100% of What?

Could California’s ambitious zero carbon electricity policy make it harder to cut greenhouse gasses overall?

Sometimes two ideas that seem joined at the hip end up butting heads. A couple current discussions in the energy blog-o-sphere illustrate. One is the debate over moving to 100% carbon-free electricity in California. Another is the push for “electrification” of transportation, water heating and anything else that these days relies on burning natural gas, oil or coal.

The two policy initiatives seem to be complimentary in their pursuit of a low-carbon future: One policy cleans up electricity while the other gets people to switch from using other dirty fuels over to clean power. Except there’s a hitch: Money. If zero-carbon standards significantly increase the retail of price power, then firms and consumers are going to be less likely to favor electricity-intensive products.

Too much of the debate we’ve heard over 100% targets are stuck on the question of whether it is technically feasible. I don’t have strong doubts that it is technically possible. After all you could always resort to rolling blackouts when renewable energy falls short. That’s technically feasible. Buying enough Tesla batteries will (eventually) be technically feasible. Importing hydro power from the Pacific Northwest is definitely technically feasible.

The relevant question is the cost gradient as we scale up from 60 to 70 to 80 percent and higher. What if going from 90 to 100% renewables triples the cost? The timing of the targets also affects the cost, because a zero carbon standard without demand growth requires the early mothballing of existing fossil fueled facilities rather than a diversion of new building from fossil to zero-carbon sources.

It’s not just about cranky electricity customers and a “ratepayer revolt” anymore. Not if we are trying to electrify new sectors. Now you may be thinking: “Of course customers would love electric cars. Isn’t gasoline hella expensive in California?” There certainly has been a lot of media attention paid to gasoline prices, from the potential repeal of the new infrastructure gas tax to the impacts of the low-carbon fuel standard, not to mention one blogger’s obsession with the “mystery surcharge.”

Look at these two trends, however. The right-hand panels plot gasoline prices in California (red) vs. Texas (black). The lower right-hand panel plots the ratio of California gasoline prices over Texas prices. The left-hand panel plots residential electricity price levels and the ratio for the same two states. Not surprisingly, gasoline has always been more expensive in California relative to Texas, and has grown somewhat more so in recent years. The main impression is that both are dominated by global oil prices.

The electricity story is more complicated. Upon restructuring, both the California and Texas markets became more closely tied to the price of natural gas. Both markets rode the gas price up in the 2000s. Texas power prices have ridden the gas price back down again since 2008, while California prices have continued to increase.

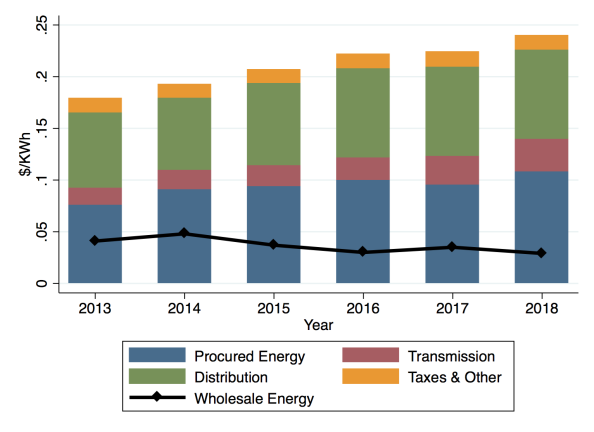

The differences are not a result of differential costs of wholesale power in the two markets. In fact, wholesale prices are a little lower in California. A closer look at an electric bill in California provides some more detail. Conveniently, PG&E and other California utilities break down the component costs of retail rates into several categories. Also conveniently, I have a colleague who is, um, “detail oriented” enough to keep careful records of every aspect of his/her energy expenses over a long period of time.

This figure plots the component parts of my colleague’s PG&E rates over time. Unfortunately, comparisons before 2013 become difficult as PG&E’s treatment of the increasing block structure changed in 2013. Distribution and transmission costs have been rising this decade, but what is most striking is that the cost of energy procured by PG&E has been rising, while the wholesale price of energy has been falling. The blue bars constitute PG&E’s average (procured) energy costs, including all its contracts, regulated plants, and other purchases and fees. The black line illustrates the wholesale energy price, as based upon day-ahead northern California June prices in the CAISO’s market. Energy prices in the CAISO market have been trending downward, yet the overall cost of procured energy is going in the opposite direction.

Now I wager that some commenter is going to blame PG&E for this, but this trend of higher procurement cost and lower wholesale prices is a general one for California. It is captured in the comparison of California rates with those of Texas. The Renewable Portfolio Standard (RPS) is likely playing a big role. The growing gap between wholesale and retail prices is a consequence of rapidly adding renewable capacity at costs above the wholesale price that in turn drives down the wholesale market price even farther. It is true that renewable costs are declining, but so is the value of renewable output as captured by the wholesale price. Recent work by Kevin Novan and I have estimated that the additions of utility-scale solar over the last half-decade have reduced power prices by close to $20/MWh during mid-day. Since most new renewable capacity is producing in those same time periods, a solar contract signed in 2016 produced power worth half as much as a contract signed in 2012.

One theme of my work with Severin Borenstein has been that pressure for disruptive change in the power industry grows with the gap between retail prices and wholesale costs. In the past, such pressure help create the Independent Power Producer industry and later spurred the movement for electricity deregulation. Now the pressure may be pushing users off the grid. Anecdotes from Hawaii, another state with a 100% renewable electricity law, point to the risks of pushing the electricity industry too far in front of other sectors. When I last visited, I heard several stories of large commercial or industrial customers considering on-site (gas-fired) generation. Such measures become increasingly attractive as the retail electricity prices rises farther above the option of self-generation, which is not subject to the RPS. It’s enough of a concern that the state is now debating a possible renewable mandate for natural gas.

This is another example of what Meredith Fowlie has called the waterbed effect. You push carbon down on one side and it pops up on another. Just as high energy costs may drive energy-intensive firms to other states, high-cost electricity may drive consumers away from electric power just when we are trying to lure them in. We may resort to the always-popular tool of subsidizing investments for electrification, but the costs of those subsidies are bound to rise if the cost disadvantage of electric water heating or heat pumps grows. And those subsidies are often paid for out of electric rates, making the cost-gap even larger.

Goals like 100% clean or “net-zero” carbon sound like nice round numbers and are politically popular, and there is no easier target than the highly-regulated electricity sector. As we have repeatedly written on this site, however, the world’s climate problem is not going to be solved just by cleaning up the electricity industry, let alone the California electricity industry. Eventually we are going to need a holistic approach that considers all sources of greenhouse gases and makes some attempt to balance the costs of abatement across sectors.

William Nordhaus was just announced as a Nobel Laureate in Economics, largely for his work on the concept of broadly applied carbon pricing. The increasing substitutability of gasoline, electricity, and natural gas illustrates why such an approach is so much more effective than sector level technology mandates. While the Competitive Enterprise Institute may complain that carbon taxes raise electricity and gasoline prices, alternative regulations that pursue piecemeal and uncoordinated solutions ultimately cost more.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas

Categories

SB100 mandates 100% renewables. But, the language is interesting. That is, the bill’s language speaks of utilities buying “energy products” to meet the 100% requirement. Do compliance REC’s meet that definition? If the answer is yes, then renewables built anywhere in WECC that meet the definition for California are eligible. Does that mean that California only consumes electrons from renewables? Of course not. Yes, its true that a compliance REC is bought and its cost goes into the cost bin for rates, but let’s be clear how the physical system operates. We know it operates differently from the contract “system” that is used to identify costs for rate recovery. its true that a compliance REC is a legal way to claim “greeenness” but as loads grow in California and other parts of WECC, it seems possible to have more renewables plus more thermal, ergo, a net increase in WECC-wide carbon emissions. This dichotomy between resource operation and contracts leads me to question the goals. Why aren’t we pushing for the closing of thermal plants if what we want are fewer carbon emissions?

