The Cushion in Coal Markets that Will Make it Harder to Kill

Fat margins in rail shipping are likely to partially absorb a price on carbon.

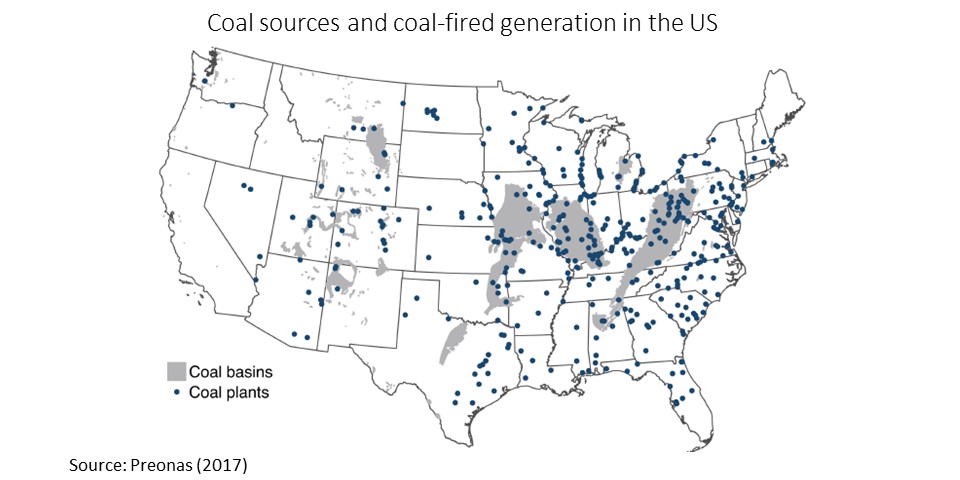

Discussions of U.S. coal policy generally focus on coal mining or coal burning, but hardly ever on coal transportation, the critical link between the two. Yet, transportation is a significant percentage of the total cost of electricity from nearly all coal-fired generators. And hidden in that link between mining and generation is a protective layer that is likely to slow the decline of coal in the American energy system.

That is one conclusion of an important new Energy Institute at Haas working paper by Louis Preonas, a PhD student at EI, who will be finishing his dissertation this year. The paper, “Market Power in Coal Shipping and Implications for U.S. Climate Policy” shows that rail transportation of coal to many power plants comes with fat margins for the railroads. In those markets, Preonas demonstrates that new profit pressures — such as would come from a price on carbon that raises the cost of coal generation relative to other sources — are partially absorbed by the railroads in order to keep from losing coal-shipping business.

That’s good news for coal-fired generation, but bad news for the goal of reducing GHG emissions in the electricity sector. Researchers studying climate policy typically translate a carbon price into a cost increase for coal generation by assuming that the generator’s costs rise by the price of their GHG emissions. But Preonas shows that such pressures on generator profits cause charges for coal transportation to fall in many areas, keeping coal in the money to a greater extent than the standard calculations would suggest.

This cushioning effect doesn’t impact all coal generation, but it is clearly present at plants served predominantly by a single railroad, which constitute about 44% of all U.S. coal-fired power plants. At plants served by multiple railroads, or those located on a river or lake that allows them to receive shipments by water, margins of the transportation companies are already thin so they have little room to lower their charges to keep the customer’s coal plant running.

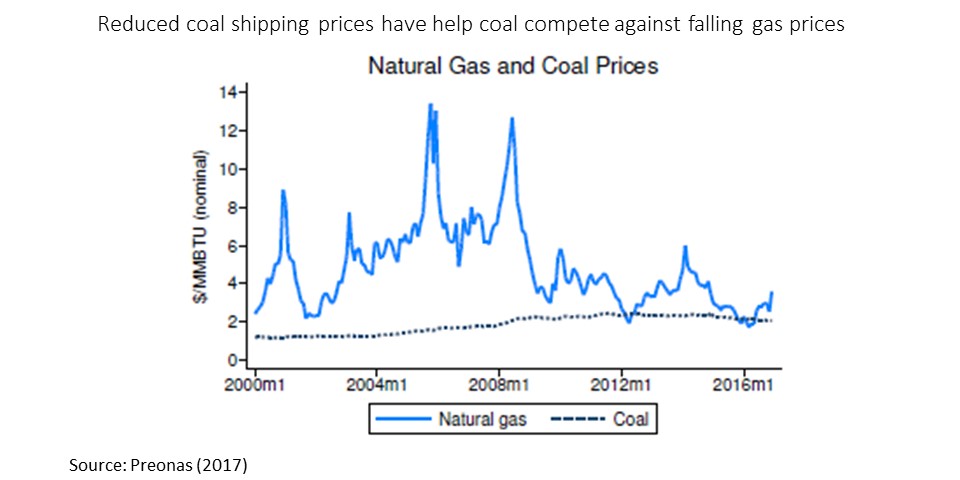

Of course, the price of GHG emissions is zero, or very close to zero, in most of the country, so it’s not possible to measure the impact of pricing GHGs on coal-fired generation directly. But the fracking boom over the last decade has cut natural gas prices, imposing pressures on coal from the demand side, as cheap gas has taken an increasing share of electricity generation. The response of railroads suggests how they are likely to respond if coal plants are hit by a significant carbon price.

