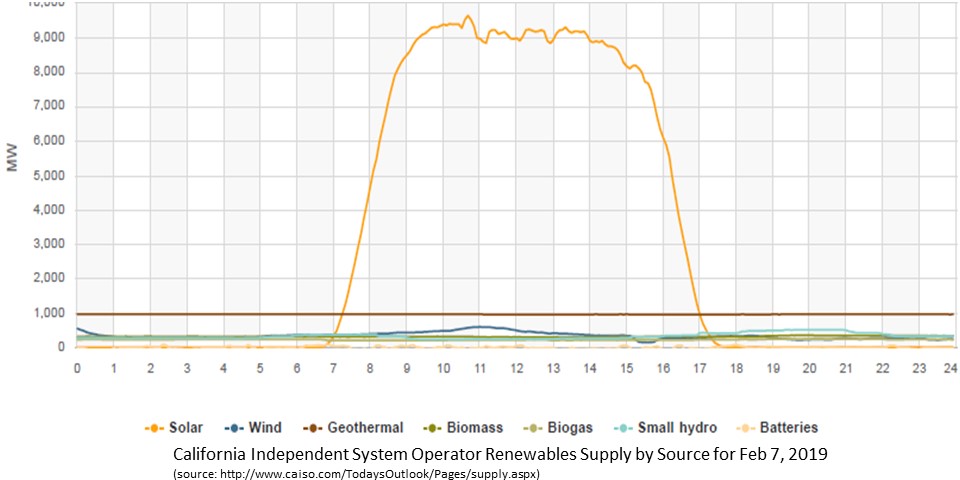

It had been a fairly clear and cool day in the Golden State, lots of solar power production and fairly moderate demand. That meant that as the sun set, operators had to ramp up non-solar supply very rapidly. The personnel in the control room were relaxed and professional, but they were also busy keeping the system in balance as about 8 GW of supply from solar farms — about a third of the total demand CAISO was serving that afternoon — disappeared over the course of a couple hours.

The scene got me wondering again why California isn’t doing more to coordinate end-use demand with electricity production from intermittent renewable sources. In fact, watching the efforts of the CAISO grid operators prompted me to take action to make their lives a tiny bit easier: I reprogrammed our hot tub to run its filter cycle in the middle of the day — the so-called belly of the duck — instead of later in the afternoon. If we had a programmable electric water heater, I could have also set it to heat during the duck’s belly, but we are sadly still combusting natural gas for our hot water and space heating.

In discussing the value of such coordination of demand and renewable generation, I’ve found that there are three types of views among the few people who think about such things: naïve, glib, and correct (uh, that is, the one I agree with).

Naïve: “I will shift my electricity use towards hours when there is a lot of renewable electricity on the grid. That way a larger share of the electricity I use comes from renewables.” This may sound right and feel right, but that’s not how an electricity grid works. The immediate impact of your consumption on the amount of renewable power generation, or on the level of GHG emissions, depends on how generation changes incrementally (what economists call “on the margin”) as demand changes.

So, to know whether your consumption is “green” you need to know how the grid operator is adjusting generation in the system for incremental increases or decreases in demand. Catherine blogged a few years ago about software (created by former Berkeley PhD student in environmental economics, Gavin McCormick) that can make a really well-informed estimate of how the grid is adjusting to marginal demand changes, and the emissions effect of those adjustments.

Unfortunately, production on the margin is typically dirtier than the overall average and much dirtier than 100% wind or solar. That leads us to Glib.

Glib: “When you increase or decrease your consumption, the grid operator adjusts production from a controllable power plant, which is almost never wind or solar. Most of the time, it is from burning natural gas or, occasionally, coal. So, your consumption is almost never green, regardless of the time or how much renewable power is on the grid.” This response is partially right, but it misses two important points.

The first point is that California is so deep in intermittent renewables these days that there are times we are just throwing it away, that is, curtailing production from wind and solar plants. More demand in those hours means less curtailment; in other words, wind and solar are occasionally on the margin.

The second important point is what gets us from Glib to Correct.

Correct: Shifting your demand from one hour to another causes prices to rise in hours that get more demand and fall in hours that get less. So, moving your electricity consumption to correspond with production from wind and solar means that those intermittent renewable generators get a larger share of the total revenues paid to producers without changing their production.

That makes investment in a wind or solar plant more profitable, and that leads to more investment in these technologies. “Shifting my demand is raising profits for wind and solar plants” just doesn’t have the same warm and fuzzy feel as “my electricity comes from a wind or solar plant”, but it has more basis in reality.