I really appreciate much of what this blog says, and it is certainly true that we pay higher prices than we otherwise would due to renewable procurement. But the primary reason for higher retail electric prices is distribution ratebase:

http://www.turn.org/california-electric-bills-going-hint-dont-blame-renewables/

I don’t have a lot to say here, but just wanted to remark that (1) climate projections improve over the years, and (2) it was always clear that, if we waited collectively long enough before reducing, in order to hit cumulative emission targets we would necessarily have to retire fossil fuel assets well before their depreciation or actual lifetimes. Climate projections have gotten worse, and the urgings to stop building fossil fuel assets, including natural gas facilities, have not been heeded.

Accordingly, to now say it’s a waste to retire these assets is an imperfect analysis, at least when assigning the blame for why that is the case. It’s clearly the case because some of them shouldn’t have been built in the first place. To the degree that could not be foreseen, the need to shut them down early can also not be foreseen.

Finally, while California is its own jurisdiction, clearly energy supply and management is a regional problem.

Unless the current state of urgency to reduce carbon emissions is a false premise, eh? Then everything you just said falls apart.

Currently, California, much less the entire U.S., does not control the supply of hydrocarbons around the world. While the U.S. may be the #1 producer of hydrocarbons, it accounts for only 15% of world production. You can go quite a ways down the list of producers Russia, Saudi Arabia, Iraq, Iran. China, UAE Kuwait, Nigeria, Angola…before running into any other country that might be persuaded not to produce oil and gas and sell it. In fact most of these countries it is a existential necessity to produce and sell hydrocarbons. Without it, they have little else to offer the world. Beyond that there are trillions of tons of coal in poor countries.

So we don’t control supply.

From a demand side, we are in the same boat. While we have high per capita demand, we have a relatively small population. The developing world is much larger, and ravenous for energy. China and India will double, triple, quadruple demand in the near future.

So we don’t control demand.

In addition, there are natural climate forcings we don’t control. There were ice ages and warm periods long before we started emitting carbon dioxide. Those forces are not in abeyance, and are either increasing or decreasing anthropogenic forcing of the climate.

So we don’t control the natural climate.

So the climate crises that must be solved in the next 10 year won’t be solved in the next 10 years. It is an economic, physical, and technological certainty. There is no sense breaking the bank, punishing the poor with high electrical costs, driving out manufacturing, for the sake of doing “something” that will gain us absolutely nothing.

The best possible approach would be for us to chart a future where we reduce greenhouse gas emissions AND show that it can be done at low cost, no subsidies, with minimal disruption. That MIGHT persuade other countries to follow suit on the demand side, which is really our only hope. Pushing expensive renewables on a fixed timetable, in a market wrecking experiment, gains us nothing, solves nothing, accomplishes nothing, and is likely detrimental to our goal.

So lets sit down and figure out series of steps that will get us to 100% carbon free power that are logical, and cost effective. Let’s figure a way to make electric costs decrease at the same time emissions are decreasing. If we are serious about this, then by all means let’s get bloody serious for a change.

Again, if the solution increases retail electric prices it is by definition NOT a solution, because no developing country will be willing to adopt it, and without them, what we do scarcely matters.

If civilization as we know it become largely untenable because of climate changes in the next century, the entire premise of your argument falls apart. That’s why we have the urgency.

But further, the cost effective future you are telling to wait for is already here. Coal is now uneconomic vs. wind and solar, and natural gas could be soon as well. Battery storage costs have dropped enough that setting up local microgrids that avoid transmission investments will be cost effective in the developing world. (All of the large hydro projects in the developing world have been heavily subsidized.)

As for natural climate variation, that’s a distraction thrown up by climate change deniers…

And that my friend is why you are going to fail miserably. If it is urgent, then get bloody serious about was is and is not possible, what will, and will not work.

Coal is not uneconomic – Not in India, china, or the developing world where such things actually matter. In fact it is cheap, literally dirt cheap. Locally produced coal dug by hand out of the ground by people making $1 a day is much much cheaper than imported solar panels and wind turbines and always will be. You say they are cheaper because that is the dumb lazy thing you have memorized, and it makes you happy to say it. The fact that its not technically true and doesn’t matter troubles you not a bit.

Again, if this is serious and urgent, why don’t you educate yourself on the issue properly? Why don’t you think strategically? Why are you posting such lazy thinking? Who is the denier here? Certainly not me. You can’t even engage on the issue because you have no actual thoughts of your own, know nothing, and will do nothing but squawk and complain, and propose things that will never happen and never work.

You are focused solely on the fuel costs (which are heavily subsidized, at least in India to keep coal miners employed to supply poorly inefficient power plants). Also, mining mechanization is more cost effective than using labor–that’s why Australia can export its coal to Asia. From a TOTAL cost perspective that includes the full capital costs, solar and wind are competitive with new coal plants because the low labor costs that make coal inexpensive to CONSTRUCT also makes it cheap for solar and wind. And in part thanks to the huge subsidies paid by California ratepayers (in large part due to contract mismanagement by the IOUs and CPUC) the rest of the world is now enjoying those low technology costs.

I see that the developed world is going to have to subsidize further some of these new technologies, but on the other hand the World Bank and IMF are going to have to stop subsidizing fossil plants and huge transmission lines that can be replaced by decentralized small, local power plants in the developed world. (And large centralized nuclear plants do not fit into this model anymore than the disastrous hydro projects.)

As one who has worked on electricity issues in both India and China, I am dismayed by the lack of understanding reflected in this post. And also dismayed by the disrespectful tone.

Both India and China are building solar and wind projects at a very fast pace, to take advantage of low-cost clean energy. The Renewables 2018 report from the International Energy Agency shows this. China has more solar than the next top two countries (US and Japan combined). In 2017, China added more solar than the entire world added in 2015.

In 2017, China was 54% of all solar added globally, followed by the US (11%), India (9%) and Japan (7%).

In wind, China has more than the US, Germany, and India combined. 190 GWh. Enough kilowatt-hours to power the entire CAISO (yes, a monstrous amount of storage would be needed to actually do that with wind alone).

China also has more solar water heating capacity than the rest of the world combined. 71% of the world total.

Click to access 17-8652_GSR2018_FullReport_web_-1.pdf

Coal usage in China is declining, due in part to retirement of inefficient old units as newer more efficient coal units are in service, but also from sharp increases in wind and solar. Coal use in China peaked in 2013. They’ve learned that there are better ways to do things.

https://www.brookings.edu/2018/01/22/chinas-coal-consumption-has-peaked/

There was a 1% blip up in 2018, due to weather, drought, and nuclear reliability issues. But the decline will likely resume in 2019.

Yes, India is behind China in both wind and solar. There are lots of reasons, economic, political, and physical. China is really efficient. India is the world’s largest democracy, but no leader in efficiency. But only China, US, UK and Germany added more wind last year, and only China and the US added more solar.

Can people on this list please stick to facts with citations, and put aside the nastiness.

“You are focused solely on the fuel costs.” More wishful thinking.

China is planning 300 to 500 more coal plants.https://unearthed.greenpeace.org/2019/03/28/china-new-coal-plants-2030-climate/ How about this: “We expect coal to remain the dominant fuel in the power sector in India, through 2030 and beyond.”

https://www.brookings.edu/blog/planetpolicy/2019/03/08/coal-is-king-in-india-and-will-likely-remain-so/

Guess they didn’t get the your memo on wind and solar being cheaper.

You and I don’t control them. What WE do scarcely matters. They will decide, for themselves what they want to do, and right now that is coal. You can say something is cheaper, but unless they agree with you, then you are by definition wrong and unserious. And yes you can go carbon free at a price. A price China and India and the rest of the developing world will refuse to pay, and a bill we can’t possible pay for them.

China is generating 1.84% of total electricity production via solar. Wind is 4.7% Coal is 66% of the electricity generation. They use 4,475 kWh per person per year. This is low – the U.S. uses 12,071 kwh per person per year. But let’s talk about somewhere more efficient, like Taiwan which uses 10,632 kwh per year. So expect electrical generation in China to double. India? A factor of 10.