Like a carbon price would do, the decline in gas prices has had heterogeneous impacts on the demands of coal generators for fuel. Some have operating costs well below the wholesale electricity prices in the markets where they sell, so most of their sales are not at risk. At those plants, shipping charges have been less responsive to falling gas prices, Preonas finds, presumably because the railroads know these plants will still have a strong incentive to run.

It’s at the plants whose costs put them closest to the margin that the railroads have adjusted their pricing the most to keep those generators running. As gas prices have fallen, these coal plants have lost share in electricity markets. But they have not lost as much share as they would have if railroads hadn’t lowered coal transportation costs for those very plants most threatened by the declining costs of competing gas-fired plants.

Overall, Preonas estimates that railroads’ practice of lowering prices to keep selected coal plants in the money means that the fracking boom has reduced GHG emissions 8% less than would have occurred if the railroads had not helped cushion the impact.

OK, the effects of fracking are interesting, but what should really grab the attention of policymakers is what this implies for the effects of carbon pricing on coal plants. The estimates of the response to natural gas prices can be applied to forecasting the possible response of coal generation to a carbon price. Preonas shows that for the most captive coal plants as much as one-quarter of a carbon price would be absorbed by shippers, meaning that those plants would effectively be responding to a 25% lower carbon price than other generators or any other producers of GHGs.

The idea of using market mechanisms to correct environmental externalities is nearly 100 years old, but we only have a few decades of experience with actual implementation of such programs. And even today they play a much smaller role than direct pollution control regulation. As we gain more experience with market mechanisms, it will be critical to continue to assess whether they work as we expected and where they can be improved. The effect of additional market failures, such as market power on the supply side, is an important part of that research area.

The paper by Louis Preonas contributes to a growing literature evaluating the potential uses and complexity of market mechanisms for pollution control. The challenges are significant.The world is a much more complicated place than exists in economic theory. But the alternative approach of direct pollution control has been shown in many cases to reduce pollution at much higher costs than necessary. This sort of insightful, unbiased, and transparent analysis, applied to all policy options, will be needed to effectively respond to the enormous challenge of climate change.

I tweet interesting (to me) energy articles/research/opinions most days @BorensteinS

Categories

Severin Borenstein View All

Severin Borenstein is Professor of the Graduate School in the Economic Analysis and Policy Group at the Haas School of Business and Faculty Director of the Energy Institute at Haas. He received his A.B. from U.C. Berkeley and Ph.D. in Economics from M.I.T. His research focuses on the economics of renewable energy, economic policies for reducing greenhouse gases, and alternative models of retail electricity pricing. Borenstein is also a research associate of the National Bureau of Economic Research in Cambridge, MA. He served on the Board of Governors of the California Power Exchange from 1997 to 2003. During 1999-2000, he was a member of the California Attorney General's Gasoline Price Task Force. In 2012-13, he served on the Emissions Market Assessment Committee, which advised the California Air Resources Board on the operation of California’s Cap and Trade market for greenhouse gases. In 2014, he was appointed to the California Energy Commission’s Petroleum Market Advisory Committee, which he chaired from 2015 until the Committee was dissolved in 2017. From 2015-2020, he served on the Advisory Council of the Bay Area Air Quality Management District. Since 2019, he has been a member of the Governing Board of the California Independent System Operator.

If I am a RR facing competition by players who are barely getting by, wouldn’t I like something that reduces Demand a bit? That seems likely to push some of those marginal competitors out of the market. Sort of the flip side to a raising rivals’ costs story, perhaps?

A lot of details here in this report from the Association of American Railroads … but one important point for context,

‘According to data from the Energy Information Administration, total U.S. electricity retail sales in 2016 were $381.4 billion. Class I rail gross revenue from hauling coal in 2016 was $9.1 billion, equal to just 2.4 percent of the value of electricity sales.’

Click to access Railroads%20and%20Coal.pdf

Have economists considered what the secondary effects will be of basically eliminating coal generation for the US energy mix? Certainly small cities where a coal plant might employ 1000 people directly will be devastated.