In fact, recent work by Jim Bushnell and Kevin Novan (which they will present at the Energy Institute’s 2019 POWER research conference next week, a few seats are still available) shows the importance of changes in the supply/demand balance over the day. They find that increasing California grid-scale solar capacity from 2GW (about where we were in 2013) to 10 GW (about the 2017 figure) has added so much mid-day supply that it has reduced wholesale average prices in those hours from around $40/MWh to about $15/MWh. When you run a solar plant with virtually zero marginal cost, that $25 drop is almost all lost profits.

At the same time, Bushnell and Novan show that California’s increased solar generation has raised prices in the evening when the sun sets and other (mostly fossil) plants have to rapidly fill in. When you time your consumption to coincide with solar production you are helping to reverse that redistribution, making solar investments more attractive and reducing the need to keep as much fossil fuel capacity standing by to ramp up in the evening.

Of course, if customers had the option to pay retail prices that reflect those wholesale fluctuations, just responding to those prices would steer their consumption to the hours of abundant renewable generation. As we put more intermittent renewables on the grid, dynamic retail pricing will be ever more critical for achieving a sustainable energy system.

So, no, you’re not getting green electrons by charging your EV or heating water when the sun is shining. You are doing something more important: creating financial incentives for more renewable generation investment. And also making sunset a little bit less exciting at the CAISO.

I’m still tweeting energy news stories/research/blogs most days @BorensteinS

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas

Suggested citation: Borenstein, Severin. “Charging With the Sun.” Energy Institute Blog, UC Berkeley, March 11, 2019, https://energyathaas.wordpress.com/2019/03/11/charging-with-the-sun/

Categories

Severin Borenstein View All

Severin Borenstein is Professor of the Graduate School in the Economic Analysis and Policy Group at the Haas School of Business and Faculty Director of the Energy Institute at Haas. He received his A.B. from U.C. Berkeley and Ph.D. in Economics from M.I.T. His research focuses on the economics of renewable energy, economic policies for reducing greenhouse gases, and alternative models of retail electricity pricing. Borenstein is also a research associate of the National Bureau of Economic Research in Cambridge, MA. He served on the Board of Governors of the California Power Exchange from 1997 to 2003. During 1999-2000, he was a member of the California Attorney General's Gasoline Price Task Force. In 2012-13, he served on the Emissions Market Assessment Committee, which advised the California Air Resources Board on the operation of California’s Cap and Trade market for greenhouse gases. In 2014, he was appointed to the California Energy Commission’s Petroleum Market Advisory Committee, which he chaired from 2015 until the Committee was dissolved in 2017. From 2015-2020, he served on the Advisory Council of the Bay Area Air Quality Management District. Since 2019, he has been a member of the Governing Board of the California Independent System Operator.

Seems like this would be a strong incentive to somehow bank that daytime power. California now subsidizes installing a battery in your home for temporary storage of solar power. This would better be handled by a utility on a block by block basis. A storage device covering 50 or so homes would be able to average the loads and sources better than a single home device could.

I think the key takeaway is, there need to be incentives for consumers to shift their demand away from periods with little or no solar production to periods with lots of solar production (wind isn’t predictable enough far enough ahead of time to be worth the trouble). The best way to do that is with prices so that consumers see lower bills for their trouble. The problem, if course, is 100 years of ratemaking aimed at doing exactly the opposite by shifting demand from day to night, assuming rates are time-differentiated at all.

However I would caution folks to have modest expectations about the amount of demand that might end up being moved. Air conditioning is a no-brainer. But changing the timing of demand for hot water and winter heating in homes won’t be quite so simple. Residential consumers will take showers in the morning or the evening, not in the middle of the day. They’ll want their homes to be comfortable when they get out of bed in the morning, and they won’t be enthused about coming home to an uncomfortably warm house..

seems like the reasoning here should go through the rate-setting process. In the short run, wouldn’t said demand-shifting lower utility costs of meeting their solar PPAs (and raise their profits)? In the longer run, this would presumably lower rates.

Severin – I understand that shifting demand to times when wholesale prices are low should tend to raise those prices. Thank you for clearly explaining this. But there are no merchant generators building new plants based on the wholesale price alone. So shifting demand would not be enough to “create financial incentives” that get more renewable generation on the grid. The only thing that gets more renewable generation and displaces fossil generation is a long term power purchase agreement. PPAs are solely a result of LSEs making commitments to comply with RPS requirements. For this, we need the actions of the CCAs to match their rhetoric. Shuffling NW hydro contracts to claim low GHG emissions won’t suffice.

Marc Joseph

I was with Marc until he repeated the shibboleth that CCAs are not signing contracts with new resources. Marc represents the IBEW union which demands that CCAs be functioning as fully-formed utilities immediately upon creation as though they have developed full creditworthiness and staffing resources. In contrast to Mark’s mistaken viewpoint, every new organization requires a period of development. Many CCAs relied on renewable energy credits (RECs) in the first year or two, but all have moved to full power purchases, and now more than 2,000 MW of new plants have been constructed solely through CCA agreements. Other existing plants have expanded to fill CCA PPAs.