But hey, the amount of solar in increasing 12% a year, which is 0.22 % of the total currently generated, and 0.1% of what China actually needs! quit fooling around with nonsensical statements like “In 2017, China was 54% of all solar added globally…” you know that actually means nothing, right? 54% of nothing = nothing?

I apologize if I seem a little nasty, but frankly this is beyond frustrating – I listen to Greens all the time spout facts and figures on things that are either wrong, or more typically don’t matter at all. My point is, and remains, that we don’t control supply or demand for hydrocarbons. And expensive, complicated solutions will not work in developing countries. Certainly wish casting wind and solar isn’t going to be the solution.

You make unsubstantiated assertions. Both Jim Lazar and I have provided evidence that solar and wind are now on parity or cheaper than coal in those countries. I’m not sure why you keep alluding to “wishful thinking” when we have been providing hard evidence. Whether China and India agree with me or not doesn’t make my reference to specific evidence to the contrary wrong–it just means that they may not have fully considered all costs in making their comparisons. (The fact that I disagree with the CPUC on certain rate matters doesn’t make me “wrong”–it just means that I have a different well substantiated perspective that the CPUC decided to ignore in its decisions.)

Now, those nations may be building more coal for reasons other than lower costs (which isn’t uncommon in developing economies.) That China and India continue to invest in coal doesn’t make coal “cheaper”–they are not infallible in making energy investments.

So you complain that no one is coming up with cheaper solutions, yet we have shown that solar and wind are cheaper solutions, just being ignored by China and India. Your frustration is borne out of an inability to carry on a dialogue that is more than just your assertions that we are apparently supposed to capitulate to. What is your proposed cheaper solution? I don’t think we can come to an agreement on this until you provide your data that makes legitimate cost comparisons, not references to how much capacity of each technology is being built.

I see now that you don’t get the urgency of addressing the climate change threat. You think that we have decades, even a century, to transform the global energy economy. We don’t have that time (and it may even be too late now). All of these transformations need to be accelerated.

You claim that we don’t “control” supply or demand (which I’m not clear on what you mean by “control”) yet corporations have been able to rapidly push new technologies into the market. Many consumer technologies have reached near saturation in just a couple decades. (See https://mcubedecon.com/2014/07/29/what-we-might-expect-for-diffusion-of-new-decentralized-energy-technologies/) We can use this knowledge to spread low carbon technologies.

I’m not sure what your proposed new approach is but first, we need to get an agreement on the current set of facts and second, “patience” is not one of the acceptable answers.

China put just over 43 gigawatts (GW) of new solar generation capacity into operation in 2018, down 18 percent from a year earlier. China will add 259 GW of coal capacity, satellite imagery shows. That is the equivalent of the entire U.S. coal fleet. Expenditures for the power stations reached US$210 billion, which would be equivalent to deploying around 300 GW of solar PV. China, the largest coal producer in the world, currently has around 993 GW of coal capacity. The additional capacity would increase its total coal capacity by more than 25% and conflict with the cap for total coal capacity – 1,100 GW – the country set itself in its five-year plan (2016-2020). China’s CO2 emissions grew by approximately 3% last year, the largest rise since at least 2013.

So tell me again, how wind and solar are cheaper, and will take over China.

Meanwhile India cuts solar capacity addition target by 23% for 2019–2020. Oil giant BP projects that coal demand in India will nearly double from 2020 to 2040. They are adding 10 -20 GW per year of coal power, and plan to be 57% coal powered in 2040.

Look, batteries are not going to cut it, and wind and solar, if we are very lucky, will top out at 20% of the energy mix. India and China, if left to their own devices, plan on emitting far more carbon dioxide than they do today. Many times more than the U.S.

The problem will never be solved until we stop lying about what is and what is not the problem.

“You make unsubstantiated assertions.” Stop. Lying. Especially to yourself. That is my sole assertion.

“Both Jim Lazar and I have provided evidence that solar and wind are now on parity or cheaper than coal in those countries.”

Ha hah – very funny. Look, saying china is installing more solar than anywhere else is a “fact” and utterly meaningless because you both know it simply isn’t enough and doesn’t matter. You state a lot of “facts” that are simply irrelevant, and pretend they are relevant. That is the big lie in all your statements.

Look at pure numbers – how much solar is installed and how much they actually need? How much coal they are using, and how much will they use? You can move a ton of sand one teaspoon at a time, and pretend it is progress. Most people would laugh at you, just like I am.

The problem won’t be solved with wind and solar, mathematically, economically, physically, it can’t be. Have you read Michael Greenstone and Ishan Nath’s study? They tried to fully delineate the actual costs of renewables in their April 2019 paper. Their paper compares states that did and did not adopt RPS policies, using the most comprehensive data set available from 1990-2015. They came up with three key findings:

• RPS standards overstate beneficial impacts.

• Overall electricity prices increase substantially after RPS adoption.

• RPS programs lead to reductions in the carbon intensity. Unfortunately the cost per metric ton of CO2 abated exceeds $130 in all specifications and can range up to $460, making it at least several times larger than conventional estimates of the social cost of carbon, which is roughly $40/ton.

The paper is devastating and irrefutable. And it is WHY India and China will not install enough wind and solar to matter. And without their support, we fail.

“Whether China and India agree with me or not doesn’t make my reference to specific evidence to the contrary wrong–it just means that they may not have fully considered all costs in making their comparisons.” Listen to yourself – that is the definition of wishful thinking. You think China and India are wrong, solar and wind are actually a cheaper and better choice. But what you think doesn’t mater, and your “opinion” is de facto “wrong” because they don’t have to listen to you and get to decide for themselves. Let’s say I’m driving in a car, and you are my passenger. And you think I’m driving too fast and will crash, and I say, nah, I’m going just the right speed. After we crash, you get the satisfaction of being right, you also get to be dead in a car crash. That is the argument you are trying to make here.

“Now, those nations may be building more coal for reasons other than lower costs (which isn’t uncommon in developing economies.) That China and India continue to invest in coal doesn’t make coal “cheaper”–they are not infallible in making energy investments.” How vacuous. You should send them a sternly worded e-mail explaining how they are wrong.

“What is your proposed cheaper solution?”

Well, our choices are quite limited. The plan would have has to result in cheaper electricity (think < $0.10/kwh retail, < $0.03 wholesale). It has to be reliable (97% or so). It has to be plentiful (probably 4 x world generation now).

A program that might work would be:

1) Expect wind and solar to contribute < 20% of the total. Beyond that costs for back-up (batteries or back up generation) swamp any savings (Greenstone and Nath 2019).

2) Hydro 20%. Improve generators and non-powered dams. Pay down dam capital costs to get wholesale $<0.03/kwh.

3) Geothermal – maybe we can ramp this to 5-10% with a significant reduction in drilling costs. Technology is currently being studied that will do just that, and we should fully fund it. Cheapest energy in the world if you can make it work.

4) Nuclear – focus on lowering the cost of nuclear using SMRs. 30% of the total. We don't have to get it rock bottom cheap, just cheap enough to balance with cheaper sources.

5) Fracking and natural gas 25%. The reduced drilling costs from #3 will come in handy here. Improve efficiency of gas plants using supercritical carbon dioxide generators, which can up efficiency 10%. Experiment with carbon capture systems.

Like I said, that MIGHT work. It won't get us to 100% carbon free, maybe nothing will. But it will substantially reduce emissions, and is doable over the next 20 to 30 years. We might have to buy out some patents and simply give them away to China and India to make it work. Pay off some capital costs for them. It's a terrible plan, but has the attraction of actually, maybe, working.

Stop. Accusing. Us. of Lying. Name calling will get you nowhere. That we disagree with your portrayal of the facts does not mean that we are being dishonest. You are not the sole arbiter of truth. We have put out there the analyses and actual transactions that show solar and wind at <3c/kwh, especially in the developing economies.