On the transportation front addressed in your article, the railroads will still need to make enough money to maintain their tracks. Will the transportation rates for other commodities need to increase to make up for the lost margin from coal deliveries?

Who pays for all the rail cars that will no longer be needed to transport the coal?

Should we have protected the buggy whip industry against the invasion of automobiles? We should think about how to help those workers move to new jobs (and I’ve pointed this out as a error in BCA), but that doesn’t mean to protect the industry.

Nice quantitative work. Always good to be aware of the limits of price signals. Glad to see that most of the impacts of gas prices and potential carbon prices get through.

It will be interesting to see if either railroad share prices fall or transport rates for other commodities rise to make up the the difference. If it’s the latter, we may see an offsetting effect of reduced GHG emissions from reduced rail transport (or increased of trucking increases in response.)

You’ve raised some interesting points and it makes me wonder about jobs impacts of dealing with the climate.

My understanding is that:

Western coal is mined with few jobs per ton of coal and shipped further distances to compete with eastern coal.

Eastern coal is mined with more jobs per ton (more cost per ton) and shipped shorter distances. I see some statistics quoting workforces of 51,000 for coal mining and 210,000 for all rail transport including coal. If weak carbon prices are installed, there would be mostly a reduction of high cost, low shipping eastern coal mining and the several western coal strip mine jobs would be safe. This results in a higher than average loss of jobs per ton. If coal power production ceased entirely and coal power exports ceased, metallurgical coal mining (10%) remains and still needs to be shipped to ports and industry. I imagine there would need to be retraining for 40,000 coal miners and maybe 40,000 rail workers into growth industries of methane leak repair workers, wind turbine mechanics, firestorm fighters, weather disaster repair workers and electrification installation workers (EV chargers, heat pumps, insulation etc to fight carbon and the duck curves). Perhaps this would be interesting to study.

Back in the the 1980s I was hired to support the State of Montana in litigation between the state and the Crow Indian Tribe. Montana had imposed a tax on coal extraction and the Crows claimed it was being damaged. NERA represented the tribe and the witness testified that the tax would increase the delivered price of Montana coal, thus would reduce demand. Turns out the situation was far more subtle than that which NERA portrayed. The delivered price of coal shipped to Lake Superior (where it was loaded onto barges) consisted of the BN railroad’s tariff on the coal movement plus the cost FOB the mine. What I discovered was that the railroad’s profit margin on that traffic was so fat that it was in the BN’s interest to absorb the Montana tax rather than accept a reduction in traffic volume. The judge ruled in our favor.

So here we are 30 years later and the same phenomena reappears. LOL!

FYI Robert, this may be of interest to you as the source mine is on Crow land.

http://lastbestnews.com/site/2017/11/hardin-could-lose-coal-fired-power-plant-early-in-2018/

Also in that region, albeit far larger, Colstrip has approved writing down the last two units by 2027 (that weren’t scheduled for 2022 retirement). This was announced in the last month of interested in reading more.

The good news is that, according to the EIA in June 2017, coal use in 2016 is down 35% compared to 2008 (which they claim is the year of peak US coal production) — 93% of domestic coal use is for power generation. Coal shipments – as of the end of Oct 2017 – are down ~8% compared with last year (Assoc. of American Railroads data, I think). Coal shipments by rail are certainly one of the economic mainstays of American class 1 railroads – though last June Huffpost had an article (picked up from E&E news) quoting the CEO of CSX that “Coal is dead” and that CSX would not be making any major future investments in coal-related infrastructure.

You make two comments in your last paragraph – one of which I wholeheartedly agree with and one I don’t. The world certainly is more complicated than economic theory would have you believe. This is probably the main reason that politics has become unburdened by facts (witness the current, uh, “discussion” about the tax “reform” bills as case in point). If political (or economic) theology becomes the policy driver, then facts don’t matter and besides they are just too messy to deal with.

I continue to worry that what economists see as the glass mostly empty – in terms of the benefits of directly pollution control by regulation (because it is alleged to be economically inefficient) – is mostly empty because the health and environmental externalities are ignored or incompletely or incorrectly accounted for. Coal is and has been a poster child for this issue – where to begin: mountain top removal mining, acid mine drainage, destruction of creeks and the riparian habitats they support, local and regional air pollution, not to mention the occupational hazards. The political environment established by the current regime appears to be based on “air pollution doesn’t kill people, breathing does” (to borrow a phrase…).

Yep, coal transport rates have been falling. The Waybill Data definitely bears that out.

Frank