The real problem here is that the investor-owned utilities (IOUs) failed to properly manage their portfolios by disposing of their excess assets through sales to the new CCAs when they started up. Instead the IOUs attempted to choke off the development of the CCAs (with the IBEW’s assistance). The CCAs have now proposed an auction that would redistribute the IOUs’ excess resources while keeping all ratepayers whole. Instead, the IOUs and IBEW continue to oppose any real solutions to the mess that they’ve created themselves.

The good news is that new products exist and are being developed to automatically move demand to peak solar hours. For example, this year ecobee will push out a new TOU optimization feature to all of its thermostats, using a combination of the customer’s TOU rate, outdoor temperatures, and specific household energy patterns to initiate efficient precooling and peak setback algorithms designed to shift loads every day, and save customers money on their bills.

https://www.cnet.com/news/ecobee-looks-to-save-you-money-with-new-peak-relief-feature/

For dynamic rates like critical peak pricing (CPP), utilities can use the same thermostats to initiate even more savings on the few days a year where it’s especially needed. This is just one example of how vendors can develop products that deliver efficiency, load shifting, AND demand response (EE-TOU-DR) using time-varying rates and automation. Although smart thermostats are the obvious first step – especially in California – I expect we’ll soon see similar devices created to schedule other large loads: water heaters, hot tubs, electric vehicles, pool pumps, etc.

I think the next step is to encourage Bring Your Own Device (BYOD) automation programs at the California utilities. The research is clear that adding customer automation to TOU or TOU-CPP rates significantly increases savings, but I don’t think any California utilities yet have both in the same place: PG&E has a TOU-CPP rate, but no BYOD program that would automate customer response, while SCE has BYOD programs, but no TOU or TOU-CPP rates. SDG&E has BYOD and TOU, but no TOU-CPP. Getting these in place seems like a simple way to start towards a grid that can maximize renewables and reliability through automated mass-market demand management.

SCE has TOU rates: https://www.sce.com/residential/rates/Time-Of-Use-Residential-Rate-Plans. The CPP option is include here: https://www1.sce.com/NR/sc3/tm2/pdf/ce360.pdf

Ah yes, my apologies. I meant widespread (default) TOU yet – looking forward to 2020. Thanks for the link to the SCE CPP option. I hadn’t seen it.

Thank you, Severin, for this clear explication of what it means to plug-in at peak-renewables production. In addition to doing more to coordinate end-use demand with electricity production from intermittent renewable sources, the CPUC could also be doing more to encourage retail suppliers to procure more balanced renewable-energy supply portfolios. For example, while the CAISO gives the CPUC its causation-based assessment of flexible-ramping costs, which assigns costs to load-serving entities based on their use of flexible ramping resources (i.e., the resources used to meet the net-demand depicted by duck’s neck), the CPUC chucks that out and instead assigns those costs on a load-share basis when it apportions its flexible resource adequacy requirements. As a result, LSEs with solar-heavy portfolios are allowed to shift ramping costs to LSEs with more-balanced portfolios. Better cost signals here and elsewhere could reduce integration costs and the need to coordinate demand with excess production during the daytime.

At the core of the problem is that the CPUC has not developed an adequate way to credit the resource adequacy for behind the meter and distributed resources. The system is still set up to be heavily reliant on natural gas generation. All of this needs to be reformed together, or will just reinforce the status quo.

We’ve been working on this! The CPUC convened a “Load Shift” working group on how to achieve this ‘correct’ view over the last year and there is a report available here: https://gridworks.org/initiatives/initiatives-archive/load-shift-working-group/

My take on why it is important to Shift load is that if you can increase load in a period when solar and/or wind would otherwise be curtailed, it is in fact possible to use that marginally curtailed renewable electron — avoiding the curtailment. Yes, there are nuances in the CAISO operations, but in expectation this tends to reduce curtailment. What is the effect? This means that solar and wind energy investments have higher capacity factors, and we aren’t leaving green electricity on the table. Since there is a binding RPS, it reduces the need to build even more solar and wind to hit the same target. In other words, reducing curtailment through load shifting makes it cheaper for society to hit our RPS targets. The distribution of those gains to generation owners vs. load shifters is the next fun and interesting topic, IMHO. Should there be new contracts between generators and customers that properly incentivize the behavior? Should we have more coarse, less targeted programs? Maybe try all of the above and see how things work? Those are all discussed in our report too 🙂

Sorry Severin, but you’ve got this wrong. When the large majority of power on the grid is solar, during the solar window, of course consumers are indeed charging mostly with solar electrons. Where else is the power coming from? As the CAISO charts show, during sunny days there is very little conventional generation feeding the grid.