The GW of solar installed in China that you cite are of the same order of magnitude at coal installed which tells me that it could soon surpass coal given where it was 5 years ago.

Here's my take on the substantial errors in the Greenstone et al paper: https://mcubedecon.com/2019/05/06/u-of-chicago-misses-mark-on-evaluating-rps-costs/

Again, that China and India won't listen to us doesn't make us wrong. You have a very bizarre definition of what is correct if it relies entirely on how others act rather than on the facts on the table. What you're actually saying is that the political forces in China and India are driving toward the installation of more coal, and we are making the point that they are doing so contrary to the actual economics of power generation. But that means you're proposed solution of lowering costs won't be effective at bringing them on board. It's going to take instead political changes that shifts the favored technologies. But don't try to claim that's its about costs. Again, I looked at India's situation a while ago and it was clear then that was exactly what was happening there.(I joked at the time that India should hire the Indians on staff at SCE to move back and solve their energy problems more efficiently.) [I'm wondering if English isn't your first language so that you are having a problem using the language in the same way that we do.]

As for nuclear as 30% of the generation mix, that is wishful thinking. SMRs still aren't commercial and I've come across several responses to the nuclear power advocates (who never seem to be actually employed in the power or engineering industries) that point out that the new technologies still don't address fundamental problems, and still aren't cost effective. (And why do the nuclear power advocates have to always be so adamant that they have the only one true answer to the problem???)

More news today

“NV Energy did not disclose power purchase agreement prices for the

projects, but 8minute said its project, at 300 megawatts of solar and

135-megawatts of 4-hour storage, will come in around $35 per megawatt

hour. That’s comparable with the projects NV signed last year, which

ranged between $30.94 and $36.94 per megawatt hour.”

Reported 6/25/19 by E&E

What exactly is in the fine print of the deal? These types of things make headlines, but based on my own experience (and many others) the deals vary significantly in value. To put is bluntly, I might offer you a very low price for my renewable energy package, but in the fine print…..

Nevada allows the creation of RECs which can be sold as off-sets to other producers. From 2015 to 2017 RECs purchased have averaged between $0.15—$0.045 per kWh produced.

So, I’m guessing, the actual produced price for this solar power is no where near $35/MWh. That translates to $0.035/kwh. To that I add $0.15 to 0.045 for the sale of the REC (a high side price is more likely, because SRECs are more valuable). With my federal Investment Tax Credit (ITC) I can claim 30% of my solar equipment and installation costs. There is the Renewable Generations Rebate program that kicks in another 0.0317/kwh. Large Scale Renewable Energy Property Tax Abatement (55% for 20 years). Of course the previously mention RPS standard (6% solar by 2025) guaranteeing my market. And the Renewable Energy Sales and Use Tax Abatement (not sure that applies, but what the heck). Plus a high five from the governor, and a kiss from a Hollywood star at the ribbon cutting.

With all that I’m surprised they aren’t offering to install it for free.

All of this is easily discoverable and never, ever, reported.

And naturally, none of this financial hanky panky applies to India, China, or the rest of the developing world who are furiously building coal plants. Oh, and we can’t afford to pay them to install solar like we do here, and they can’t afford to pay for it themselves. But that’s okay. Because this isn’t about tackling the real problem, it is about pretending to tackle the problem.

“From 2015 to 2017 RECs purchased have averaged between $0.15—$0.045 per kWh produced.”

If you have evidence that RECs were selling for $45/MWH in 2017, please come forward with that, because my clients need that data. The truth is that RECs in California (and the West) are selling for a fraction of that. Please read the filings the PCIA OIR and in the PG&E’s 2019 ERRA Forecast to see the REC values reported there.

mcubedecon – “Stop. Lying. Especially to yourself.”

You understand the last part of that statement? “Especially to yourself?” That means you are telling yourself fibs, convincing yourself of things you know, deep down, are probably not true. You are looking away from the ugly truth, pretending it away. Making excuses, manufacturing reasons why what you want to do is going to work. “Here are all the reasons eating cake for breakfast is perfectly healthy: 1) it is made with eggs and flour”. You are shuffling your feet and the facts. I’m asking you to confront reality as it is. Preventing a climate catastrophe depends on realism, on viewing things as they are, not how we wish them to be.

In the interest of honesty, perhaps you’d like to share with everyone who you are and what you do for a living? Do you perhaps have a financial interest in believing the things you say? Of policing every blog for anyone saying anything that might hurt your business? Since you don’t lie, I’ll let you fill in those gaps.

“You are not the sole arbiter of truth.” No I certainly am not. Never claimed to be. But of course, when everyone lies, speaking the truth becomes insulting, boorish, and tiresome. “We have put out there the analyses and actual transactions that show solar and wind at <3c/kwh, especially in the developing economies." No you haven't. You first denied that $0.03/kwh wholesale was even a requirement and demanded I provide a reference. Then you fervently searched the web for headlines designed to be misleading. People who are ripping you off commonly claim you are actually getting a really good deal.

"The GW of solar installed in China that you cite are of the same order of magnitude at coal installed which tells me that it could soon surpass coal given where it was 5 years ago." Based on what? Wishful thinking? Guess what – the Chinese lie. A lot. About everything. Especially what they are doing regarding renewable power. And about carbon emissions. I mean, why the hell not lie? China is the world’s largest consumer of coal, using more coal each year than the United States, the European Union, and Japan combined. Consumption in China rose last year. Emissions increased 3%. 2018 data also showed a 7.7% increase in electricity generation and a 8.5% increase in total electricity use. Energy-hungry industries such as coal, steel, cement and chemicals are swelling electricity demand. Don't listen to what they say, look at what they are actually doing. China put just over 43 GW of new solar generation capacity into operation in 2018, down 18 percent from a year earlier. So demand is up, and solar installations are down. So no, I don't share your optimism.

https://www.reuters.com/article/us-china-solarpower/china-installed-18-percent-less-solar-power-capacity-in-2018-idUSKCN1PB09G

"Again, that China and India won't listen to us doesn't make us wrong." In what way does it make you right I wonder? You say renewables are so cheap China and India are not going to be a problem. I say, well, they show little sign of building enough renewables to avoid a climate catastrophe, and they seem to be evaluating the cost/benefit relationship differently than you, and oh, by the way, your opinion about cost/benefit of renewables in China is worth a bucket of warm spit.

So, in every single way that matters you are wrong. In the save the Earth way you are wrong. You are whistling past the graveyard. Yet you twist your arm patting yourself on the back.

"You have a very bizarre definition of what is correct if it relies entirely on how others act rather than on the facts on the table."

Yes, I rely on observing what people do, not what they say, and not what they claim. Especially governments and large corporations. Especially people with strong financial interests in making me believe in one thing, which just so happens to be the one thing that profits them the most.

"What you're actually saying is that the political forces in China and India are driving toward the installation of more coal, and we are making the point that they are doing so contrary to the actual economics of power generation." Uh no. I'm not making that point at all. That is the point you are trying to make. I'm saying the Chinese and Indians are doing what is in their economic best interest. I'm saying they may know their own economic interests better than you do.

I certainly don't use language the same way you do – yours is the language of ardent environmentalism, which is just a new variety of Orwellian newspeak designed to obfuscate rather than reveal. For example, I define "cheaper" as meaning "costs less." You define it as "after subsidies" or "someone else pays for it" or "the cost to me personally" or "because I said it was cheaper." Unfortunately the Chinese and Indians use my definition and not yours.

And hey, I'm not a nuclear power "advocate". Where or where did you get that idea? I'm an advocate for realism. However you can make a carbon free energy system work worldwide in the next 10-15 years, I'm all in. Give me your plan, year by year, especially for China and India. How much renewable should they be installing? How are we going to make them install it? You haven't a clue, and both know that it isn't going to happen. And we know that because it isn't happening right now.

To meet the goal of a carbon free energy supply our sources must be cheap, fast, reliable, and proven. It can't depend on inventions to be named at a later date, like magical storage solutions that are just a gleam in an engineer's eye.

“I’m saying the Chinese and Indians are doing what is in their economic best interest. ”

Don’t confuse what is in their own best POLITICAL interest with best economic interest. As anyone in economic development will tell, history is littered with many more choices of the former than the latter.

There’s nothing more to add to this debate. You continue to assert without real evidence that you are the sole arbiter of the truth. Those reading this blog can look through as see who had made the best case.

One sure sign of ideological possession – self-righteous laziness. You don’t have to look up anything you “know” is wrong.

“From 2015 to 2017 RECs purchased have averaged between $0.15—$0.045 per kWh produced.” Copy that statement into Google search. Press enter. Upsidaisy pops Wikipedia that says “From 2015 to 2017 RECs purchased have averaged between $0.15—$0.045 per kWh produced.” Wikipedia references that statement to “Green Power Markets” produced by the U.S. Department of Energy. Go to that document – they provide a nice list of retail prices for RECs between 2015 and 2017. In 2014-2015 it was $0.15/kwh. In 2017 it was 0.045/kwh. Currently it is $0.07/kwh. Next time, if you think I’m wrong, spend a minute or so looking up the relevant data before telling me I’m wrong. Save us both a lot of time.

“Don’t confuse what is in their own best POLITICAL interest with best economic interest. As anyone in economic development will tell, history is littered with many more choices of the former than the latter.” Of course:

1) It doesn’t mater to the climate whether someone is doing something for political or economic reasons. You seem to believe that is an important distinction when we both know it isn’t. What matters is that they are doing it. In fact, the more terrifying outcome is they are doing it for political reasons – that tells me no matter how much we improve the technology it won’t matter. Do you have a solution to the problem? A political OR an economic solution? Please feel free to share. My guess is you have no idea what to do, and unless we solve this problem nothing else matters. So you quibble over stuff and pretend it is important.

2) You BELIEVE that solar is cheaper, ergo the only reason they are not using it is political. However, you provide no evidence they are not doing the math themselves and coming up with a different answer. My guess is they are making very sound economic decisions from their point of view, which is the only point of view that actually matters.

You confusion stems from ignoring all the subsides in the U.S. making solar cheap, subsidies that do not apply in India or China, of the rest of the developing world, subsides they cannot afford to pay, and we can’t afford to give them. Absent those subsides, solar is too expensive and that is why they are installing cheap coal power. That scenario makes perfect sense to anyone not ideologically possessed.

“You continue to assert without real evidence that you are the sole arbiter of the truth.” I think you meant to say “You continue to assert facts without evidence and consider yourself the sole arbiter of truth.” Of course both are false statements. Hard to believe you were making fun of my English skills.

“Those reading this blog can look through as see who had made the best case.” Heh…you’d better hope not.

I guess you are still not going to tell anyone who you are and what you do for a living? Please, don’t be modest. You are quite an impressive person.

https://www.latimes.com/business/la-fi-california-clean-renewable-energy-hydropower-20190430-story.html

Fun article from the LA times – you know they are saying that hydro doesn’t actually count toward California’s renewable energy goals? And here I was thinking I had just made that fact up. “None of the [hydro] electricity is counted toward California’s push for more renewable energy on its power grid…..A new bill advanced by state lawmakers last week would change that — and it’s being opposed by environmental groups, who say it would undermine the state’s landmark clean energy law by limiting the need to build solar farms and wind turbines.”

“list of retail prices for RECs between 2015 and 2017″. You’ve made a critical error. While the utilities selling retail may be getting a green premium price, NOT the wind generator. You should be aware of the difference between retail and wholesale electricity transactions if you’re going to comment on this issue.

” It doesn’t mater to the climate whether someone is doing something for political or economic reasons.” And you raise a good point that we now need to rethink how we get them to change their policies. But that completely obviates all of your previous posts that nuclear is cheaper and renewables are too expensive so those nations won’t change for ECONOMIC reasons. I’m not here to propose an alternative solution–I’m here to rebut your original claim that other resources were much cheaper than solar and wind. And you haven’t provided any evidence to back up your claim–you were relying on India’s and China’s POLITICAL motives to demonstrate ECONOMIC advantage. We both now agree that is not the case. You might be “guessing” that they are making sound decisions, but my own experience for India at least is that they are NOT. Come up with a different solution.

No confusion about subsidies. I posted much earlier in this thread the comparison of solar prices and noted that in India and China prices were about one-third of subsidized US prices. I’m presenting to you the same evidence over and over that refutes your points and claims.

You’re taking the LA Times article out of context. Its the larger than 30 MW hydro that doesn’t count. I’m right now looking at the list of hydro PPAs that PG&E has, and most of the sub 30 MW plants are listed as RPS eligible. It is true most of the large hydro isn’t RPS eligible, but it is counted as GHG free (although that is not entirely true). I’m not sure why you’re so focused on the RPS. If hydro was eligible, the IOUs would just displace solar and wind with that large hydro and they still would be aiming for just 33% RPS in 2020. We would be no closer to reducing overall GHGs. With large hydro in a separate non RPS GHG free category, we actually get a much higher percentage of GHG free generation. That’s one reason why the RPS was designed as it was in 2002.

I’d like to piggyback on Jim Lazar’s comment without agreeing or disagreeing with anything he said….

It is very feasible for a state to go 100% renewable and rely on imports and exports to provide balancing. What if all the states around California also went 100% renewable? What if everyone west of the Rockies went 100% renewable? Of course you could look to balancing from Canada and Mexico, but that is not really the point. What I take from Jim’s post is that thermal resources provide balancing, even if they are out of state. Take away all the thermal resources and balancing will rely on storage or load shedding.

I know some will counter that the interties between east and west need to be strengthened. While that may be true I would point out that if all states in the east also try to go 100% renewable, then increasing transmission only solves some of the problem. The rest of the problem still needs to be solved through storage or load shedding.

Which is one of the many “whys” of why it won’t work.

So storage or load shedding. But storage has the same problem – namely we cannot store enough energy for a long enough period of time to make this work. At least not using technology we have today. And load sheading is a disaster to the economy.

There is a third solution, and that is building massive renewable over capacity – most of which is wasted. But the cost of that is astronomical.

Which kicks us back to maybe 20% wind + solar. The rest has to be something else.

Unfortunately, Tennhauser showed only the RETAIL price of green power programs in that reference to the Green Power Markets publication of USDOE. That’s what retail utilities are charging for a green power product. Those are adjusted periodically, and include marketing costs to acquire subscriber-customers. It’s not an indication of the incremental cost of green power in the wholesale power market.

A better indicator of the incremental cost of wind and solar over other market-clearing power products is the bulk REC market, in which these utilities (plus Amazon, Walmart, and other bulk buyers) purchase RECs. That is published by NREL at:

Click to access 72204.pdf

Unfortunately, this blog won’t let me paste in a graphic of the wholesale REC prices, from page 19 of the NREL report.

It’s really pretty impressive: the wholesale REC market has below $1/MWh since mid-2014. That’s right: under a tenth of a cent per kilowatt-hour. Much of this is coming from wind products in Iowa, Kansas, Oklahoma, and Texas. It’s not the same as buying those wind resources for delivery in Los Angeles, Seattle, or even Dallas. Just the raw market clearing price for the wholesale REC.

Quite dramatic. Obviously influenced by the PTC (wind) and the ITC (solar), but at least for solar, the raw costs have come down by more than the ITC in the past three years, so what was “doable” WITH the ITC three years ago should be “doable” without it today.

Given that we have days in California where we are producing far in excess of 50% renewables, your ceiling of 20% is already irrelevant.

Sorry for the late response – been traveling.

“maybe 20% wind + solar. The rest has to be something else.”

Total electricity generated in California 2018 = 194.8 Twh

Solar electricity generated in California 2018 = 14.0 Twh

Wind electricity generated in California 2018 = 27.3 Twh

Solar plus wind = 21% of total electricity generated. And you are already having financial and storage problems how much is is the bankrupt utility PG&E paying in subsides? $2 billion per year for solar and wind? It’s just going to get worse. You need more geothermal, hydro, or nuclear to make any progress. Battery storage helps, but just a little, since it can’t store power seasonally.

Good news – you can probably score some great geothermal, maybe 20 Twh. And some more hydro, just by improving existing plants. But the rest…is going to have to be nuclear or pumped hydro. Or learn to live with gas.

The subsidy to Diablo Canyon is proportionately higher–on the order of $400M per year.. In addition, NEW solar and wind is costing close the (misleading) short term market price benchmarks used by the CPUC to measure the value of stranded assets–the $2B you quote (it’s closer to $3B) is from poorly managed PAST contracts that are sunk costs. (See my analysis here: https://mcubedecon.com/2019/10/28/pge-has-cost-california-over-3-billion-by-mismanaging-its-rps-portfolio/)

There are no more sites available for significant hydro additions.

Nice piece Jim. Thanks! Nonetheless, I would accuse you one-handed economistism here. What if not going from 90 to 100% results in climate catastrophe? It’s as unreasonable to not balance costs and benefits as it is to establish arbitrary standards, e.g. zero net energy consumption or 100% renewable power generation.

Here is a response – what if it is impossible to go from 90% to 100%? What is 70% is a stretch? I mean economically, mathematically, physically, politically, or technologically impossible? To deny that possibility is to believe in Scientism.

Given the U.S., Europe, and the west don’t control the supply or demand for hydrocarbons, perhaps we are better off looking at the problem in the same way one might view an erupting volcano. Awful, but we can stop it, we can only adapt to it as best we can.

The Green argument always assumes that going to 100% green energy is even possible, but that has yet to be demonstrated at anything other than the smallest of scales.

Tennhauser

Your statement has a very important premise–that our civilization will survive a catastrophic climate change event. If the choice is reaching 100% or the end of our current civilization (or even most species including humans), then we have to aim for 100%. This is not about cost effective or benefit cost analysis. The benefit of avoiding a catastrophic outcome is very difficult to measure.

There are exactly two proven solutions to reduce emissions. 1) Grinding poverty. For example, Mali has emissions of 0.1 metric tons of carbon dioxide per person per year. 2) Nuclear/geothermal/hydro power. Much like France, Iceland, Norway, Costa Rica. No one has succeeded, yet, with wind and solar and batteries. Where it has been tried, electricity prices are the highest in the world.

We may or may not be able to substantially reduce emissions with wind and solar, and several recent studies suggest it is impossible.

You can’t have it both ways. You can play around with wind and solar and hope some sort of advanced battery will save the day, but by doing that you are acknowledging that the crises is not serious or immanent. In which case adaptation becomes an option.

If you think the problem is serious and immanent, then you would be pushing construction of nuclear, and hydro, and geothermal as fast as humanly possible.

Look at the Salton sea. An estimated geothermal resource of 2,400 MW. Of which only 450 MW has been tapped. What’s the hold up? Why are most of the plants only 25 MW? There certainly has been interest in building more. For years, state officials rebuffed the pleas from Imperial Valley leaders to support more geothermal development in the region, even as California lawmakers adopted a 50 percent renewable mandate. In 2015, the Imperial Irrigation District sued the California Independent System Operator, which runs the power grid for most of the state. The lawsuit said the system operator was making it difficult to export geothermal and other forms of clean energy from the Imperial Valley.

How does that happen? In California no less?

So again, is this serious or not?

California has reduced emissions while retiring a nuclear plant and reducing hydropower output. https://www.energy.ca.gov/renewables/tracking_progress/documents/Greenhouse_Gas_Emissions_Reductions.pdf

To get a better understanding of the issues related to geothermal in California, you can read the CEC’s Cost of Generation reports that discuss these (I was a coauthor of the 2014 and earlier versions). You can’t just snap your fingers, and it’s not just simple legal issues. Pricing premiums might eventually make these economic, but there are technical issues, including durability.

https://www.energy.ca.gov/almanac/electricity_data/cost_of_generation_report.html

Such a silly and unserious answer.

Problems with geothermal? Are there more problems than managing the duck curve? developing new battery technology? figuring out how not to fry birds at Tonapah? Building new transmission in a NIMBY state? Or is it that you simply ignore some problems, and make a big deal about others?

All the solutions are “hard”. There is no easy solution. Which is why picking and choosing is not really possible if you want to achieve your goal ASAP. Picking and choosing is a sign you either don’t understand the scope and scale of the problem, or don’t really believe this is a crises. Which is it?

Greens actively campaign against hydro power, against geothermal, and against nuclear. All of which could be used to substantially reduce emissions much faster than they have been reduced. Which says, to me, that concerns about climate change are fundamentally unserious.

Reduced carbon missions while retiring nuclear? Bully for you, dumbass. Imagine how much MORE emissions would have decreased if you hadn’t prematurely retired San Onofre. Total greenhouse gas emissions from power plants in California increased by 35% from 2011 to 2012, according to figures from the California Air Resources Board, due to the early closure of San Onofre. What is the lifespan of carbon dioxide in the atmosphere? 200 years? Ah well, I guess climate change isn’t THAT important. What other conclusion can I make?

And we both know San Onofre had zero reason to be prematurely retired – it was retired solely by green activism. You set back reductions in the emissions curve by a decade by retiring early. SONGS reactors typically contributed around 8% of the state’s annual electricity generation, due to their high utilization rates. Carbon free. Replacing the annual energy contribution of the SONGS units would require around 7,200 MW of solar generating capacity, equivalent to nearly 2 million 4-kilowatt rooftop photovoltaic (PV) arrays. Was any of that installed before SONGS closed? No?

Then you just didn’t care about emissions when that decision as made.

Studies showed that each megawatt-hour (MWh) of replacement power for SONGS emitted at least 560 lb. more CO2. That’s an extra 4 million metric tons of CO2 per year, from its electric power sector and almost 1% of total state emissions. Since they close 10 years early, 40 million metric tons of CO2 was unnecessarily released.

Obviously climate change is your number one priority.

Seems to me most people don’t see this as a crises, but as an opportunity. And I don’t see many greens giving up a blessed thing, or changing a single opinion, because of the climate crises, I see them picking and choosing, acting like they have all the time and money in the world to solve the problem. Then screaming like bloody fools that we have just a decade left. So which is it?

Wouldn’t having SONGS operational, and fully exploiting the Salton Sea Geothermal, wouldn’t that help substantially to accelerate the transition to clean power in California? Tell me, what Green group protested or will protest in favor of either one?

The crickets chirp your answer. Don’t think no one has noticed.

Since you seem to only be able to enter discussions by belittling others and namecalling, we’re done here. You can continue to live in your fantasies about your preferred solutions, or you can acknowledge what is economically feasible (much less what’s politically viable). I won’t bother to reiterate each our points that have already addressed everything in your latest response. (Obviously you haven’t bothered to look at the specific citations I provided.) We’ve shown why we disagree with your assertions (and why so many are untrue) and you continue to just simply ignore them because they so soundly contradict your statements. You claim that we should be pushing for the lowest cost technologies and then turn around and advocate for full ahead adoption of technologies that would cost $100/MWH or more. I really have no clue what course of action you want to take other than “nukes, nukes, nukes.” Based on what actions are actually being taken versus what you want, it’s pretty clear who is being listened to.

I will acknowledge one truth that you have written through your insults: we are not taking the threat of climate change sufficiently. I saw that when I was working on the Desert Renewable Energy Conservation Plan (DRECP). Biologists and politicians restricted access to some of the most productive sites out of concerns to protect ecosystems that will disappear in just a few decades if climate change isn’t arrested. That kind of rationale is impeding important progress. We need to be more clear about the tradeoffs that are actually being made about future conditions and not pretending that we can preserve the present.

That said, you have yet to acknowledge the decades of failures in the nuclear power industry that have led to the only technology that has RISING per unit costs. You need to tell us why it will be different this time around when the track record is so bad. Asserting without evidence that we are wrong in this assessment ignores the reality that almost everyone else sees. (Only those with a vested financial stake in nuclear power denies this reality.)

I’m still wondering exactly what index must reach 100%. It’s certainly not the percent of generation since some the generation goes for line losses, own-utility and other uses. Instead the denominator is “retail sales.” I’m a bit suspicious because Hawaii’s index has net utility sales in the denominator and total renewable generation in the numerator. So distributed solar for example goes into the numerator, but is netted out of the denominator. This makes it plausible to have 50% of generation renewable and still achieve an index equal to 100%. California has a different index but there is some vague wording in the amended law about being able to count renewable credits that may allow for a similar illusion. Any clarification would be appreciated.

I can clarify – it’s a scam. They want to be able to say they are 100% renewable without, you know, actually achieving that goal. Probably because they know they can’t achieve it at any sort of reasonable cost. It is really quite simple.

Most RPS mandates are various forms of scams designed to fool Greens, who, for the most part, are easily fooled. For example, RPSs generally do not include hydroelectric power, which produces no carbon dioxide. geothermal is often excluded. nuclear is always excluded. That make any sense? Most have various ways of double counting contributions of wind and solar.

Tennhauser

Now you’re just making wild assertions with no basis in fact. We’ve refuted each of your claims. (BTW, large hydro does have GHG emissions (methane) from its reservoirs.) I know of nowhere geothermal is excluded from the RPS. I’ve seen no evidence of double counting solar or wind (and in fact rooftop solar is excluded from most RPS counting.)

Actually you haven’t “refuted” anything, other than to say that has been “refuted” without actually, you know, addressing any claim specifically.

Is nuclear included in RPS? Where is that? You have no answer because there is no answer.

Why did Imperial valley have to sue CASIO to get more geothermal built? You might want to read the basis of their 2015 lawsuit sometime. Then you can get on with some serious “refuting.”

As stated in Section 25741 of the Public Resources Code, renewable resources include “small hydroelectric generation of 30

megawatts or less, …ocean wave,… or tidal current, and any additions or enhancements to the facility using that technology.”

“A small hydroelectric generation facility is not an eligible renewable electrical generation facility if it will cause an adverse

impact on instream beneficial uses or cause a change in the volume or timing of streamflow.”

Not sure how a hydro facility can have no negative impact on instream flow, or change the volume or timing of streamflow, meaning almost all hydro counts for zero.

That’s in California. Like me to do a run down state by state?

Double counting? How about you just READ what I responded to “I’m still wondering exactly what index must reach 100%. It’s certainly not the percent of generation since some the generation goes for line losses, own-utility and other uses. Instead the denominator is “retail sales.” I’m a bit suspicious because Hawaii’s index has net utility sales in the denominator and total renewable generation in the numerator. So distributed solar for example goes into the numerator, but is netted out of the denominator. This makes it plausible to have 50% of generation renewable and still achieve an index equal to 100%.”

My response – it’s a scam. Which goes to the title of this post “100% of what?”

But let’s dive deep into the scam, shall we?

When a renewable energy source puts one megawatt-hour (1 MWh) on the electrical grid, it writes itself a certificate (REC) saying it has done so. These certificates are transferable and can be sold to a broker who sells them to a utility. So a utility can be 100% renewable while still providing 100% electricity running a dirty coal plant. Just spend a bunch of money buying up RECs.

How about the PTC? The PTC gave wind operators a credit of 1.5 cent per kWh of generation. This allowed wind to make money even when the price of electricity is nearly zero — not unusual during periods of low demand. Oh, and a second standard is set up requiring utilities to buy renewable power if it is offered, stiffing every other power source.

Say, under this insane system, couldn’t’ I build a wind generator, and receive a 1.4 cent/kwh PTC, and then generate my REC, then sell my REC to some utility? I wouldn’t even need to connect my wind generator to the grid, just discharge the energy into the ground, and still make money. But if I did connect to the grid, I could underbid any generator – any money I make selling electricity would be pure profit. Small wonder Berkshire Hathaway invested so much in wind power. “I will do anything that is basically covered by the law to reduce Berkshire’s tax rate. For example, on wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.” Warren Buffet, 2014.

An appropriate RPS standard would say “The emissions in your service area are X from all sources. Cut that by 20% by 2030”. The utility could then decide what is the best path for doing that. Maybe improving their hydro generators. Maybe providing cost breaks for electric cars. Or wind, or home solar. Or nuclear. Or reforesting. Or carbon capture. Or improved gas plant efficiency. Or any mix of all. And all we actually care about is emissions, right? Do we really care what the emissions are from, or just that they are reduced? Any RPS standard that doesn’t make it this simple is some sort of scam designed to favor one solution over others, usually to steal money from the public.

See my post with the explanations of the REC and ZEC. In your example if utility 1 sells its RECs to utility 2, then utility 1 will not be able to reach 100% renewables. In fact, utility 1 would then become 100% dirty. RECs are a zero sum situation, not double counting.

I’ve looked at the IID-CAISO dispute. It’s much more complicated than just getting geothermal on line. Given that complexity, it’s not relevant to your point.

The RPS was designed in 2002 with much more than just GHG reduction, but to also include other environmental impacts. Nuclear waste storage was deemed to be too significant to be included. You may differ with that judgement but it is the way it is. Hydro less than 30 MW was deemed to have de minimis streamflow impacts (the MW threshold obviously was a political choice). The cap & trade program adopted in 2008 was intended to mitigate some of that advantage, but the utilities and CPUC have acted to mute that price signal since. What you are asking for ignores the other goals spelled out for the RPS in California. You are instead arguing for a ZEC which is already covered in the CATP in California–the ZEC is duplicative here. And California has many of the other credit programs that you list, e.g., LCFS. I suggest that you spend more time reviewing all of the various actions being done at the California agencies.

Your hypothetical about the wind PTC isn’t valid. The project needs to be interconnected to gain the credit. By the way, the wind industry prefers that the PTC expire: https://www.greentechmedia.com/articles/read/another-wind-ptc-extension-no-thanks-say-many-in-industry

This is becoming a fascinating debate. I appreciate your diligence in persevering, even when the truth is solidly against you.

Let’s say I generate wind power, and I sell that for, say, $0.035 per kwh. I then generate a REC. Now, If the government is requiring I show a certain % renewable power, I can keep the REC. Otherwise I get to sell it on the market. I might get another $0.07/kwh. AND depending on the state I might get additional state, local, and federal tax credits. AND, depending on the state, I get to sell my power no matter what – say I generate it in the middle of the night when demand is low? Hah ha suckers, you pay me anyway! If I generate it, you must buy it. You are required to by law! So what if you incur other ancillary costs? So what if you just decide to “spill the wind” basically discharging the wind power you paid $0.035/kwh to the ground because you have no way of storing it, and no buyers, and have to protect the grid? Happens all the time.

“I’ve looked at the IID-CAISO dispute. It’s much more complicated than just getting geothermal on line. Given that complexity, it’s not relevant to your point.”

Translation – you can’t excuse it so you’ll ignore it. Let’s make this really easy for you. What state has the largest untapped geothermal resources in the nation? Resources that would be ideal to pair with wind and solar? How long have we known about them? Has the state ignored them, or at times, been actively hostile toward them?

It really isn’t that complex.

“The RPS was designed in 2002 with much more than just GHG reduction, but to also include other environmental impacts.”

Ah well, then this is not a climate crises after all, is it? If climate was THE most important thing, smaller environmental impacts would be ignored, right?

You fail to explain why existing hydro impacts, that have already been incurred, are more important than impacts via new solar and wind development. Also most hydro in the state is necessary to maintain drinking and agricultural water for 38 million people – if we ripped out the power generation capacity on the existing dams, we’d still need most of them anyway or the state would go dry. So the hydro power is essentially a bonus – the environmental damage is due to too many people needing water in California, and not hydroelectric generation. There is zero objective and rational reason for not including existing hydro, except a desire to steal money from the ratepayers.

“the MW threshold obviously was a political choice.” Really? You don’t say. Tell me more.

Environmental impacts from existing nuclear power plants? What are those? Right – nothing. Lets count the number of raptors killed by Diablo Canyon versus Altamont Pass. Diablo Canyon = 0. Altamont Pass = an estimated

880 to 1,300 birds of prey each year, including up to 116 golden eagles, 300 red-tailed hawks, 380

burrowing owls, and additional hundreds of other raptors including kestrels, falcons, vultures, and

other owl species. Meanwhile the waste from Diablo Canyon sits in a concrete cask in the parking lot, harming no one.

Yes, I can certainly see how one is better than the other.

“The cap & trade program adopted in 2008 was intended to mitigate some of that advantage.” What advantage? The fact that they are cheaper, better, and already constructed and paid for? Look, it was designed to devalue hydro and nuclear power, because environmentalists hate them more than they fear climate change.

“What you are asking for ignores the other goals spelled out for the RPS in California.” Yes. Because since this is a climate crises, all other goals become secondary. Instead of choosing to achieve a bunch of ancillary environmental goals, while continuing to emit more carbon dioxide than necessary, I would have prioritized and maximized the reduction in carbon dioxide emissions, and dealt with other needs and wants after that first critical goal was accomplished. We both know that for the same time and money wasted screwing around with wind and solar, California could be emission free today.

Imagine a state that had maximized nuclear, hydro, and geothermal in 2008, then added as much wind and solar as necessary to reach 100%. Over time that state could retire nuclear or hydro as wind and solar were added to slowly replace it. We’d have decades to transition – really as much time as we needed. How many hundreds of millions of tons of carbon dioxide emissions would have been avoided? How many billions of $ saved?

Oh well.

The original drafting in Hawaii did not recognize the problem James has identified: that the numerator is a gross generation number, and the denominator is a net sales number. The difference is generation used on-site (never sold) and line losses (generated by never sold). So the Hawaii 100% really works out to about 85% or so.

Folks in Hawaii are aware of this, and there is tension among them whether to push to amend the legislation to make numerator and denominator match, or to be patient for a few years until we actually figure out how to get to a “real” 100%. The most ardent “greens” want to make it a “real” 100%, and the more pragmatic advocates figure that will be relevant in a decade or so. As long as the “slop” is in the equation, the more conservative analysts are comfortable with “100%.”

One option that Hawaii is already deploying (the Schofield Barracks power plant) is to use liquid biofuels in conventional power plants. If you view biodiesel derived from purpose-grown crops as a “renewable”, that is certainly a way to get to 100%, including inertia from spinning mass power plants. And pumped storage hydro, now under development on Kauai, is another “renewable” that, in addition to providing storage, can also provide frequency regulation, voltage support, operating reserves, inertia, and other traditional services we obtain from fossil combustion units. Obviously flywheels can and do provide some benefits of spinning mass, and can be powered by intermittent renewables. So there are tools — they may not be cheap.

Many folks in Hawaii are genuinely concerned about the loss of inertia from retirement of combustion power plants, replacing that generation with inverter-based resources. Others are less concerned, because battery systems can respond as fast as spinning mass can. I’m an economist, not an engineer, so I’m satisfied to observe their deliberation. But I have worked with several island systems that are 100% inverter-based, and seem to provide reliable service. Indeed, the island of Apolima, Samoa has the most reliable power in the country.

Pragmatically, every motor home in America is a system operating without inertia, and millions of people trust those inverter-based systems to run their CPAP machines, firing up the generator only to run the microwave oven or toaster for a few minutes a day.

I’d appreciate input from EEs on this list as to whether inverter-based systems can operate reliably at the utility and interconnect level, or whether they believe we will need traditional spinning mass at least at the reserves level.

Two issues: First, “hourly” markets and “wholesale” markets are not the same thing. Wholesale markets are composed of contracts and resources of of varying lengths and terms. The CAISO hourly energy market that is cited here has not been used to meet load growth in California since at least 2010 and is only relevant for load balancing purposed in the transmission grid. All incremental resources are now added through either renewables or distributed resources, of which the vast majority are procured through long-term contracts or behind the meter investments. The prices for those transactions have become disconnected from the hourly market prices for a variety of resources, and the hourly prices are as relevant to the larger wholesale market as AirBNB bedroom rental rates are to the housing market.

Second, the blog states “because a zero carbon standard without demand growth requires the early mothballing of existing fossil fueled facilities.” That last significant natural gas plant in California was added in 2010. A utility-owned plant investment will be paid off in 30 years, or by 2040 BEFORE the 100% renewable goal in 2045. But the real investment is in merchant gas plants. Those have been financed with a 20-year return (not 30). We reported this fact in the CEC’s Cost of Generation reports. Almost all of these plants were built before 2010 (there might be a couple small ones since), which means that their economic lives will be done by 2030. So there’s almost no stranded assets there either. Notably, all of the utilities’ PPAs with merchant plants expire by 2027 (I’ve seen the contracts and this was provided in the PCIA OIR).

Great post. I was anticipating where it would end up (carbon pricing) as I was reading along — ultimately the only way to get a truly firm mattress for effective carbon control.

Next stop after pricing is atmospheric CO2 removal offsets (a “negative price,” i.e., reward, for additional sequestration). Carbon pricing that is both binding and sufficiently even-handed (loophole free) seems likely to remain the economists’ fantasy for some time. But perhaps we can do thought experiments that ask what would happen at the sectoral level if we priced carbon strongly, projecting the likely behavioral (technology and program investment) changes. . Might we then use those results to guide sectoral policies that are less inefficient?

This is a nice post, and it raises an important set of questions:

1) Why are California retail prices so high? There are many reasons, partly rooted in state policy, part in generous rate making, and part in the high cost of doing business in California.

2) What is the MARGINAL resource that will serve load growth, including electrification load?

3) What pricing changes will be needed to encourage beneficial electrification?

I’ll address only one aspect of one of these questions: what is the MARGINAL resource? The post says “we can import hydro from the Northwest”. Not so simple.

California seldom imports hydro from the Pacific Northwest. It happens in the Spring, when there is a surplus of hydro above northwest electricity loads. But the rest of the year, nearly all imports are really coming from thermal generating resources.

That is, except for the Spring freshet, PNW in-region loads exceed PNW in-region hydro production. Given the “regional preference” law passed by Congress, utilities in the region have first call on any surplus from the federal hydro system.

It’s a game that California plays, pretending that the power they get from the PNW is clean. It’s not. And extensive data on this was presented to CARB when the AB32 implementation process was underway.

You can look at the BPA system resources and loads in real-time at https://transmission.bpa.gov/business/operations/wind/baltwg3.aspx If you add up the “fossil” and “nuclear” generation in the region, it usually exceeds the “interchange” amounts. “Interchange” means power exported from the region, nearly all of which leaves on the AC and DC interties to California.

However, what this does NOT tell you is the nature of the non-BPA loads and resources, including utilities like Puget Sound Energy, Pacific Power and Light, and Avista. Those utilities operate significant amounts of coal and gas generation, If the PNW federal system has a surplus of hydro, they have first right of refusal. Often they do buy that hydro in the region, and continue operating and exporting their thermal resources if market prices are high enough.

Pragmatically, what happens is that the hydro is consumed in the PNW, and our thermal (nuclear, coal, and natural gas) generation flows to California. Ask yourself a simple question: if the intertie lines were not operational, which would get shut down in the PNW: hydro, coal, nuclear, or gas? Obviously the units with variable fuel and operating costs (ranging from a penny or so for nuclear to three cents or so for coal and gas) are the units that would be shut down. Reopen the interties, and the thermal generation would resume operation.